Have you been thinking about buying a home in the Garden State? A home is a great way to create a firm foundation for your future, but it's also important to know just how much that white picket fence will ultimately cost. That's why we've put together this New Jersey mortgage calculator. Take it for a spin to help budget for your future home expenses.

Have you been thinking about buying a home in the Garden State? A home is a great way to create a firm foundation for your future, but it's also important to know just how much that white picket fence will ultimately cost. That's why we've put together this New Jersey mortgage calculator. Take it for a spin to help budget for your future home expenses.

New Jersey housing market

New Jersey has one of the more expensive housing markets in the United States, with a median home sales price of $514,800 in August 2023 -- nearly 24% higher than the U.S. average home price of $416,100 in second quarter 2023. However, median home prices vary dramatically within the state. Cities in the New York City metropolitan area are among the highest-cost housing markets in the country. Homes along the coast tend to be more expensive as well.

Despite these high prices, the median days on market for New Jersey homes was 31 days in August 2023, down five days year over year. So, not only are houses selling for more, they're doing it faster than last year. This is probably because housing supply is so limited, with just two months of inventory, or 25,933 homes listed for sale in August 2023. Inventory was down over 32% year over year, making it a tough market for anyone to buy in.

Because of limited inventory, almost 60% of homes sold over their asking price in August 2023, with the sale-to-list price at 103%, meaning more houses got higher offers than their listing price than those that didn't. In a competitive market like this, don't hesitate to call on the best mortgage lenders to secure a loan with a great rate for the New Jersey home of your dreams.

How do I calculate my mortgage payment?

Your monthly mortgage payment consists of interest paid to your lender plus a portion of the principal you owe. You'll probably have to pay certain other expenses we'll get to later in this section alongside your monthly mortgage payment. Nevertheless, the principal and interest (P+I) you pay each month is your actual mortgage payment. That's one of many reasons it's important to be aware of current mortgage rates when shopping for a lender.

There are three main factors that determine your payment:

How much you borrow: The most obvious and straightforward factor in your mortgage payment is the amount you borrow to buy your home. That depends on the price you pay for the home and the size of your down payment. This is the only one of the three factors that has a linear relationship with your mortgage payment -- in other words, your payment on a $400,000 mortgage will be exactly double the payment on a $200,000 loan, all other factors being equal.

Interest rate: Lenders charge interest when they loan money, based on the perceived credit risk of the borrower. Your mortgage will have an interest rate. This rate is the amount of interest you'll pay, expressed on an annualized basis. For example, a $400,000 mortgage at 7.5% interest will initially accumulate interest at the rate of $21,916 in the first year. But here's where it gets mathematically complex: Each month, a portion of your mortgage payment reduces the principal you owe, and therefore reduces the amount of interest that accumulates before your next payment is due. Over time, the amount of your payment that goes to interest will gradually decrease, and the amount applied to your principal balance will gradually increase. This is the basic idea behind the mathematical concept called mortgage amortization. The credit score needed for a home loan varies by lender, but if your credit score is good, you'll likely benefit from a lower interest rate.

Repayment term: If you're deciding between a 15- or 30-year mortgage, there are a few things to consider. First, your monthly payment on a 30-year mortgage will be lower than your monthly payment if you choose a 15-year mortgage. But thanks to the mathematical complexities of amortization, it's not a linear relationship -- the 15-year payment won't be exactly twice as much as the 30-year payment.

All of these factors are taken into account in our New Jersey mortgage calculator above.

The mortgage payment formula

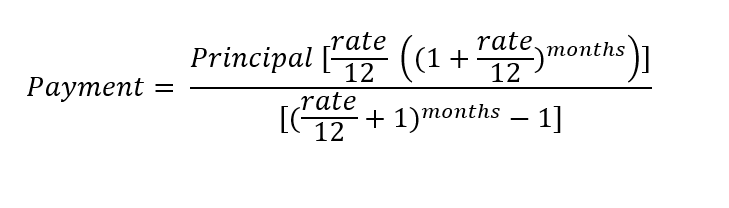

Determining a mortgage payment can be mathematically complex. This is why we're providing this handy New Jersey mortgage calculator that does the hard work for you.

If you insist on calculating your mortgage payment by hand, here's the mathematical formula to do so:

Your actual monthly payment will likely be much higher -- especially in New Jersey

Your principal and interest mortgage payment doesn't tell the whole story of how much you're actually going to pay each month. Most mortgage lenders require borrowers to pay a monthly share of their property taxes and homeowners insurance along with their mortgage payment. And if the property is located in a community with a homeowners association (HOA), you may have to pay the monthly dues to your lender, who will then pay them on your behalf.

And if you put less than 20% down when obtaining your loan, you'll probably have to pay for private mortgage insurance, or PMI. You'll send that along with your monthly payment as well.

Fortunately, our New Jersey home mortgage calculator allows you to incorporate these expenses. You'll notice text that says "show additional inputs" below the primary input boxes on the calculator. If you click on this, you can add your taxes, insurance, and HOA dues to the payment.

Things to know before buying a house in New Jersey

New Jersey is one of the more expensive real estate markets in the U.S. In addition, New Jersey property taxes are some of the highest in the nation. The average New Jersey homeowner pays 1.89% of their home's assessed market value in property taxes each year. That's more than twice the national average. This means the median property tax bill in New Jersey is about $6,579.

Also, if you live near the coast (excuse me -- the "shore") or in a low-lying area, you might be required to purchase flood insurance. And even if you aren't required to do so by your lender, you might want to consider purchasing flood insurance anyway. It's important to note that all homeowners insurance policies specifically exclude water damage caused by flooding. Buying flood insurance could potentially save you from a financial catastrophe down the road. Don't forget to add the cost of flood insurance when using our NJ mortgage calculator for the most accurate estimates of your monthly mortgage payments.

Tips for first-time home buyers in New Jersey

New Jersey has programs to assist residents in becoming homeowners. Here's a rundown of the two main programs, as well as links to find out more information:

- The NJHMFA Down Payment Assistance Program provides $15,000 in forgivable assistance for qualified first-time home buyers. Those funds are meant to go towards down payment and closing costs.

- The New Jersey Housing and Mortgage Finance Agency's (NJHMFA) First-Time Home Buyer Mortgage Program provides first-time home buyers with incomes up to $138,500 (depending on county) with government-insured mortgages through a network of participating lenders. Home buyers can use this program and the down payment assistance program together.

Still have questions?

Here are some other questions we've answered:

FAQs

-

New Jersey offers first-time home buyer programs down payment assistance. You can also get a zero down payment mortgage through VA or the USDA. If none of those options works for you, conventional mortgages typically only require 3% down, and FHA mortgages just 3.5%.

-

New Jersey closing costs can be substantial. If you're buying a house, expect to pay an average of $7,915, but if you're refinancing, it will be considerably less, on average about $4,963.

Our Mortgages Experts

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.

Please note that this calculator is not personalized financial advice and should not be considered or used as such. Nor are we promising that by use of this calculator, will you be able to save more money, preserve wealth, or otherwise.