Invoice factoring has been in existence for decades and is traditionally used by businesses that need to boost their cash flow.

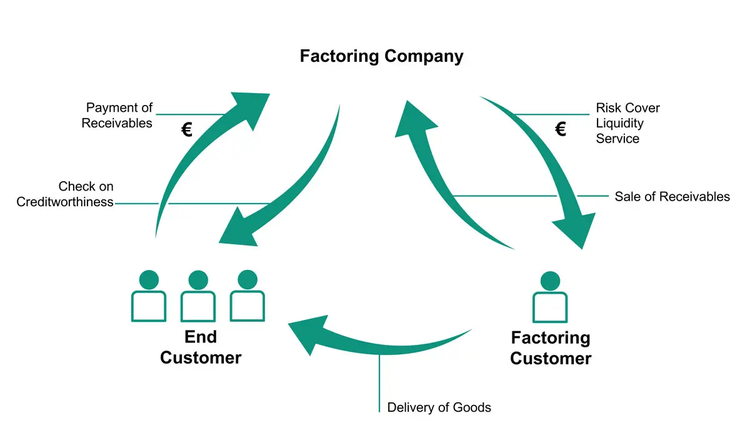

The factoring process is simple: A factor, or outside company, agrees to purchase your outstanding invoices at a discounted rate, which includes commissions and fees. You receive the discounted funds from the factoring agent, and the agent then becomes responsible for collecting the amount due from your customers.

Factoring can help solve short-term cash flow issues and usually involves a contract that requires you to sell all of your invoices to the factoring company for a set time.

But what if you’re interested in using factoring only occasionally? That’s where spot factoring comes into play.

Overview: What is spot factoring?

Most regular factoring arrangements are long-term, with a minimum contract of at least six months or longer required.

Spot factoring allows business owners to contract with a factoring company on an as-needed basis and usually involves single invoice financing or factoring.

While spot factoring may be convenient for business owners, it’s also more expensive, with higher commission and fees charged than standard factoring. It’s important to note that not all invoice factoring companies offer single invoice factoring, so locating one that offers this service may be more challenging.

Once you do locate a spot factoring company, you’ll have to complete an application and prove that you’re using good accounts receivable practices in your business, which is easily done if you’re using accounting software. You’ll also need to provide proof that you’re writing your business invoices properly.

Though some factoring companies charge a flat rate, most charge per 30 days. For instance, if you agree on a rate of 3% per 30 days and 1% per 15 days after, your fee will be 3% of the invoice if it is paid within 30 days. However, if your customer pays the factoring company in 45 days, your fee increases to 4% of the invoice total.

Factoring advances also vary, with the advance averaging between 70% and 85%. Be sure to pay attention to these rates and costs before agreeing to use the factoring company.

How does spot factoring work?

Spot factoring works like regular invoice factoring, with the only major difference being the frequency that you use the factoring services.

For example, Joe owns a small manufacturing business. In January, three of Joe’s machines stop working and must be replaced immediately. Unfortunately, replacing these machines means that he cannot make payroll. Because Joe’s current payment terms with his customers are Net 90, he will not be getting paid in time to cover payroll.

Joe contracts with a spot factoring company, allowing him to sell one large invoice to the company, while not committing to selling additional invoices in the future. Joe submits an invoice of $50,000, which the factoring company approves at a rate of 4% per 30 days.

Joe is advanced 80% of the invoice amount, or $40,000, enabling him to make payroll. The company withholds the balance of $10,000 until the customer pays. Once the invoice is paid, the factoring company takes its 4% commission, which is $2,000, and pays Joe the balance, which is $8,000.

Because Joe is using spot factoring, he will not need to continue to submit any additional invoices to the factoring company unless his operating cash flow drops again.

This is the general process you’ll need to follow if you decide to use spot factoring in your business.

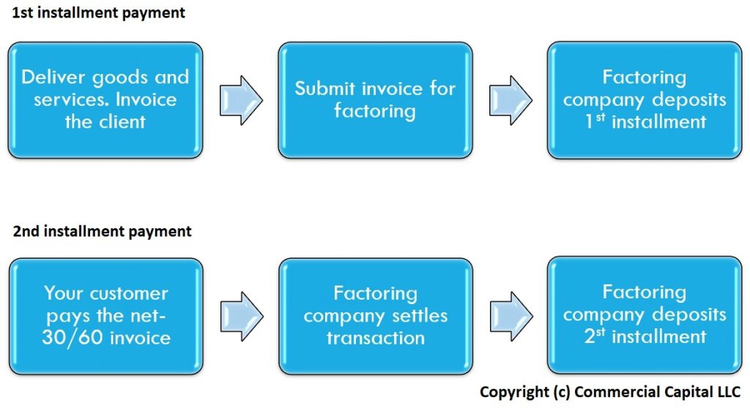

- Locate a factoring agent: There are a lot of factoring companies. Be sure to locate one that offers spot factoring.

