Although real estate prices have risen quickly throughout the United States in recent years, the Sun Belt states have been particularly hot markets. Georgia is a great example of a state with below average costs of living, above-average job and wage growth, a moderate climate, and nearby access to major cities, beaches, and mountains.

With that in mind, here's a quick guide to the current state of Georgia's housing market, and some of the important things to know about buying a home in Georgia, whether you're a first-time buyer or have years of homeownership experience. We'll also discuss how your mortgage payment is determined.

Use this Georgia mortgage calculator to help you set your budget and figure out how much house you can afford.

Although real estate prices have risen quickly throughout the United States in recent years, the Sun Belt states have been particularly hot markets. Georgia is a great example of a state with below average costs of living, above-average job and wage growth, a moderate climate, and nearby access to major cities, beaches, and mountains.

With that in mind, here's a quick guide to the current state of Georgia's housing market, and some of the important things to know about buying a home in Georgia, whether you're a first-time buyer or have years of homeownership experience. We'll also discuss how your mortgage payment is determined.

Use this Georgia mortgage calculator to help you set your budget and figure out how much house you can afford.

Georgia housing market

As of August 2023, the Georgia median home sale price has increased by 4.4% over the past year to $371,800, significantly less than the overall U.S. median home sales price of $420,284 in August 2023.

Although the median number of days on the market for homes in Georgia is hovering around 30 as of August 2023, up just four days from last year, a significant number of homes, 30.3%, experienced price drops prior to being sold. Despite this, the ultimate sales price of homes in Georgia averaged about 98.6% of their asking prices, which points to a market that's still pretty competitive overall.

Having said that, Georgia is a diverse state in terms of housing markets, with massive cities, coastal destinations, and many rural markets throughout the state. So here's a quick snapshot of some of the largest markets within Georgia and where things stand.

| Metropolitan Area | Median Home Value | 1-Year Change |

|---|---|---|

| Atlanta | $418,000 | 4.5% |

| Augusta - Richmond County | $193,250 | -3.4% |

| Savannah | $331,655 | 5.3% |

| Athens | $350,000 | 16.7% |

How do I calculate my mortgage payment?

First off, the easiest way to calculate a mortgage payment is to use a mortgage calculator, like the Georgia mortgage calculator we've included in this article. A calculator like this can do the heavy lifting for you, and there aren't many situations where anyone would need to calculate a mortgage payment manually. That said, if you're mathematically inclined or simply like knowing where your payment comes from, we can walk you through the process.

There are three different variables involved in the mortgage payment calculation -- principal, interest rate, and the number of mortgage payments you'll make.

Principal (P)

This is the amount of money you originally borrow when you obtain your mortgage, or your home sale price minus your down payment. And if you plan to roll any closing costs or lender fees into your principal, which is quite common with refinancing loans and FHA mortgages in particular, be sure to include those as well.

Interest rate (r)

Your loan's interest rate, but expressed on a monthly basis. To find yours, take your loan's interest rate (not the APR), convert it to a decimal, and divide it by 12. For example, if your mortgage interest rate is 7.5%, you would take 0.075 and divide it by 12, to find 0.00625.

Number of payments (n)

The number of monthly loan payments you're scheduled to make. For 30-year and 15-year mortgage loans, this is 360 and 180 months, respectively. If you have a different loan term, simply multiply the number of years by 12.

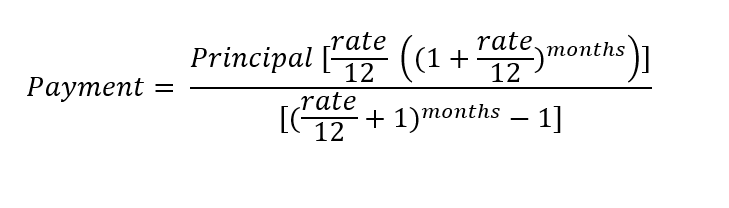

Putting it all together, here's the mathematical formula to calculate a mortgage payment:

It's also important to mention that this formula only calculates the principal and interest payment for a mortgage, which isn't likely to be the only thing you're required to pay each month. Specifically, most lenders require buyers to pay a prorated amount of their taxes and required insurance every month along with the mortgage payment, and if you put less than 20% down, you'll probably have to pay private mortgage insurance, or PMI.

