Your employees count on you to give them an accurate paycheck every few weeks. You’ll certainly hear from them if it’s too low -- or inaccurate in any other way.

Beyond cutting checks, you’re responsible for setting aside a portion of your employees’ pay -- called withholding -- and contributing to their health insurance and retirement plans. Most importantly, you need to make regular payroll tax payments on their behalf.

Payroll deductions streamline the payment process for these contributions and expenses.

Employees are ultimately responsible to pay their payroll taxes. As their employer, you’re withholding their tax and regularly remitting it for them.

Overview: What are payroll deductions?

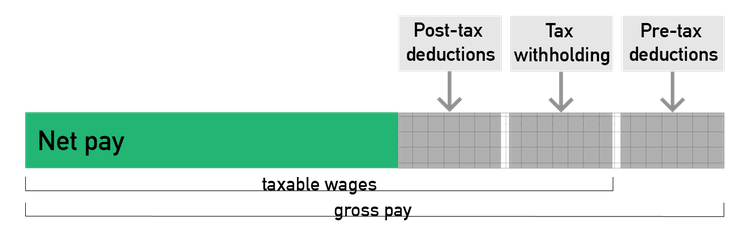

Payroll deductions are all the costs taken out of a paycheck before it goes into employees’ wallets. It’s the difference between an employee’s salary or wage, called their gross pay, and the amount of their paycheck, their net pay.

Payroll deductions get grouped into three categories: pre-tax, employee tax withholding, and post-tax. Pre-tax deductions, such as health insurance, reduce the amount of payroll tax both your business and your employee pay.

Pre-tax deductions reduce tax liabilities for both employees and employers. Image source: Author

For example, if your employee’s gross paycheck is $1,000 and pre-tax deductions total $100, taxable wages are $900, meaning both the business and the employee pay payroll taxes on only $900. That’s why pre-tax deductions are often more favorable than post-tax deductions for small businesses.

Employer-paid payroll taxes, like federal (FUTA) and state unemployment taxes, one-half of Medicare and social security tax, and state workers’ compensation, are not considered payroll deductions. They don’t reduce the amount of your employee’s paycheck, though they are tax deductions for your small business.

Note that payroll deductions are only for employees, not contractors. You don’t deduct any money from contractors’ wages since they, and not you, are responsible to pay their taxes.

Mandatory payroll deductions for your small business

Mandatory deductions are required by law, so you don’t want to miss them.

Federal, state, and local income tax withholding

These taxes go to funding public programs, infrastructure, and education. As an employer, you’re required to withhold a certain amount of each employee’s income and send it off to federal, state, and local governments.

All but nine states -- Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming -- have a state income tax. If you live in one of those states, that’s one less step for you.

The amount you withhold is determined by the paperwork your employee filled during the onboarding process, including Form W-4 and any state and local income tax withholding papers.

Employees tell their employer how much of their paycheck to withhold based on whether they’re married, have multiple jobs, or are entitled to certain tax credits. They can change their tax withholding status at any time by filling out a fresh copy of these withholding forms.

And this is why there’s a tax filing process every April (well, it’ll be July this year). When your employees file their taxes, they’ll either receive a refund for withholding too much or have to make an additional tax payment for not withholding enough.

Before 2020, the W-4 had employees choose a number of federal allowances, but the IRS has rejiggered the withholding process, which is explained in IRS Publication 15. To figure out the right amount of federal withholding, your employees can use the IRS withholding calculator.

Medicare and social security tax

Otherwise known as the Federal Insurance Contribution Act (FICA) tax, Medicare and social security taxes are paid by both the employee and the employer.

In 2020, the employee pays 6.2% of their gross pay for social security and 1.45% for Medicare. Social security taxes stop once the employee makes $137,700 for the year, but the 1.45% for Medicare has no cap.

Employers are required to match employees’ contributions to FICA taxes.

A tax fun fact: If your children are under age 18 and work for your sole proprietorship or partnership, they don’t have to pay FICA tax on their wages.

Wage garnishment

Businesses are sometimes required to withhold a portion of employee pay because of the employee’s debt.

The most common reasons for wage garnishment are:

- unpaid child support

- defaulted student loans

- back taxes

- defaulted credit card debt

If your employee’s wages need to be garnished, you’ll receive a court order to withhold and remit a certain amount of money from each of the employee’s paychecks until the debt is either paid off or otherwise resolved.

Wage garnishment is a post-tax deduction, providing no tax benefit to you or the employee.

Health insurance

If your small business employs more than 50 people, you’re required to offer health insurance to them and their dependents under 26 years old. If you have fewer than 50 employees and choose not to offer health insurance, this deduction is not mandatory for your business.

The health insurance plan you choose will decide how much of the insurance premium you’re allowed to pass on to employees. Check out our guide to small business health insurance for all the rules and regulations.

Health insurance is a pre-tax deduction, meaning employees don’t have to pay federal, state, local, and FICA taxes on their premiums.

Voluntary payroll deductions for your small business

Other payroll deductions arise from employee benefits. None of the following deductions are required unless you choose to offer the associated benefit.

Retirement contributions

One of the most popular employer-sponsored retirement plans in the U.S. is the 401(k), which lets people contribute up to $19,500 in 2020, and employees over age 50 can kick in another $6,500.

Employees tell their employer the percentage of their pay that they’d like to contribute to the 401(k) and how the money gets invested.

There are two types of 401(k) plans: traditional and Roth. The plan you offer determines whether the contribution is a pre-tax or post-tax deduction.

Let’s say you offer a traditional 401(k) to your employees, and an employee’s gross paycheck is $1,000. She told you that she wants 10% of her pay to go into her Traditional 401(k). Since Traditional 401(k) contributions are pre-tax deductions, the employee’s contribution is $100 ($1,000 * 0.1).

Commuter benefits can save both your business and your employees money. Image source: Author

Maarten van den Heuvel

Roth 401(k) contributions are post-tax deductions, but unlike Traditional 401(k) plans, your employee won’t pay tax when they withdraw their contributions in retirement. There’s no tax benefit to your business with Roth 401(k) plans, but they can be beneficial for your employees (and for your personal retirement).

If an employee’s net paycheck is $600 and wants to contribute 5% to her Roth 401(k), you’ll deduct $30 from her paycheck ($600 * 0.05).

Commuter benefits

It could save your business money to offer your employees a break on their commuting expenses.

The IRS allows employees to spend up to $270 monthly of their pre-tax dollars on public transportation and parking. Since it’s a deduction before taxes, it reduces both the business’s and employee’s tax liabilities, saving everyone money in the process.

Other fringe benefits

Fringe benefits, also called imputed income, are the perks you offer, like group-term life insurance, moving assistance, and gym memberships.

There are many fringe benefits you can offer your employees, and they fall into both the pre-tax and post-tax deductions categories. Check out our guide to fringe benefits.

Calculate your employees’ paychecks with confidence

Payroll processing doesn’t have to be hard: While you can run payroll yourself, you have plenty of choices when it comes to payroll software to show you how payroll works.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.