Form 2553: Election by a Small Business Corporation is used by small businesses that elect to be taxed as an S corporation, rather than the default C corporation business structure assigned by the IRS. Filing Form 2553 has specific qualifications and filing deadline requirements. Learn more here about Form 2553, including eligibility requirements, deadlines, and whether it’s right for your business.

Overview: What is IRS Form 2553?

Any time you form a business entity, the IRS automatically assigns that entity a tax classification. If you form a corporation, the IRS will automatically place you in the corporation tax classification.

If that’s where your business should be, that’s great. But for smaller businesses looking to lower their tax burden, the smart thing to do may be to request that your classification be changed. To do that, you need to file IRS Form 2553. You can request this classification change if your business is designated a C corporation or a single-member or multi-member LLC.

Since the IRS does not offer automatic S corporation classification, filing Form 2553 is the only way you may obtain it. Form 2553 serves as an S Corporation election form.

3 reasons why you’d want to file Form 2553

S corporation designation has tax benefits including a significant reduction when you prepare your taxes. Other benefits include the following.

1. Protection from creditor claims

If you’re a sole proprietor, your personal assets are fair game for creditors and anyone that may file a legal claim against you. However, an S corporation protects the personal assets of all shareholders.

2. No double taxation

S corporation taxes can be significantly lower than those of a C corporation, since all S corporation income, credits, and deductions are passed through to shareholders, who are then taxed at their personal tax rate. If you’re looking for a way to reduce your taxes, Form 2553 may be a good start.

3. Ownership transfer

Unlike a C corporation, transfer of ownership is much less complicated with an S corporation and can be undertaken with a standard sales agreement.

Is your business eligible to make an S-corp election?

If filing Form 2553 sounds like a great idea, before proceeding, be sure your business meets the following IRS eligibility requirements.

- Your business is a domestic corporation or entity.

- You have no more than 100 shareholders. Family members, including a spouse, can be treated as one shareholder.

- Shareholders are individuals, estates, or exempt organizations.

- There are no nonresident alien shareholders.

- You only offer one class of stock.

- Your business is not a bank, an insurance company, an international sales corporation, or a corporation treated as a possessions corporation.

Besides the requirements above, you’ll also have to adapt your tax year to suit IRS requirements which include:

- A tax year ending December 31

- A natural business year

- An ownership business year

- A tax year elected under section 444

- A 52-53 week tax year with reference to one of the tax years listed above

4 steps for correctly filling out Form 2553

Form 2553 has four parts you will need to fill out before filing. We explain each part and let you know what information is needed to complete the form.