To add these, take your most recent property tax bill and insurance premium, and divide each by 12 to figure out how much you need to add. And if you're buying a home and want to estimate yours, property tax bills can typically be found on the county's website and a local insurance agent can likely help you estimate your premium.

Things to know before buying a house in Georgia

We're focusing on mortgage payments in this article, but it's important to keep several other things in mind before buying a home in Georgia.

Georgia property taxes

The average Georgia homeowner pays 0.83% of their home's assessed fair market value in annual property taxes, which is near the middle of the pack nationwide, ranked 33rd out of 50 states. This means the typical Georgia property tax bill on a $300,000 home would be about $2,490 per year.

Insurance costs

When it comes to homeowners insurance, Georgia's average rates are just above the national average of $2,777, at $3,024 for a $300,000 home. It's also important to note this can vary significantly based on the geographic location of the property, and if you're buying a home in a coastal area, you may be required to carry flood insurance as well.

Credit and income requirements

Before you apply for a mortgage, it's a good idea to figure out if you're qualified. You'll need to meet the minimum credit scoring standards for whichever type of loan you're applying for -- at least 620 for a conventional loan and 580 for an FHA mortgage. You'll also need enough income to justify the loan, as well as a steady employment history. You should speak to several of the best mortgage lenders before you settle on a mortgage that will be best for your situation.

Rental restrictions

Are you planning to buy a second home or investment property in Georgia, or do you want the ability to list it on Airbnb or a similar platform when you aren't home? If so, be sure to check into local regulations governing short-term rentals. Many homeowners associations prohibit short-term rentals entirely, and it's not uncommon for entire cities to greatly restrict rentals, especially in areas with lots of tourism.

LEARN MORE: Home buyer checklist

Tips for first-time home buyers in Georgia

Homeownership assistance programs in Georgia

Like many other states, Georgia has a program to help make homeownership accessible to first timers. Specifically, the Georgia Dream Homeownership Program partners with lenders to provide conventional, FHA, USDA, or VA loans to eligible buyers. First-time home buyers can qualify, as can buyers who have not owned a home in the past three years or who buy a home in certain areas in the state.

The program provides up to $10,000 in down payment assistance to all eligible homeowners, but offers an additional $2,500 to public protectors (police, fire, EMT, etc), educators, or healthcare providers, as well as families with a member who is disabled.

How to qualify

Buyers must have household income under a maximum limit that varies by county, but ranges from $74,500 to $86,500, have liquid assets of no more than $20,000 or 20% of the home price (whichever is greater), and meet the lender's credit requirements. Homes must be priced under the caps for the county in which they're located, which range from $297,000 to $350,000 as of Jan. 1, 2023.

Home buyers must contribute a minimum of $1,000 toward their home purchase. The down payment assistance is structured as an interest-free loan with no payments -- home buyers don't have to pay anything back until they sell the home or refinance their mortgage.

Read more: Best mortgage lenders for first-time home buyers

Still have questions?

Here are some other questions we've answered:

FAQs

-

If you qualify for Georgia down payment assistance, you can get into your home with as little as $1,000 down. Otherwise, you may be able to bring as little as 3% down for your conventional mortgage or 3.5% for an FHA loan. Those buyers eligible for a VA or USDA loan often don't need a down payment at all.

-

On average, Georgia home buyers will need to have about $3,762 to cover their closing costs if they're buying a home. However, if you're refinancing, you'll only need an average of $2,727.

Our Mortgages Experts

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.

Please note that this calculator is not personalized financial advice and should not be considered or used as such. Nor are we promising that by use of this calculator, will you be able to save more money, preserve wealth, or otherwise.