4 Steps to Filing a Business Tax Return Extension

Sometimes, 24 hours in a day doesn’t cut it, and you can’t appeal to the Earth’s orbit for an extra few hours. However, the IRS can help you out by granting an automatic six-month extension on filing your business tax return.

Overview: What is a tax extension?

When you need more time to get your small business’s tax ducks in a row, you can file for an IRS extension that delays your tax return due date for up to six months.

Usually, individual tax payments and returns are due by April 15. You may file for an automatic six-month extension, moving the return date to October 15. Business returns follow different due dates, but the filing process is nearly identical.

However, it’s a misconception that getting a tax extension pushes back your tax payment due date. You’re still required to pay your taxes by the original deadline, and, if you don’t, you’ll face penalties. The IRS failure-to-pay penalty will run you 0.5% of your tax liability for every month your payment is late, up to 25%.

Of course, you won’t know your exact tax liability until you finish filing your return, but you’ll have an idea of your income and small business deductions. You won’t face a failure-to-pay penalty if you pay by tax day 90% of the filing year’s tax liability or 100% of the previous year’s.

Say you’re a sole proprietor who needs an extension on filing your 2020 taxes. By April 15, 2021, you’ll need to pay either 100% of your 2019 tax liability or 90% of what you’re expecting to owe for 2020.

How to file a tax extension for your small business

Filing a tax extension is pretty painless. Just follow these four steps.

1. Make an estimated tax payment

I can’t stress this enough: You can get an extension on filing your tax return, but you can’t delay an IRS tax payment. The self-employed are required to make quarterly tax payments that roughly amount to their annual tax liability, and the penalties accrue quickly when they don’t.

Before filing an extension, make sure your estimated tax payments reach 100% of the previous tax year’s tax liability or 90% of the filing year’s estimated tax liability, whichever is less.

If I’m a sole proprietor with an estimated $10,000 tax liability in 2020 and an actual $5,000 tax liability in 2019, I would make sure I’ve paid at least $5,000 in estimated tax payments by April 15, 2021. To avoid a hefty tax payment upon filing, I’d make payments to reach the $10,000 mark.

Don’t know your estimated tax liability? Read our guide to estimating your tax liability.

Note: You don’t have to file for an extension when you use an electronic payment method to make the estimated tax payment. As you make the payment online, indicate that it’s for an extension. Skip to step three unless you’re an analog apologist.

If you run a disregarded entity -- a sole proprietorship or single-member limited liability company (LLC) taxed by default as a sole proprietorship -- and make electronic tax payments, skip down to step four.

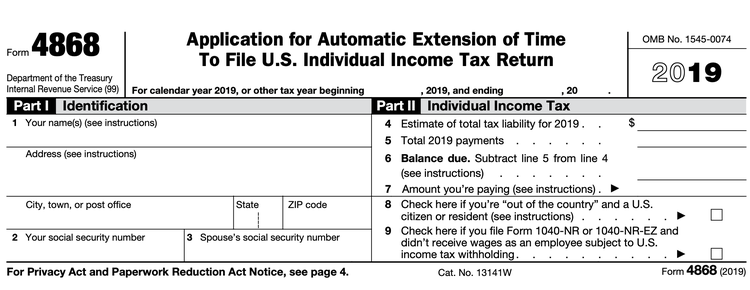

2. File Form 4868 for an automatic IRS personal tax return extension

Pass-through businesses -- sole proprietorships, partnerships, LLCs, and S corporations -- pay small business taxes using their owners’ personal returns. To delay filing a business tax return, start by delaying your personal return.

Fill out IRS Form 4868 for an automatic six-month extension on your personal tax return. It’s one of the simplest IRS forms to complete; what you see below is the full form. Form 4868 reminds you to make a final tax payment to meet the 90% or 100% thresholds.

Fill out Form 4868 to get an automatic six-month extension on filing your personal tax return. Image source: Author

C corporation owners, called shareholders, don’t need to delay their personal filing when requesting a business tax extension. As a C corp employee and shareholder, you’re all set to file your personal taxes once you receive your Form W-2 and Form 1099-DIV, which detail salary compensation and dividend distributions.

When you e-file Form 4868, you should receive a confirmation number. Keep that information because your tax software or tax preparer might ask for it.

