Considering a move to the Land of Enchantment that is New Mexico? Or just looking to finally put down roots in the state you already call home? Either way, buying a home in New Mexico can be full of expenses that you might not be thinking about right now. That's why we've put together this brief on buying a home in New Mexico, including a quick rundown of what to expect expense-wise.

Use our New Mexico mortgage calculator to help build your New Mexico home-buying budget.

New Mexico housing market 2022

If you're considering a move to New Mexico, you're not the only one. It's been a popular place for home buyers, resulting in a rapid rise in the median home sales price to $363,300 in August 2023. This is an 18.2% gain for the state from the same time a year prior. The median days on market for homes in New Mexico in August 2023 was 34, down from 35 days the year prior, indicating that the market in this state is hot, hot, hot (it's not just the Hatch chiles).

Not surprisingly, homes for sale in New Mexico are few, with just two months of inventory available in August 2023, and homes listed for sale during the same month are down 16% year over year. This has made it a very favorable market for sellers, who are generally getting about 99.4% of their asking prices for their homes.

It's no surprise, really, with the median home price in the U.S. during the third quarter hitting $430,300, that there's an immense value to be found in every part of New Mexico, even with prices on the rise. The state has a long way to go before it reaches the U.S. median.

Considering a move to the Land of Enchantment that is New Mexico? Or just looking to finally put down roots in the state you already call home? Either way, buying a home in New Mexico can be full of expenses that you might not be thinking about right now. That's why we've put together this brief on buying a home in New Mexico, including a quick rundown of what to expect expense-wise.

Use our New Mexico mortgage calculator to help build your New Mexico home-buying budget.

New Mexico housing market 2022

If you're considering a move to New Mexico, you're not the only one. It's been a popular place for home buyers, resulting in a rapid rise in the median home sales price to $363,300 in August 2023. This is an 18.2% gain for the state from the same time a year prior. The median days on market for homes in New Mexico in August 2023 was 34, down from 35 days the year prior, indicating that the market in this state is hot, hot, hot (it's not just the Hatch chiles).

Not surprisingly, homes for sale in New Mexico are few, with just two months of inventory available in August 2023, and homes listed for sale during the same month are down 16% year over year. This has made it a very favorable market for sellers, who are generally getting about 99.4% of their asking prices for their homes.

It's no surprise, really, with the median home price in the U.S. during the third quarter hitting $430,300, that there's an immense value to be found in every part of New Mexico, even with prices on the rise. The state has a long way to go before it reaches the U.S. median.

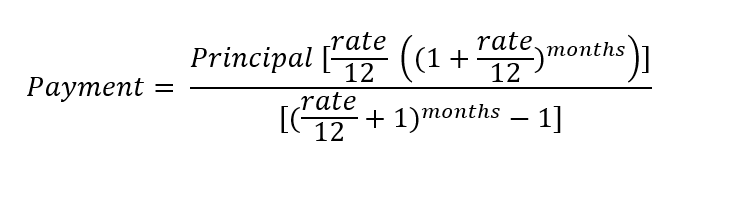

How do I calculate my mortgage payment?

The formula to calculate by hand is quite complex, so we recommend using our New Mexico mortgage calculator. But if you'd like to manually compute it, the formula looks like this:

To get your monthly mortgage payments with our calculator, enter your mortgage loan amount (there's an option to enter your down payment amount as well), the term of your loan, and the rate you expect to get. The term of your loan is the number of years you have to repay your mortgage. Keep in mind that the higher your credit score, the more likely you are to get the most competitive rate.

In addition to the principal and interest, be sure to add monthly insurance costs, taxes, and other fees, like HOA dues, that are regularly paid out of mortgage escrow.

What other costs do I have to pay?

There are other monthly expenses to account for, like homeowners insurance and property taxes. To enter these additional costs into the above mortgage calculator for New Mexico, just click "Additional inputs" (below "Mortgage type").

When you use our New Mexico mortgage calculator, remember that property taxes paid as a percentage of owner-occupied homes are on average 0.55%, but may be different in your county. Homeowners may also be part of a homeowners association (HOA) and have to pay a monthly HOA fee on top of their mortgage payment. HOA fees usually cover the maintenance of common areas, and often include services like trash pickup. You may also need to account for private mortgage insurance (PMI). Homeowners pay PMI if they don't make at least a 20% down payment on their home.

Our tool will help break down your costs so you can see what your monthly mortgage payments will look like in different scenarios. If you want to refinance an existing mortgage, our New Mexico mortgage calculator can also help you determine your monthly payment -- and you can check out our list of the best refinance lenders to get that process started.

Things to know before buying a house in New Mexico

Before you buy a home in New Mexico, it's important to make sure you have your finances in order so you can get the most competitive rates. You need:

- A good credit score

- A low debt-to-income ratio

- A steady source of income

- A down payment or down payment assistance

- Additional funds to cover other expenses of homeownership like maintenance, repairs, and emergencies

There are also specific issues you should be aware of when buying a home in New Mexico. New Mexico has one of the most diverse landscapes in the U.S., ranging from desert to grasslands, mountains, and mesas.

Despite the 18.2% increase in median home sales prices this past year, homes in New Mexico are relatively cheap compared to homes in California and Arizona. It is important to know what you want, find the ideal location, and work with the right agents and mortgage lenders to find the best price and rates.

LEARN MORE: Home Buyer Checklist

Tips for first-time home buyers in New Mexico

There are several programs available for first-time home buyers through the New Mexico Mortgage Finance Authority (MFA), a quasi-governmental entity that provides financing for low- and moderate-income New Mexicans. Using funding from housing bonds, tax credits, and other federal and state agencies, the MFA provides financing and resources to build affordable rental communities, rehabilitate aging homes, and supply down payment assistance, affordable mortgages, and other services to New Mexicans.

To qualify for New Mexico MFA mortgage programs, home buyers need to have a minimum credit score of 620 and receive pre-purchase home buyer counseling.

First-time home buyer loans and programs

New Mexico offers two first-time home buyer programs to qualified New Mexicans. These are:

- FirstDown: FirstDown is down payment and closing cost assistance in the form of a fixed-rate second mortgage, offered through participating MFA-approved lenders. The program has income limits based on household size, and purchase price limits, but provides up to 4% of the home's sales price for down payment or closing cost assistance.

- HomeNow: HomeNow is a program similar to FirstDown, in that it's a second loan that can be used for down payment and closing cost assistance, but it has significant differences in who can qualify and how much they will get. All successful applicants have incomes at or below 80% of the area median, based on location and household size (the income caps are roughly half of FirstDown). The loan can be forgiven after 10 years of occupying the home, and no payment is required. HomeNow provides up to $7,000 to assist lower-income New Mexican home buyers.

Still have questions?

Here are some other questions we've answered:

FAQs

-

If you're buying a home in New Mexico, you'll need to bring at least a 3% down payment for a conventional mortgage or 3.5% for an FHA loan. However, there are first-time home buyer assistance programs available that can cut that figure down significantly, depending on the cost of your home and your personal financial situation. In addition, some borrowers may be eligible for 0% down loans through VA and USDA.

-

New Mexico home buyers can expect to pay $3,513 in closing costs on average for a home purchase, but only $2,693 if they're simply refinancing.

Our Mortgages Experts

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.

Please note that this calculator is not personalized financial advice and should not be considered or used as such. Nor are we promising that by use of this calculator, will you be able to save more money, preserve wealth, or otherwise.