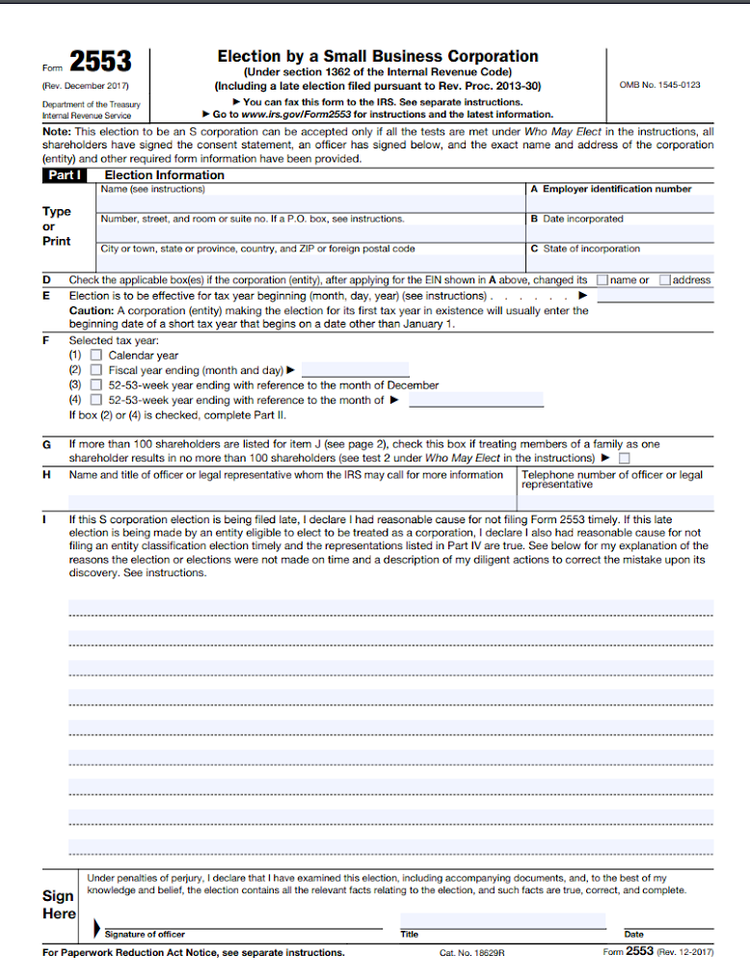

1. Election information

Part I of Form 2553 is where you enter all election information. Part I will take the longest to complete, requiring the following information.

- Name and address

- Employer Identification Number (EIN)

- Date incorporated

- State where incorporated

- Fiscal year

- Name and title of officer or legal representative

IRS Form 2553 Part I is used to enter contact information and other details about your business. Image source: Author

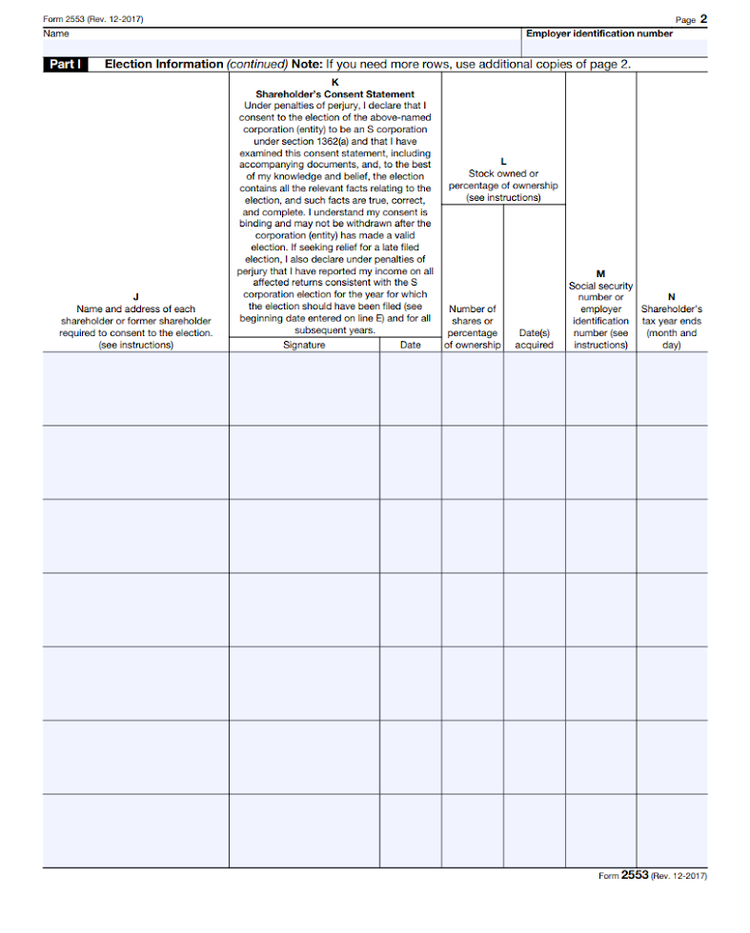

- Name and address of all shareholders, number of shares owned, date shares were acquired, and shareholder’s tax year

Part I, page 2 of Form 2553 is where you need to enter shareholder information. Image source: Author

In addition to providing the information above, each shareholder will need to sign and date the form before filing.

