If you're thinking about picking up everything and heading out West, you might be considering Utah. This sunny, dry state has a lot to offer, including an active housing market. If you're buying a house in the Beehive State, use our Utah mortgage calculator to estimate your monthly mortgage payment with taxes, fees, and insurance.

If you're thinking about picking up everything and heading out West, you might be considering Utah. This sunny, dry state has a lot to offer, including an active housing market. If you're buying a house in the Beehive State, use our Utah mortgage calculator to estimate your monthly mortgage payment with taxes, fees, and insurance.

Utah housing market 2022

Like the rest of the United States, Utah has experienced significant price growth in the last few years, though 2023 was far less dramatic. The median sales price of a home in Utah in September 2023 was $566,900, up 7% over the same time the previous year, and almost 32% higher than the national median sales price for homes in the third quarter of 2023, $430,300.

This is likely at least in part due to the low number of homes for sale -- just four months of housing supply -- and a count of 14,187 in September 2023, which is down 11.5% from the same time the previous year.

The fact that home sellers are still getting 98.7% of their asking prices for their homes, a number practically unchanged from September 2022, further supports the strength of this housing market. Almost 25% of homes sold in Utah went above list price in September 2023.

How do I calculate my mortgage payment?

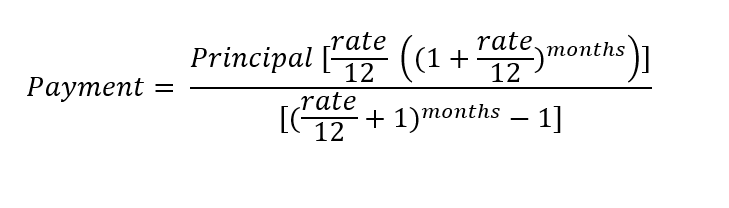

We recommend using a mortgage calculator to calculate your mortgage payment. The formula to calculate by hand is quite complex. It looks like this:

To calculate your monthly mortgage payments in Utah, you'll need to enter in your estimated mortgage loan amount, the term of your loan, and the rate you think you'll be eligible for.

The loan term is the number of years you have to repay your mortgage. Common terms are 15-year and 30-year mortgages. The higher your credit score, the more likely you'll be to get the most competitive mortgage rate available. In addition, you can choose a fixed interest rate throughout the term of your loan or an adjustable rate that changes over time based on market conditions.

Check with several of the best mortgage lenders to get a better idea of what kind of mortgage interest rate you may qualify for.

What other costs do I have to pay?

There are other monthly expenses you'll need to account for beyond just the purchase price, like homeowners insurance and property taxes. When you use our Utah mortgage calculator, remember that property taxes paid as a percentage of owner-occupied homes are on average 0.6%. Property taxes may change based on your county.

Homeowners may also be part of a homeowners association (HOA) and have to pay a monthly HOA fee on top of their mortgage payment. HOA fees usually cover the maintenance of common areas, and often include services like trash pickup. To enter these additional costs into the above mortgage calculator for Utah, just click "Additional inputs" (below "Mortgage type").

You may also need to account for private mortgage insurance (PMI). Homeowners will have to pay PMI if they don't make at least a 20% down payment on their home. With all these potential costs, it is helpful to use our Utah home loan calculator. Our tool will help break down your costs so you can see what your monthly mortgage payments will look like in different scenarios.

If you want to refinance an existing mortgage, our Utah mortgage calculator can also help you determine your monthly payment -- and you can check out our list of the best refinance lenders to get that process started.

Things to know before buying a house in Utah

Before you buy a home in Utah, it's important to make sure you have your finances in order. Make sure you have set a budget for buying a house. To get the most competitive mortgage rates from a lender, you will need:

- A good credit score

- A low debt-to-income ratio

- A steady source of income

- A down payment

- Additional money beyond the down payment to cover ongoing maintenance, repairs, and other emergencies

Utah has three major geographic areas: the Rocky mountains, the Basic and Ridge Region, and the Colorado Plateau. Utah is a popular outdoor state with five national parks, top-rated ski resorts, and many national wonders.

Utah is also home to common natural disasters such as wildfires, floods, and severe storms. Utah has an estimated 800 to 1,000 wildfires a year and is considered one of the most fire-prone states in the U.S, so be sure to check with your insurance company about coverage long before you start looking for a home there. It can be very expensive in high- risk areas, which may affect how much home you can afford.

Learn more: Home Buyer Checklist

Tips for first-time home buyers in Utah

Here are some important tips for first-time home buyers in Utah. There are several programs available for first-time home buyers through the Utah Housing Corporation (UHC). Created in 1975 by the Utah state legislature, the purpose of UHC is to help provide more affordable housing for low and moderate income families. The UHC has two first-time home buyer assistance programs for Utah residents:

- UHC Down Payment Assistance Second Mortgage. If you qualify for a Utah Housing Corp first mortgage home loan, you may also be able to borrow the entire cost of your down payment and closing costs. You will need to qualify for this loan through a participating lender.

- First-time Homebuyer Program Assistance. This program helps first-time home buyers purchase newly built homes with up to $20,000 in program funds, provided as a 0% interest second loan with no payment requirements that's due at the time the owner decides to refinance or sell their home. The price of the home can't exceed $450,000 as of Oct. 17, 2023.

Still have questions?

Here are some other questions we've answered:

FAQs

-

If you qualify for first-time home buyer assistance in Utah, you may not need to bring any money to closing. But even if you don't, you still may qualify for a zero down mortgage through the USDA or VA. Other low-cost options would include conventional loans with 3% down payment requirements and FHA loans that require just 3.5%

-

Utah is not a terribly expensive state for closing costs, with the average coming in at $4,837. If you want to refinance your loan, you'll only need an average of $2,380.

Our Mortgages Experts

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Please note that this calculator is not personalized financial advice and should not be considered or used as such. Nor are we promising that by use of this calculator, will you be able to save more money, preserve wealth, or otherwise.