How to Complete and File Your Business Tax Return

Tax day can feel like the worst day of the year. You struggle 60 or 80 hours per week all year just to get buried in paperwork trying to decipher what tax form to use or what the depreciation rate needs to be on your business return.

It doesn’t have to be that way. In this article, we’ll show you how to make your small business tax filing as painless as possible as well as how to prepare throughout the year to complete the return faster than ever on tax day.

Overview: What is a small business tax return?

Business tax is often one of the biggest expenses you'll see in any given year. But preparing to report it doesn’t have to be complicated.

You don’t need to hire an army of tax attorneys and a CPA to head accounting for every department. You just need to stay on top of your income statement, balance sheet, and depreciation schedule. Your company tax return may end up being under 10 pages.

How to file your business tax return

Here are five stress-free steps to filing your small business taxes.

Step 1: Determine entity type

Your tax preparation begins before you’ve officially launched your business. Keep taxes in mind when you decide what entity type to use; it'll be one of the first decisions you’ll make as a business owner.

Though you can change in the future, it is best to pick a type you will stick with to avoid fees and the headache of making the change.

Entities report income to the IRS differently. So-called "pass through" entities don't pay taxes as a business. Instead, they produce an IRS document called a Schedule K-1 that goes to individual owners who then pay the tax on their personal returns.

Here are the most common entity types along with the tax form required for each:

- Sole Proprietor: Typically used for side businesses and contract work. Sole proprietors will report taxes on the Schedule C of their personal tax return and are personally liable for the taxes.

- General Partnership: Has the same legal structure as a sole proprietor while allowing for multiple owners. The IRS Form 1065 will be filed along with a Schedule K-1 to each owner to report pass-through income on their respective Schedule E.

- S-Corporation: An S-Corporation allows for multiple owners like a general partnership, but it shields the owners from the liability of the business. Additionally, shareholder numbers are limited and shareholders must be U.S. citizens. For an S-Corporation, use IRS Form 1120-S and the Schedule K-1 to report pass-through income.

- C-Corporation: Most big businesses will be C-Corporations. Shareholder numbers aren’t limited and the corporation shields all owners. A C-Corporation files and pays its own taxes, however, if it pays dividends out to its shareholders, they must report the dividend income and pay taxes on it. This phenomenon is known as double taxation and is the main weak point of a C-Corporation. Use the IRS Form 1120.

Step 2: Make financial decisions

It isn’t possible to be honest and avoid the tax man forever, but you can make some smart accounting decisions to change your tax deductions.

- Capital expenditures: Cash outflows related to business operations are either expensed or capitalized. When an item is expensed, it is directly deducted from revenue on the income statement. When it is capitalized, the entire transaction takes place on the balance sheet, and a new asset is created. Generally, small purchases are expensed, and big purchases or real property are capitalized. If you buy a box of printer paper, that will be expensed as an office expense; if you buy a new truck, you add the truck to the balance sheet as an asset and depreciate the value over time.

- Depreciation: Assets are typically expensed in a straight line, meaning the same amount is expensed each year for a set number of years. However, you can also accelerate depreciation with a few different methods. Under Section 179, the total value of some assets can be depreciated in the first year. Using MACRS (Modified Accelerated Cost Recovery System), you can depreciate the asset sooner and reduce taxes now.

- FIFO Vs. LIFO inventory costing: If your raw material costs have gone up during the year, the LIFO (last in, first out) method will allow you to expense the higher cost materials first which will reduce your net income and tax liability.

Step 3: Complete return

Organization and keeping good records throughout the year is the most important part of completing your tax return. The following items are the most important:

- Invoices and receipts: Input all invoices as soon as possible and keep receipts -- if you are audited, these could be required.

- Keep bank statements: Loan payments are made up of principal and interest -- while principal payments reduce the loan amount and do change the balance sheet, only the interest portion can be deducted on the income statement. Reconcile bank accounts to the general ledger on a monthly basis to avoid surprises at the end of the year.

- Keep up with financials during the year: You don’t want to sit down in January and discover a multitude of issues and errors that need to be corrected all at once. If you run financials every month or so, you can spot issues in advance. And if you have a really good year, you may need to plan ahead to pay a higher than normal tax bill.

- Keep track of other taxes paid: Businesses can deduct different types of taxes, such as property, sales and FICA (the employer portion of Social Security and Medicare taxes).

If you keep your financials organized leading up to tax day, inputting the numbers is the easy part. Print out or export the income statement, balance sheet, and depreciation schedule and the IRS instructions will guide you through each step.

Step 4: Submit return

Business tax returns are typically due on March 15. In 2020, they are due July 15 because of COVID-19.

There’s no shame in filing an extension -- however, the IRS intends extensions to be used to gather information for the return, and you will be expected to pay estimated taxes. Any tax due when the return is filed above the estimated tax paid could have interest due.

Your tax software will generally allow you to submit the return and pay taxes with the IRS e-file system if you are filing a Schedule-C with your personal return. Otherwise, you can file business taxes directly on the IRS website.

Step 5: Complete and submit all related materials

You’d think submitting your return would be the final step. Unfortunately, there are a few more items you'll need to take care of:

- Submit W-2s and 1099s: All of your employees and contractors will need to file their own taxes, so sending out the info they need should be near the top of your end-of-year tax prep checklist.

- Submit K-1s: If you have an S-Corporation or General Partnership, complete and send out the K-1s to all shareholders with their respective portion of the reported net income for the year.

