How Net Operating Loss Affects Your Business

It’s rare for a business to be profitable every year of its operations, especially when it’s just getting started. From a natural disaster to a pandemic to an unfortunate year, there are plenty of reasons why a business’s expenses will exceed its revenues.

U.S. tax laws are designed to help businesses absorb the blow of losses through the net operating loss deduction.

The rulebook on net operating loss (NOL) has changed a couple of times in recent years, but the Coronavirus Aid, Relief, and Economic Security (CARES) Act has temporarily made NOL provisions the most generous they’ve been in recent history.

Overview: What is a net operating loss?

A business has a net operating loss when its deductible business expenses -- payroll, cost of goods sold, rent, and the like -- exceed its revenues in a given tax year.

When a business incurs an NOL, it’s likely hurting. It signals the company isn’t earning enough in revenues to cover the expenses associated with running the business, or that an outsized expense caused by theft or a natural disaster destroyed its profitability. The U.S. government steps in to give a reprieve on either past or future tax bills.

NOL tax provisions ease the burden of getting the business back on its feet by putting money back into company coffers or offering a reduction on future taxable income.

How your small business can calculate net operating loss

If the difference between a business’s revenues and its deductible business expenses is positive, you have taxable income, and if it’s negative, you have a net operating loss.

Unlike personal tax deductions, business tax deductions cover most ordinary expenses, such as wages, cost of goods sold, and equipment.

If your business has robust bookkeeping practices, you’ll be able to make short work of calculating most deductible business expenses. Your net operating loss will be similar, but not the same, as the net operating loss you see on the income statement in your business’s accounting software.

The NOL on your income statement will differ from the one on your tax form because of special rules for certain types of expenses. Check out our guide to small business tax deductions for specifics.

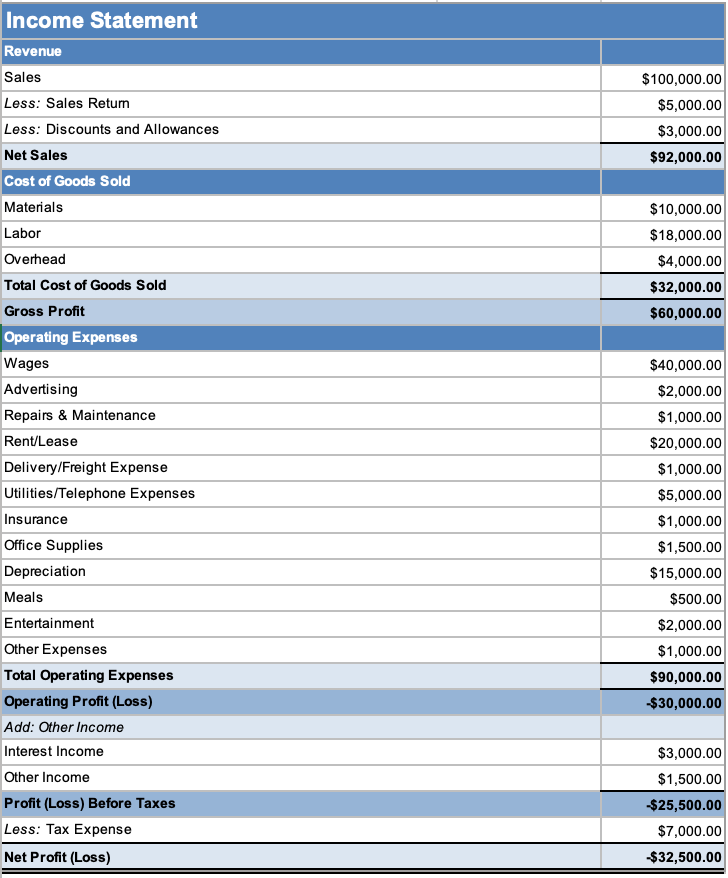

Let’s take a look at an example. This is your income statement for calendar year 2019.

Income statement courtesy of Image source: Author

FreshBooks template

According to your books, the business incurred a $30,000 NOL. You’ll need to adjust the depreciation, meals, and entertainment accounts to arrive at your NOL for tax purposes.

Capital assets are substantial, one-time purchases of things like vehicles, heavy machinery, and buildings. Your outsized purchase will be depreciated: The cost gets deducted over a period of years determined by the Internal Revenue Service (IRS).

While your business most likely follows straight line depreciation, the IRS uses its proprietary Modified Accelerated Cost Recovery System (MACRS).

Entertainment expenses, like tickets to a sporting event, aren’t considered deductible expenses for tax purposes. Only half of meal expenses can be deducted on your taxes.

The $2,000 entertainment expense gets added back, and so does half of the $500 meal expense. Then, there’s depreciation, which we calculated as $15,000 using the straight line depreciation method. Let’s say that according to MACRS, the depreciation is $20,000. So we subtract $5,000 from the book NOL.

The NOL for tax purposes is $32,750 (-30,000 + 2,000 + 250 – 5,000). That amount gets reported on the taxable income line of your business’s tax return.

NOL carrybacks and carryforwards: How to turn NOL into a tax reduction

In the year your business has a NOL, your business will owe no federal income tax, and in some cases, can get a refund of some taxes paid in past years, the effect of a “NOL carryback.” In other cases, the business can reduce taxable income in future years, a “NOL carryforward.”

Carrybacks reduce taxable income from prior year(s), and carryforwards reduce future taxable income, both by the amount of the NOL.

NOL carrybacks and carryforwards might remind you of a similar concept related to capital assets. If your business sells a capital asset for less than it’s worth on your books, the difference is considered a capital loss, and it may be deducted through a carried back or forward similar to a NOL.