2. Selection of fiscal tax year

Part II is where you select your fiscal tax year. If you choose a calendar year, or a 52-53 week year ending in December for your fiscal year, you don’t have to fill out Part II.

Part II of Form 2553 only needs to be completed if you didn’t choose a calendar year in Part I. Image source: Author

However, if you checked box 2 or box 4 in Part I, you will need to complete Part II, which covers the selection of your fiscal year. New business owners may want to enlist the help of a CPA or other tax professional to complete Part II if they’re unsure about any option listed.

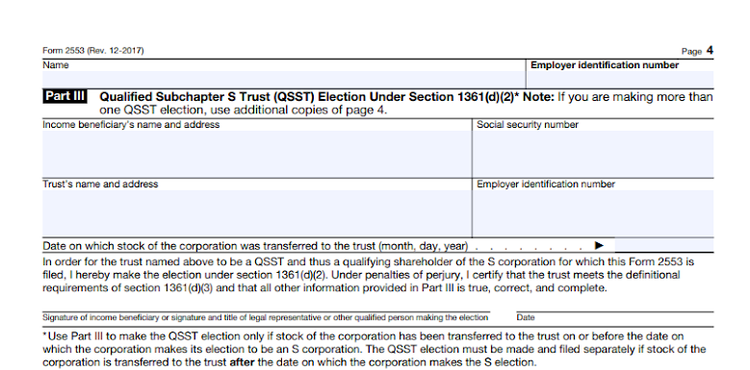

3. Qualified Subchapter S Trust Election

The Qualified Subchapter S Trust Election information will not need to be completed in Part III unless corporate stock has been transferred to a trust prior to the corporation making the election to become an S corporation.

Part III of Form 2553 is used if income from S corporation shares is paid to a beneficiary. Image source: Author

If you’re unsure about Part III, speak to your CPA or an attorney for clarification.

4. Late Corporate Classification Election Representations

If you filed Form 2553 by the required deadline, there’s no need to complete Part IV.

However, if you’re submitting past the deadline, you will need to read and agree to the representations in Part IV. These representations detail the requirements that must be met for late election relief to be granted.

Part IV of Form 2553 is only used if you’re filing past the form due date. Image source: Author

If these representations are not met, your application for S corporation election relief may be denied.

When is Form 2553 due?

Filing Form 2553 has no hard deadline. Instead, deadlines are applied to small businesses depending on their circumstances. The two main criteria that must be met are:

- The form must be filed no later than 2 months and 15 days after the beginning of the tax year when the election will take place. For example, if you use a calendar year, you would need to file Form 2553 by March 15 of the year when you want the election to take place. If your fiscal year begins March 1, then you would need to file Form 2553 by May 15 of that year.

- You can also file any time during the preceding year. For example, if you want to elect to become an S corporation in 2021, you can file Form 2553 at any time in 2020.

What happens if I file Form 2553 late?

If you file Form 2553 late, the election will typically go into effect the following year. For example, if you had to file by March 15, and file March 31, instead of being effective in 2021, when requested, the election will go into effect automatically in 2022.

The IRS does offer relief for those that file late, provided they meet certain requirements including:

- The corporation intended to file as an S corporation on the date specified on Form 2553

- The corporation has reasonable cause for late election

- All shareholders reported their income consistent with S corporation status for the year the status should have been made

If all conditions and requirements are not met, corporations can request a separate ruling and must pay a user fee.

Filing Form 2553 can be beneficial

Small business owners classified as a C corporation can significantly reduce their tax liability by filing Form 2553. Classification as an S corporation means you’ll only be taxed once on income, whereas a C corporation can be taxed twice.

To learn more about Form 2553 including eligibility and other requirements, visit the IRS website, where you can also download Form 2553 instructions.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.