If you run a multimillion-dollar empire, it’s likely that your accounting staff is using enterprise-level software that can quickly and easily produce financial projections.

But if you’re a sole proprietor, freelancer, or micro-business owner, you’re likely to use data from your accounting software in order to prepare financial projections, but the software won’t help you in the preparation itself.

While that may sound confusing, it just means that most software applications such as QuickBooks Online, Sage 50cloud Accounting, and Xero can create the financial statements needed for you to prepare your financial projections, but the software itself will not be used in the actual creation of the projections.

At a glance: How you can create and utilize financial projections

- Three financial statements -- a balance sheet, income statement, and cash-flow statement -- are required for any financial projections you create.

- New businesses need financial projections, too. If you’re still in the planning stages, be aware that you will still need to prepare projections for your business plan.

- You’ll likely be using a template to prepare your projections. While accounting software provides the basis for your financial projections, most small business accounting software applications aren’t capable of producing financial projections.

Overview: What are financial projections?

Financial projections are an important part of managing your business. Preparing financial projections may seem like a daunting task for small business owners, but if you can create financial statements, you can create financial projections. Similar to creating a budget, financial projections are a way to forecast future revenue and expenses for your business.

Frequently used as a way to attract future investors, financial projections are also an important component when preparing a business plan for a new business or creating a strategic plan for your current business.

You can create both short-term and long-term financial projections, with most business owners using both types of projections:

Short-term projections: Short-term projections usually cover a year and are typically broken down by month.

Long-term projections: Long-term projections typically cover the next three to five years and are usually used when creating a strategic plan, or for attracting investors.

What are financial projections used for?

Financial projections can be used in a variety of ways, but they’re usually used to attract investors or when applying for a bank loan or line of credit.

Here are a few situations that would call for financial projections:

- You’re creating a business plan: One of the first things potential investors or banks want to see is a financial projection for your business, even if it isn’t operational yet.

- You’re hoping to attract investors: When looking to invest in a business, investors typically look for financial viability. No one will invest in a business without a financial projection that outlines variables such as expenses, revenue, and growth patterns.

- You’re applying for a loan or line of credit: Again, banks or other financial institutions are interested in the financial health of your business. This means providing them not just with current financial statements that outline current business performance, but also where you see your business next year, and the year after.

- You want to get a better handle on your business: You may not be in the market to attract investors or obtain a bank loan, but you do want to be able to map out your potential growth and create budgets allowing your business grow and thrive. Financial projections can help here, too.

How to create financial projections for your small business

When you’re creating financial projections for your business, the same information is required whether your business is up and running or still in the planning stages.

The difference is whether you can create your projections using historical financial data, or if you’ll need to start from scratch. This includes creating projections based on your own experience in the field, or by doing some market research in the industry in which your business will operate.

Step 1: Create a sales projection

Sales projections are an important component of your financial projections. For existing businesses, you can base your projections on past performance obtained from your financial statements. For instance, if your sales tend to be higher in the summer and fall, you’ll want to include that in your projections.

You’ll also need to take under consideration some outside factors, such as the current and projected health of the economy, whether your inventory may be affected by additional tariffs, and whether there’s been a downturn in your industry.

While we all want to be optimistic about our businesses, be sure to plan realistically.

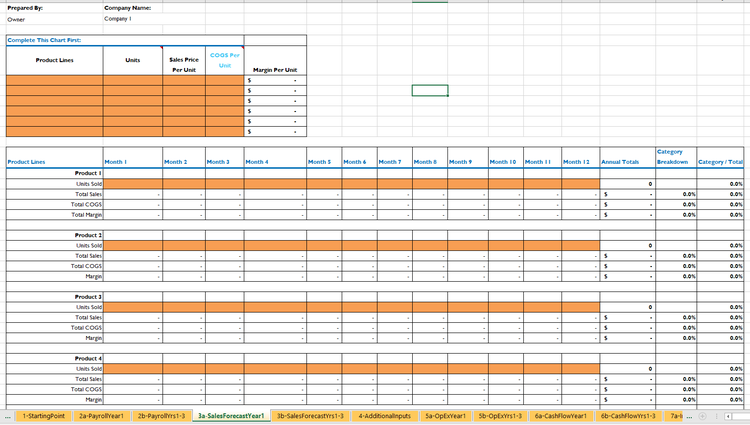

This is one of Microsoft Excel's templates for sales forecasting. Image source: Author

Those still in the planning stages can follow the exact same plan (minus historical data), but you’ll need to do some additional research into the health of similar businesses in your proposed industry in order to plan as accurately as possible.

Step 2: Create an expense projection

Creating an expense projection may initially seem a bit simpler, because it’s easier to predict possible expenses than it is to predict the buying habits of current or potential customers.

For those working from history, you can predict with some certainty what your fixed expenses are, such as your rent or mortgage, along with recurring expenses such as utilities and payroll.