- Make distribution decisions: General Partnerships and S-Corporations typically distribute the cash needed to pay taxes to owners, and owners will also need to decide if any retained earnings from the prior year can be distributed. The distributions will then go on the next year’s K-1.

The best tax software to file your business tax return

If you've graduated to a full-blown corporation or partnership, you may need to file your own business taxes, or engage a CPA, because many tax software products do not support the forms those entities require.

For Sole Proprietors or self-employed professionals who receive a 1099-NEC, these are the top three tax software choices.

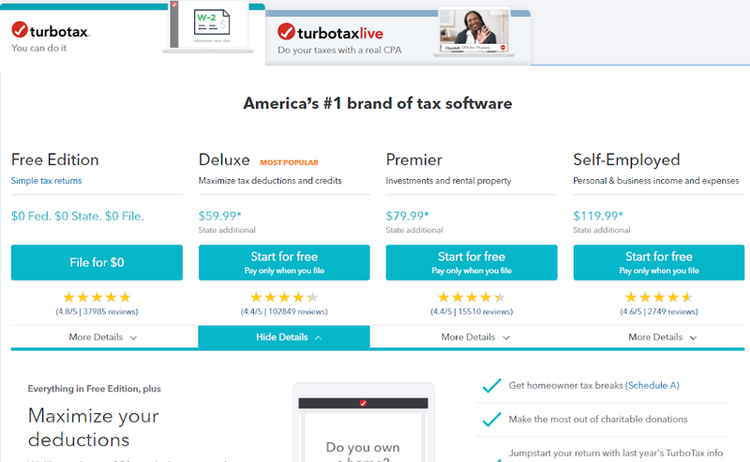

1. TurboTax

TurboTax takes the cake for me because it integrates with QuickBooks Self-Employed and gives users a free year of the software.

TurboTax offers a variety of plans, including the online Self-Employed plan for small businesses. Image source: Author

TurboTax is the most expensive of the three options here, but the QuickBooks integration makes it well worth it. As mentioned above, the most important part of tax preparation is keeping clean records during the year, and QuickBooks does that well.

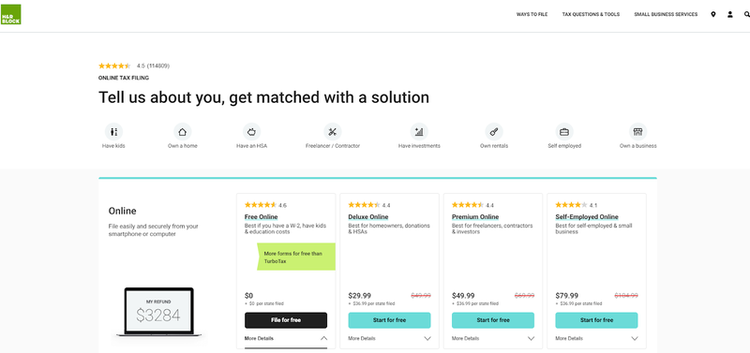

2. H&R Block

H&R Block is the 800-pound gorilla in the personal tax preparation game with thousands of offices across the country and one of the best software products. Like TurboTax, you would choose the Self-Employed plan.

H&R Block offers a variety of filing options. Image source: Author

You can choose to go it alone, pay extra to have a CPA guide you through the process, or consider taking your documents into an office if you hit a roadblock.

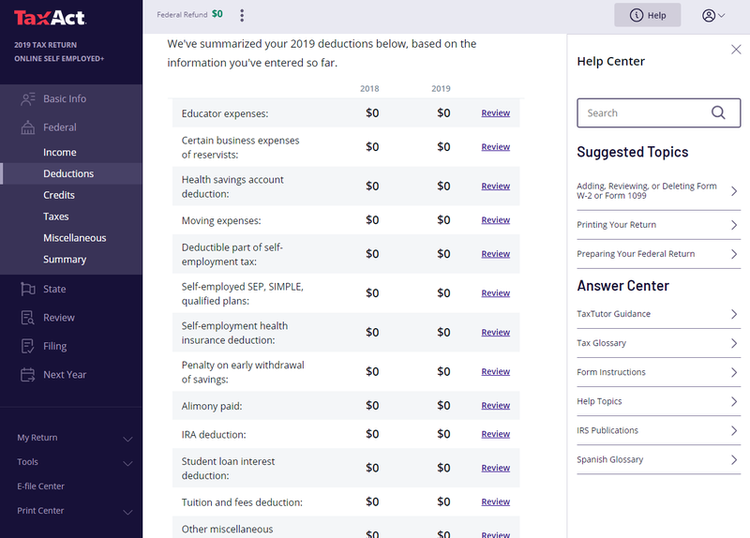

3. TaxAct

Nobody’s also-ran, TaxAct has been around for over 20 years and is the only software on this list that will allow filing with forms 1120, 1120-S, and 1065.

If you’re worried about taking that responsibility, TaxAct also offers assistance from CPAs and other tax professionals, and its Deduction Maximizer tool will ensure you don’t miss out on any deductions.

The Deductions screen displays a list that compares 2018 deductions to 2019 deductions. Image source: Author

TaxAct’s Self-Employed version is the least expensive of the three, but the full corporate versions will set you back $109.95.

It’s time to file your taxes

Hopefully, filing taxes is no longer a black hole in your mind, sucking the joy out of running your business. Remember, the most important thing is to locate your inner boy scout and be prepared. Follow these steps, and you’ll be out golfing all summer while your business owner friends are scrambling to meet their extension date.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.

Related Articles

View All Articles