4 Steps to Becoming an S Corp

The next time someone tells you they run an S corporation, an astute response might be, “And how did you register the business?”

Becoming an S corp looks different from other business types. If you’re looking to channel your inner Robert Frost and take the road less traveled by building an S corp, keep reading.

Overview: What is an S corp?

An S corporation is a special IRS tax status that can lead to significant tax savings for business owners.

You have roughly five options for business structures: sole proprietorship, partnership, limited liability company (LLC), C corporation, and S corporation. The S corporation business structure isn’t like the other four. It’s not even a business structure at all.

Think of your business as a cake, and S corporation taxation as the icing. Your business structure is the funfetti cake. When the IRS looks at your business, it taxes you based on the outermost layer.

S corps are pass-through entities, meaning you file business and personal taxes together. The company files an annual information return on Form 1120-S, but business income is taxed on the shareholders’ individual tax returns.

There's good reason to elect S corp taxation, but it’s not an option for every business. The IRS restricts S corp taxation to U.S.-based companies with 100 or fewer owners, called shareholders.

3 benefits of becoming an S corp

Three significant benefits accrue to an S corp: no double taxation, shareholder-employee status, and the net operating loss deduction.

1. No double taxation

S corporations, like sole proprietorships and partnerships, are pass-through entities, meaning business income is taxed on the owners’ personal tax returns. Pass-through entities don’t pay income tax outside their owners’ returns. In other words, S corps are taxed just once: at the individual level.

C corporations, also called traditional corporations, don’t have pass-through taxation and pay a 21% entity-level tax before passing on profits to shareholders through dividend distributions, which are also taxable. We say that C corporations are subject to double taxation because profits are taxed twice: once at the entity level and again at the individual level.

Consider the difference between C corps and S corps with an example: Imagine a company with one owner and $200,000 in taxable income.

If it’s a C corporation, the business pays $42,000 ($200,000 * 21% corporate tax rate) in corporate income tax before distributing the remaining $158,000 ($200,000 - $42,000 corporate taxes) to the owner. The owner pays federal and state income taxes on the $158,000.

As an S corporation, the business pays no income tax, passing on the entire $200,000 to the owner, who pays small business taxes at their individual tax rate.

Because the corporate tax rate is so low, it’s better for businesses that reinvest profits to retain C corp taxation. At the same time, that’s often not the case for small business owners, making S corp taxation a big hit.

2. Shareholder-employee status

A leading benefit of S corporation taxation is shareholder-employee classification. Shareholders who participate in management are considered employees, meaning they get paid in two ways: salary and dividend distributions. Translation: payroll tax savings.

Salary income is subject to Federal Insurance Contributions Act (FICA) taxes, while dividend income isn’t. You must pay yourself a reasonable salary, but any leftover earnings in your business come payroll tax-free. The IRS is watching, so don’t get smart and pay yourself a below-market salary.

Business owners don't enjoy employee classification in other pass-through structures, so they pay the employer and employee portions of FICA taxes on their share of business earnings.

Say you own a business that earned $250,000 last year before you paid yourself.

As an S corp shareholder-employee, you’re required to take a reasonable salary. Let’s say you take a $200,000 salary, leaving $50,000 as dividend income. You and your business only pay FICA taxes on the $200,000 salary; federal and state taxes apply only to the $50,000 remainder.

Other pass-through business owners would pay self-employment taxes on all $250,000. Self-employment taxes run you at least 15.3% of earnings: 12.4% to Social Security and 2.9% to Medicare. Single, self-employed taxpayers who earn more than $200,000 in a year pay 0.9% in Additional Medicare Tax.

3. Net operating loss deduction

It’s not unusual for small businesses to take a few years before they turn a profit. S corporation shareholders -- and other pass-through entity owners -- can soften the loss by claiming a net operating loss (NOL) deduction on their personal taxes, lowering their tax bill in the year of loss.

By contrast, the IRS treats C corps as separate taxpaying entities from shareholders. C corporations can also take a net operating loss deduction, but the benefits don’t extend to their owners’ tax liability.

Say you opened a business last year that posted a $25,000 loss. You file your taxes jointly with your spouse, who earned $100,000 as an employee at an unrelated company.

If your business is a C corp, your business will file a separate business tax return, pay no corporate taxes, and carry forward the loss to reduce future taxable income. Your personal tax return won’t reference the C corp loss, and you’ll pay federal income taxes on your spouse’s $100,000 income.