- Review all of the associated fees and commissions: Once you locate a spot factoring company, be sure to review all associated fees and commissions that will be charged before using the service.

- Determine which invoices to submit: In spot factoring, you’re usually choosing to submit individual invoices, not all invoices. Determine which ones you wish to submit and forward them to the factoring company.

- Wait while the invoices are reviewed: Be aware that factoring companies may not accept your invoices. Before accepting them, they’ll run a credit check on your customers to determine how likely they are to receive payment. If the customers are not approved, they will return the invoices to you.

- Receive an advance on the invoice: Once a customer has been approved, you will receive an advance from the factoring company. This advance is usually around 70% to 85% of the invoice total, depending on your agreement.

- Receive the balance on the invoice when the customer pays: Any money held in reserve will be forwarded to you once the customer pays the factoring company, with any fees and commissions owed the factoring company withheld from the final payment.

Invoice factoring involves two payments: an initial advance and the balance once the customer pays. Image source: Author

3 advantages of spot factoring

There are several advantages to using spot factoring in your business. These are just a few.

1. No long-term contract

If you only want to use factoring when you need it, spot factoring is the way to go. There are no long-term contracts, leaving you free to use the service only when the business need arises.

2. Improved cash flow instantly

If you have unpaid invoices and little cash flow, using spot factoring can boost your cash flow within a couple of days. Turnaround from the time of your initial application to receiving an advance can happen in less than three days, providing that the customer’s credit checks out.

3. Ability to cover expenses

Like all of us, business owners assume that there will always be enough money to cover expenses. But when an unexpected expense does crop up, spot factoring will allow you to cover it quickly.

3 disadvantages of spot factoring

Even though spot factoring can be helpful for small businesses experiencing limited or reduced cash flow, there are some disadvantages that you should be aware of.

1. Harder to find a factoring company

There are a lot of factoring companies, but not all of them offer spot factoring. If you think you may want to use spot factoring in your business, it might be helpful to start looking for spot factoring companies before you need one.

2. Higher rates charged

Factoring companies often base their rates on volume, so rates are naturally lower if you sign a contract for at least six months. While some factoring companies do offer spot factoring, be aware that the rates for spot factoring are higher than those imposed for a long-term contract.

3. Not cost-effective long-term

While factoring, and particularly spot factoring, can be beneficial for small businesses in the short term, they can end up costing you a lot of money if you use them for the long term. If your business is perpetually short of cash, you need to be taking steps to address the root cause of the shortage and use spot factoring for what it’s designed for -- a quick solution for a temporary drop in cash flow.

The flowchart displays the relationship between your business, your customer, and the factoring company. Image source: Author

4 best practices when spot factoring

If you think spot factoring will be a good fit for your business, be sure to follow these best practices.

1. Understand why you need spot factoring

If your roof just sprung a leak and your outstanding invoices aren’t due for another month, spot factoring may be a good solution. Other business owners use spot factoring to increase working capital, useful for business expansion or to increase production. However, if you find your business always runs out of money before month end, you have a deeper cash flow problem that needs to be addressed.

2. Do some initial research

Factoring companies tend to work in specific industries, so make sure that you find one that’s suitable for your type of business. For example, if you’re a retail business, you’ll want to locate a company that offers retail factoring. You’ll also want to work only with established factoring companies.

3. Pay attention to the fine print

Before submitting an invoice for factoring, make sure that you understand the fees and commissions charged by the factoring company. Fees will likely vary, sometimes significantly, between factoring companies. Don’t submit an invoice until you understand and accept the terms of the factoring agreement.

4. Factoring a single large invoice is better than several small invoices

If you have one large invoice or several smaller invoices, it’s always better to spot factor the larger invoice, which requires less work (and smaller fees) on the part of the factoring company.

Spot factoring

The cost of factoring receivables can vary from company to company, so due diligence is a necessity. In certain circumstances, spot factoring can be beneficial to your small business, but if you find yourself using it more than you planned, you’ll need to identify and address any cash flow issues internally, rather than relying on spot factoring.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.