However, it’s much harder to predict those one-time expenses that have the potential to destroy your business.

What if the roof leaks in your business and destroys 75% of your inventory? What if you import the majority of your inventory from China, and you’re hit with escalating prices?

The “what ifs” can drive any of us crazy. All you can do is project expenses to the best of your ability, and maybe tack on an additional 15% to your initial number.

Step 3: Create a balance sheet projection

If you’re using accounting software and your business has been operational for at least a few months, you’ll be able to create a balance sheet directly from your software.

A balance sheet shows the financial position of your business, listing assets, liabilities, and equity balances for a particular time frame.

When creating your financial projections, you can use your current balance sheet totals to better predict where your business will be one to three years down the road.

For those of you in the planning stages, create a balance sheet based on the information you have collected from industry research.

Step 4: Create an income statement projection

Current business owners can easily create an income statement projection by using your current income statement to estimate your projected numbers.

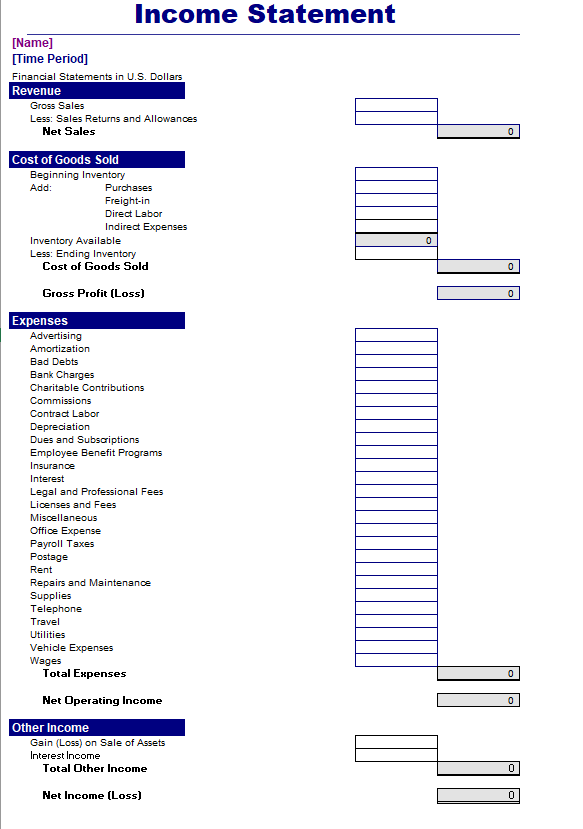

This Excel template can be used to display revenue, cost of goods sold, expenses, and other income to identify net income. Image source: Author

An income statement provides a view of the net income of your business after things such as cost of goods sold, taxes, and other expenses have been subtracted.

This can give you a good idea of how your business is currently performing as well as serve as the basis for estimating net income for the next one to three years.

If you're in the planning stages, producing a possible income statement demonstrates that you’ve done your research and have created a good-faith estimate of your income for the next three years.

If you’re not sure where to start, visit market research firms such as Allied Market Research, which can give you an overview of your targeted industry, including product sales, target markets, and current and expected industry growth levels.

Step 5: Create a cash flow projection

The last step in completing your financial projection is the cash flow statement. The cash flow statement ties into both the income statement and the balance sheet, displaying any cash or cash-related activities that affect your business.

The cash flow statement shows how money is being spent, a must for those looking to attract an investor or obtain financing.

Again, you can use your current cash flow statement if your business has been operational for at least six months, while those of you in the start-up phase can use the data you’ve collected in order to create a credible cash flow projection.

Benefits of using accounting software for your financial projections

If you’re an existing business owner, you’re likely using accounting software to track your financial transactions. If so, the availability of financial reports such as a balance sheet, income statement, and cash flow statement are valuable resources when creating financial projections.

Here are some of the benefits of using accounting software:

- Accuracy: Unless you’re still in the planning stages, having the ability to create various financial reports and transactional histories from your software application helps to ensure your financial projections are based on accurate numbers.

- Availability of data: Being able to pull financial reports can go a long way in preparing financial projections. While you’ll likely create the projections themselves using a spreadsheet application such as Microsoft Excel, the data for your projections is readily available for you and others to access and review.

- Credibility: Being able to include supporting financial statements created by your accounting software with your financial projections lends credibility to your business and signals that you’re serious.

If you’re looking for a template to use to create financial projections, SCORE offers a downloadable financial projections template from Excel.

Finding the best way to create financial projections

While you’ll likely be using a template to create your financial projections, don’t underestimate the important role accounting software plays in creating accurate financial projections -- a necessity if you’re looking for investors or additional financing for your business.

If you’re still using manual ledgers or spreadsheet software to manage your business, it may be time to step up to the next level of professionalism by choosing and implementing an accounting software application that works for your business.

If you’re not sure which accounting software is right for you, be sure to check out our accounting software reviews.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.