“It’s all about the bottom line.” You’ve probably heard that phrase a lot in your career, but sometimes it’s more about the middle line.

Today, we’re going to talk about operating profit and why it’s a favorite income statement metric of many valuation experts and private equity companies.

Overview: What is operating profit?

Operating profit, or operating income, is what’s left of revenue after subtracting out cost of goods sold and all operating expenses. Operating expenses are the normal expenses for overhead that happen doing business. Things like taxes and interest are not considered operating expenses.

Speaking of taxes and interest, another name for operating profit is earnings before interest and taxes (EBIT). It's possible to calculate operating profit by adding interest and taxes to net income and this approach is a little easier than accounting for several different types of expenses.

Note that the EBIT formula does not include other income and expenses so it can vary from operating profit.

Why is operating profit important?

Operating profit is an important metric to consider because it shows you the profit of your business without the impact of taxes or the capital structure.

If you have tax loss carryforwards or substantial debt, your net income will be affected by those numbers and won’t be a perfect representation of how well your business is working.

3 benefits of calculating operating profit

Let’s consider a few of the benefits of calculating operating profit.

1. Control fixed costs

Accountants like to break up expenses into two categories: fixed and variable. Fixed expenses are expenses that don’t change based on revenue. Expenses like rent, insurance premiums, and the salary for office employees stay the same no matter how much you increase or decrease sales.

Most variable expenses end up in cost of goods sold. These are expenses such as the cost of materials and the pay that goes to production employees.

Analyzing operating profit from year to year will let you know if you need to change fixed expenses. If your revenue is tapering off, you may see falling operating profit margin, signalling that employees need to be laid off or that you need to downsize your office space.

If the opposite happens and operating profits are increasing faster than revenue, it could be time to open a second location or hire more back-office support.

2. Compare across industry and year

It’s hard to compare net income from year to year or to businesses in different industries. Your business may have had a windfall one-time gain of $50,000 one year and a business in a different industry may need to load up on debt for capital expenditures.

Operating profit will remove those expenses not directly tied to the operations of the business and give you a better sense of where you stand.

3. Value your business

For the reasons we just discussed, private equity buyers and other people who purchase small businesses prefer to use operating profit to value businesses.

It’s a good practice to do a back-of-the-envelope valuation of your business every year to see if you’re on track for retirement or if you should think about expansion.

An example of calculating operating profit

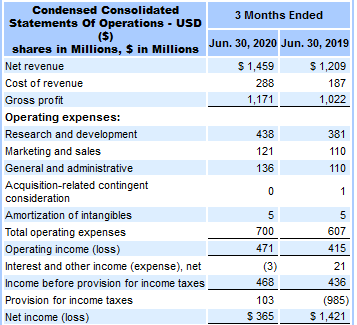

Let’s look at an example of operating profit for Electronic Arts (EA). It isn’t exactly a small business, but it’s one whose products I have used frequently during the COVID-19 pandemic and its financials work for our analysis.

Electronic Arts had operating income of $471 million. Image source: Author

Electronic Arts had an over 20% increase in revenue from Q2 2019 to Q2 2020, but net income fell from over $1.4 billion to $365 million. By looking closely at the operations statement, we can see that negative tax expenses in 2019 distorted the net income number and made it useless for comparing one year to the next.

Because of this tax issue, operating profit was a far better measure of business success between the two quarters. It grew about 13.5%.

The next step in the analysis is to pinpoint why operating profit grew less than revenue. The most important part of operating profit calculation, operating expenses, grew by 15%, led by a close to $60 million jump in research and development costs.

This means the company grew revenue at a faster rate than overhead. And cost of goods sold grew by 54% from 2019 to 2020.

Using operating profit analysis, we’re able to pinpoint the runaway growth in a key expense. If you had just focused on net profit, you would eventually get to the right answer because the net profit collapses from 2019 to 2020 as well.

But had the negative tax expense been in 2020, it’s possible the bottom line would’ve just shown a big increase and who wants to dig into a big increase?

FAQs

-

All three of these metrics are commonly used to evaluate businesses.

Operating cash flow is reported on the cash flow statement. This statement is not required in tax returns, so you may have never seen one if you haven’t specifically printed it out on your accounting software.

Operating cash flow includes tax, interest, and one-time items, but it does not include non-cash expenses, such as depreciation and amortization.

Earnings before interest, taxes, depreciation, and amortization (EBITDA) is a combination of operating profit and operating cash flow. It doesn’t include interest and taxes, and it doesn’t include non-cash expenses. EBITDA allows you to evaluate the cash your business earned and compare from year to year.

-

Tax expense is calculated one step after operating profit. Here is the accounting equation to get from operating profit to pre-tax income:

Operating Income - interest expense +/- Other income/expenses = Pre-Tax Income

-

There are two main levers to increase operating profit: reduce fixed costs and increase markup.

Reducing fixed costs means making your overhead more efficient. Stop paying for software you haven’t used in years. Downsize your building or have people work from home when possible.

Markup is the difference between what you pay for materials and what you sell them for. It’s possible the market won’t bear an increase in markup, but it may make sense to test it on some sales.

Add operating profit to your tool chest

No end-all metric will tell you everything about how your business is operating. Revenue doesn’t tell you how efficient you were. Net income includes some non-operating expenses.

Even operating profit includes some non-cash expenses. The key is to keep track of a variety of numbers and drill down into anything that doesn’t look right.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.