Since you’ve already paid your business’s income tax for prior years, electing a NOL carryback triggers an immediate tax refund. NOL carryforwards act like a coupon that stays on the business’s record until it’s redeemed.

Be warned that an immediate refund is tentative, meaning that the IRS can investigate the accounting behind your NOL and revoke it if the IRS thinks your business expense categorization was improper. Make sure you completed the small business tax preparation checklist to avoid hiccups.

As COVID-19 ravages small business sales, the U.S. government adjusted its NOL tax laws in April 2020 to pad business losses by reintroducing carrybacks.

What are the CARES Act changes to NOL?

Before the CARES Act, NOL tax got its last update under the Tax Cuts and Jobs Act of 2017 (TCJA). Until the TCJA took effect in 2018, businesses could carry their NOL back two years or forward up to 20 years.

When businesses suffered a NOL, they could receive an immediate tax refund if they paid income tax in at least one of the previous two years.

If there was no taxable income in the previous two years -- and therefore no income tax was paid -- or the company just doesn’t want to carry back its NOL, it could waive the carryback in favor of a carryforward.

The TCJA eliminated carrybacks for tax years after 2017, taking away immediate tax refunds for suffering businesses. It also removed the 20-year carryforward limit for tax years after 2017, allowing businesses to carry forward their NOL indefinitely.

Even today, any NOLs incurred before 2018 are subject to the 20-year carryforward period.

The TCJA also made it so that businesses would always have an income tax liability in years when they have taxable income. The amount of the carryforward was limited to 80% of taxable income in the year the NOL deduction was taken, a restriction that hadn’t existed before.

So if a company had a NOL of $250,000 from 2018 and taxable income of $260,000, the maximum NOL deduction would be $208,000 ($260,000 * 80%). The company will be able to continue carrying forward the leftover $42,000 ($250,000 - $208,000) indefinitely.

Then, things changed again -- but only temporarily -- when the CARES Act rolled out in April 2020. To put cash back into struggling companies’ hands, the CARES Act reintroduces NOL carrybacks for tax years 2018, 2019, and 2020, and lengthens the carryback period from two years to five years.

It also temporarily unfetters the NOL carryforward amount, which the TCJA limited to 80% of taxable income. The limitation will return in 2021, and carrybacks will go away again too.

So now, this is what NOL tax laws look like:

| For tax years before 2018 (Pre-TCJA) | For tax years 2018, 2019, 2020 (Post-TCJA, with updates from CARES) | For tax year 2021 (for now) |

|---|---|---|

| 2-year NOL carryback period | 5-year NOL carryback period | No NOL carryback period |

| 20-year NOL carryforward period up to 100% of taxable income in the year of the NOL deduction | Indefinite carryforward period up to 100% of taxable income in the year of the NOL deduction | Indefinite carryforward period up to 80% of taxable income in the year of the NOL deduction |

Businesses that suffered a NOL in 2018 or 2019 can apply now for a tentative tax refund if they were profitable in any or all of the five years before the year of loss. A business that is planning to have an NOL in 2020 for the first time since 2017 or earlier will have to wait to file its 2020 in order to get that refund.

Note: if 2018 was the year of loss, the business must file an amended 2018 return by June 30, 2020 in order to receive the tentative tax refund.

Let’s take a look at the earnings of a hardware store from 2014 through 2019.

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|

| Taxable Income (Loss) | $50,000 | $60,000 | $70,000 | $100,000 | $120,000 | $(450,000) |

In 2019, the business suffered a colossal loss due to a fire and remained closed for most of the year.

Thanks to the CARES Act, the business can now carry back its 2019 losses and receive a tentative refund. Begin by looking at earnings from the previous five years. Starting with 2014, the earliest year, the business effectively reduces each year of profits to zero until the total of the NOL amount runs out.

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|

| Taxable Income (Loss) | $50,000 | $60,000 | $70,000 | $100,000 | $120,000 | $(450,000) |

| NOL Carryback amount | $(50,000) | $(60,000) | $(70,000) | $(100,000) | $(120,000) | - |

| NOL Balance | $(400,000) | $(340,000) | $(270,000) | $(170,000) | $(50,000) |

If the business’s tax rate was 40% for all of these years, we can estimate that their tax refund will be 40% multiplied by the $400,000 carried back from 2014 to 2018. That’s a $160,000 refund.

After zeroing out profits from the past five years, the company still has $50,000 worth of losses left over. The remaining amount can be carried forward to offset future taxable income.

That additional amount carried forward is called a deferred tax asset and will sit on the business’s balance sheet until it gets used up.

Should you carry back or carry forward your net operating losses?

If both a carryback and a carryforward are available to your business, you’re almost always better off choosing a carryback.

According to the time value of money -- the concept that money in your pocket now will have a higher value in the future -- you’re better off receiving a refund on taxes already paid than receiving the promise on a tax break in the future.

Ultimately, it’s your decision. You can think of carrybacks and carryforwards like having to choose between a mail-in rebate or a coupon for your next purchase when you buy a new computer.

A carryback is like choosing a mail-in rebate. You paid in full when you bought the computer, and now the manufacturer will send you a check to offset your purchase. This is like your business getting a refund on a tax bill it paid in the past.

A carryforward is opting for the coupon for your next purchase. Your previous payment doesn’t change, but in the future, you’re going to score some savings. This is like a business foregoing an immediate tax refund in favor of a promise for a lower tax bill.

Take advantage of the NOL deduction

If your business has suffered a loss this year, there are some federal resources aimed to cushion the fall. The NOL deduction can be a significant help to your business, especially with its expanded benefits.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.

Related Articles

View All Articles