An S corp shareholder would take a $25,000 NOL, offsetting your spouse’s $100,000 income, reducing your tax bill for the year.

How to form your own S corp

Business owners often hesitate to elect S corp status because of the added paperwork. Really, it’s just one extra step to go from a C corp or LLC to an S corp.

1. Register your business

S corporations must start as another business type. While you elect S corporation status with the federal government, you register your business on the state or territory level. The most common starter structures are C corporations and LLCs.

Consult with an attorney or CPA before registering your business. Even when your end goal is to become an S corp, your initial registration has implications for your company’s operations.

Follow our guide to registering your business with your state or territory.

2. Read the qualifications

Not every business qualifies to elect S corp taxation. You can elect S corp taxation when your business:

- Is an eligible, domestic corporation: Financial institutions and insurance companies, along with domestic international sales corporations cannot elect S corp taxation. Most companies registered as LLCs or C corps meet this requirement.

- Has no more than 100 allowable shareholders: Partnerships, corporations, and non-resident aliens cannot be shareholders in your S corp. Individuals, some trusts, and estates are permissible shareholders.

- Has only one class of stock: This requirement likely won’t pose an issue for small business owners.

3. Weigh the pros and cons

While S corporation shareholders enjoy tax benefits, not all is sunny in S corp land.

To balance out the benefits listed above, consider the drawbacks:

- IRS tax filing: Compared to sole proprietorships and single-member LLCs, S corporation taxes require more steps. Tax software makes filing easier, but S corp status still brings up complications at tax time.

- Expense: I’ve mentioned talking to an attorney or CPA during the business registration process. Starting an S corp may require more time and attention than another business type, and time is money.

- State income tax treatment: Some states and territories, like California and the District of Columbia, don’t recognize S corporations. Your business will continue to be taxed as initially registered.

While you can revert to being taxed as an LLC or C corp, it requires substantial paperwork and time. Be sure before you make the jump.

4. File federal and state S corp election forms

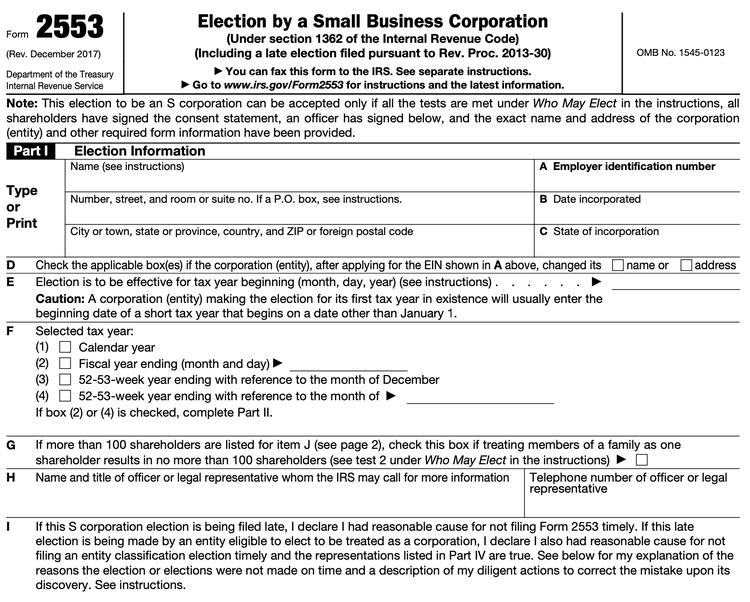

When you’re confident you want to elect S corp taxation, file IRS Form 2553. You might need to file a similar form with your state’s tax division.

To elect S corp taxation for the current tax year, file no more than two months and 15 days after the tax year begins. You can always file for S corp taxation in the year you want S corp taxation to begin.

Enlist the help of a tax attorney or CPA when filing Form 2553. Image source: Author

You’ll probably want the help of an attorney or CPA to file for S corp taxation. Bring them the following information:

- Business name

- Federal employer ID number (EIN)

- Business address

- Date and place of incorporation

- Name, address, and ownership percentage of each shareholder

Some states require you to notify them if you’re electing S corp status with the IRS. My home state of New Jersey has you fill out Form CBT-2553, but since California doesn’t recognize S corps, there’s no equivalent form.

Stoked about S corp status?

S corps have a lot to offer small business owners, from tax benefits to limited liability protections. Before you get too excited, talk to a tax professional to determine whether your business will benefit from S corp taxation.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.

Related Articles

View All Articles