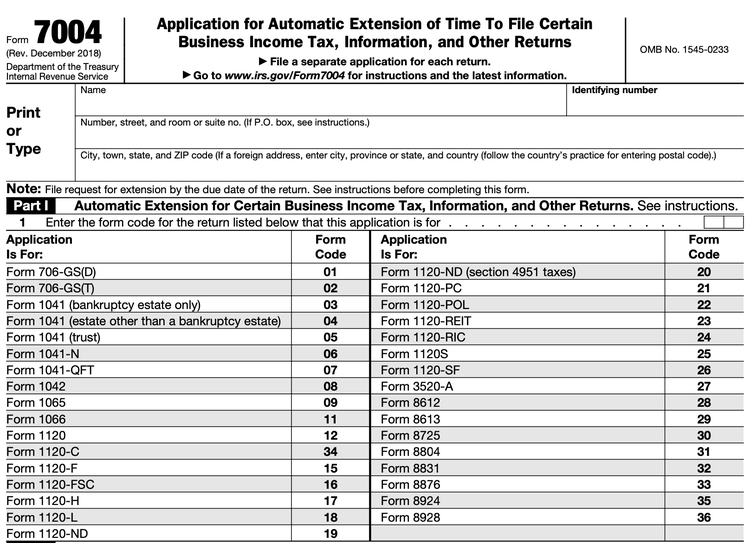

3. File Form 7004 for an automatic federal business tax extension

Unless you own a disregarded entity, you’ll also need to file for a business tax extension. There’s no way to bypass this filing, unlike the personal return extension.

Fill out Form 7004 to request an automatic business tax return extension. LLCs, partnerships, S corps, and C corps all use the same form to request an extension.

File Form 7004 to get an extension on filing your business tax return. Image source: Author

The first part of IRS extension Form 7004 has you select the business tax return form you plan to file by the extended deadline. Choose the form that corresponds to your business type. Some of the most common ones are below.

| Business type | Tax return form |

|---|---|

| C corporation | Form 1120 |

| S corporation | Form 1120-S |

| Partnership | Form 1065 |

| Limited Liability Company | One of the above, depending on taxation status |

LLCs can be taxed in many ways, so select the correct form according to your taxation status.

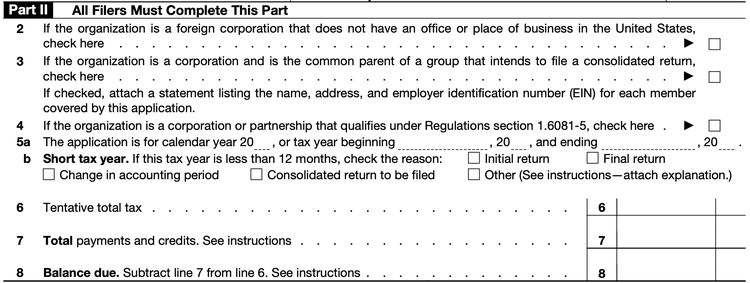

Part two looks a lot like Form 4868. Unless you’re filing on behalf of a C corporation, the numbers on Form 4868 and Form 7004 should match. C corp owners might need a tax accountant’s help with filing for an extension.

Form 7004 part two looks a lot like Form 4868. Image source: Author

By filling out Form 7004, you’ll get an automatic six-month extension to file your business tax return. C corps with a year-end of June 30 automatically get a seven-month extension when they file Form 7004 because their returns can get especially tricky.

4. File a state tax extension

Check with your state tax authority if you need to file an additional extension form. Most states will accept a copy of your federal tax extension forms to request a tax return extension. Some states aren’t as easygoing.

FAQs

-

You will receive an email confirming that you successfully filed your tax extension forms, but don’t expect a separate communication approving your business tax filing extension. You should assume your extension is authorized unless you hear from the IRS that your extension was disallowed.

-

The tax extension deadline is the original return due date. For sole proprietors in non-2020 years, that’s April 15.

Businesses taxed as partnerships, S corps, and C corps file their returns by the 15th day in the third month following the business’s year-end. In other words, calendar-year companies would want to file a business tax extension by March 15, pushing their due date to September 15.

-

Yes, but try your best not to delay filing and distributing Forms W-2 and 1099-NEC.

Every January, you must send employees a copy of their Form W-2 and independent contractors a copy of their Form 1099-NEC. If you’re using payroll software, you shouldn’t have any problem getting this done.

When you delay filing Forms W-2 and 1099-NEC, you run the risk of forcing your employees and contractors to file their individual tax returns late. A late filing will delay their refund checks, and you don’t want to be blamed for that.

Other compensation filings, like for quarterly tax reporting Form 941, don’t allow for extensions. If you’re concerned about getting IRS compensation forms filed on time, hire a tax professional.

That’s all, until 6 months from now

Filing for a business tax extension shouldn’t take you any longer than your lunch break. With an extra six months to file, you have time to dive into Small Business Taxes 101 and prepare yourself for an on-time filing next year.

Sole proprietors, we’ll see you again soon to fill out Schedule C by Oct. 15.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.

Related Articles

View All Articles