Colorado was one of the fastest-growing states per the last U.S. Census, increasing by 14.8% between 2010 and 2020. The increase in population has resulted in higher demand for homes with prices skyrocketing this past year. If you're buying in Colorado, use our mortgage calculator to help estimate your monthly mortgage payment with taxes, fees, and insurance.

Colorado was one of the fastest-growing states per the last U.S. Census, increasing by 14.8% between 2010 and 2020. The increase in population has resulted in higher demand for homes with prices skyrocketing this past year. If you're buying in Colorado, use our mortgage calculator to help estimate your monthly mortgage payment with taxes, fees, and insurance.

Colorado housing market

According to the Colorado Association of Realtors, the median for a Colorado single-family home reached $530,000 year to date in July 2023, down from the median of $540,000 for the same time period in 2022.

Although prices are still high in Colorado, with an average sales price of $667,073 for the first seven months of the year as of July 2023, that's down from 2022's average of $675,810. Still, inventory is seriously lacking, with just 2.4 months supply available in July 2023. This is up from 2.1 months in July 2022, but is still very far from a balanced market, where you can expect to see about six months of inventory on the market at any given time.

New listings are also down 21.2% year to date as of July 2023, putting more pressure on buyers seeking a home. Even so, the average sold home in Colorado as of July 2023 took a less than full price offer, receiving just 99.3% of the asking price. This is down from 102.9% in the same period of 2022, which could be a sign that pricing is starting to get a little bit more accessible for buyers.

How do I calculate my mortgage payment?

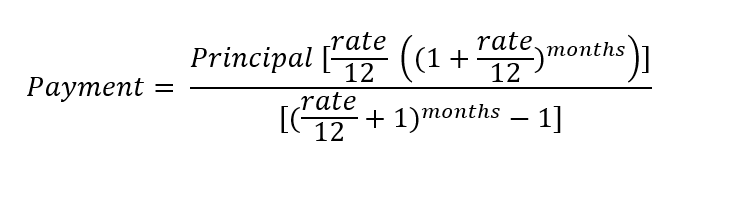

We recommend using a mortgage calculator for Colorado. The formula to calculate by hand is quite complex:

To estimate your monthly mortgage payment, you'll need to enter in your estimated mortgage loan amount, the term of your loan, and the rate you think you'll be eligible for. Common mortgage terms are 15-year and 30-year mortgages. In addition, you can choose a fixed interest rate throughout the term of your loan. Or you can consider an adjustable rate that changes over time based on market conditions.

In addition to the principal and interest, you will need to add monthly insurance costs, taxes, and other fees. Our Colorado mortgage calculator also allows you to add taxes and insurance to your monthly payment. The mortgage calculator for Colorado also has an option to enter your down payment amount. The more you put down, the less you will need to borrow and your monthly mortgage costs will be lower.

If you're considering buying a home in Colorado, check out our list of best rated mortgage lenders before you settle on a mortgage loan.

What other monthly costs do I have to pay?

There are other monthly expenses you'll need to account for, like homeowners insurance and property taxes. When you use our mortgage calculator for Colorado, remember that property taxes paid as a percentage of owner-occupied homes are on average 0.54%. Property taxes may change based on your county.

Homeowners may also be part of a homeowners association (HOA) and have to pay a monthly HOA fee on top of their mortgage payment. HOA fees usually cover the maintenance of common areas, and often include services like trash pickup. To enter these additional costs into the above mortgage calculator for Colorado, just click "Additional inputs" (below "Mortgage type").

You may also need to account for private mortgage insurance (PMI). Homeowners will have to pay PMI if they don't make at least a 20% down payment on their home. With all these potential costs, it is helpful to use our Colorado home loan calculator. Our tool will help break down your costs so you can see what your monthly mortgage payments will look like in different scenarios.

If you want to refinance an existing mortgage, our Colorado mortgage calculator can also help you determine your monthly payment -- and you can check out our list of the best refinance lenders to get that process started.

Things to know before buying a house in Colorado

Before you buy a home in Colorado, it's important to make sure you have set a budget for buying a house and have your finances in order. To get the most competitive mortgage rates, you will need:

- A good credit score

- A low debt-to-income ratio

- A steady source of income

- A down payment

- Additional money outside of your down payment to cover ongoing maintenance, repairs, and other emergencies

Colorado has a diverse geography

From the rugged Colorado mountains to the desert in the eastern part of the state, Colorado is considered to be one of the top places to live. According to the 2023 U.S. News and World Report, Boulder, Colorado is ranked as the fourth best place to live in the country. Colorado Springs placed ninth and Fort Collins was No. 23.

Colorado offers a large variety of outdoor activities

Colorado has plenty of things to do outside, and the state is home to beautiful mountains. Due to the high altitude in certain parts of Colorado, it is important to adjust to the high altitude slowly to prevent altitude sickness. Colorado is also home to common natural disasters such as wildfires, floods, winter storms, tornadoes, and droughts.

LEARN MORE: Home buyer checklist

Tips for first-time home buyers in Colorado

The Colorado Housing and Finance Authority (CHFA) offers programs to help low and moderate income families afford a home. Through its statewide network of participating lenders, CHFA offers different home purchase loan programs, grants, and second mortgage loans for down payment and/or closing cost assistance.

First-time home buyer loans and programs

In addition to the Colorado first-time home buyer programs, there are other programs to consider. Here are the most common buyer programs:

- FHA loans are mortgages back by the Federal Housing Authority and require a 3.5% down payment

- VA loans are for military service members and require a 0% down payment

- USDA loans are government-backed loans for eligible properties and require a 0% down payment

- Fannie Mae and Freddie Mac are conventional loans that require a 3% down payment

Still have questions?

Here are some other questions we've answered:

FAQs

-

Like other mortgages, you can typically get a mortgage in Colorado with as little as $0 down, depending on the program you use. If you don't qualify for USDA or VA financing, you can still secure a conventional loan with 3% down or an FHA loan with 3.5% down.

-

You can expect to pay an average of $3,881 in closing costs for a home purchase in Colorado, or $2,266 for a refinance. However, this can change dramatically based on the cost of your home, the loan program you're using, where your home is located, and additional options you choose for your mortgage, like discount points.

Our Mortgages Experts

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.

Please note that this calculator is not personalized financial advice and should not be considered or used as such. Nor are we promising that by use of this calculator, will you be able to save more money, preserve wealth, or otherwise.