There are so many types of taxes you'll come across as a small business owner. Sales taxes, property taxes, excise taxes -- you get the point. Two of the most important taxes for small business owners to grasp are payroll and income taxes.

What’s the difference between payroll tax and income tax?

Payroll and income taxes both affect employee paychecks. Pull up an employee’s recent pay stub, and you’ll find both types of taxes listed.

Payroll and income taxes affect employee paychecks. Image source: Author

Let’s start with payroll taxes. They’re calculated based on a percentage of an employee’s eligible wages. Some payroll taxes are 100% employer-paid, while others are split between employers and employees. In most cases, the purpose of payroll taxes is to fund specific government programs.

Payroll taxes include:

- Federal Insurance Contributions Act (FICA) taxes

- Self-Employed Contributions Act (SECA) taxes

- Federal Unemployment Tax Act (FUTA) taxes

- State Unemployment Tax Act (SUTA) taxes

- State disability insurance (SDI) taxes

Most business owners remit payroll taxes after every pay period. Every quarter or every year -- depending on the tax type and the magnitude of your payroll tax liability -- you file employment tax forms to reconcile your payments through the year with how much you owe.

Say your business sent the IRS $5,000 in FICA taxes last quarter. You might learn from filing Form 941 that you accidentally overpaid by $100. You’d then get the option to put it toward next quarter’s FICA liability or to receive a $100 refund check.

Then we have income taxes. Those are the federal, state, and local taxes that individuals pay during the year. By every April 15, we file tax returns to determine whether we paid too much or not enough last year. Unlike FICA taxes, federal income taxes can fund any government program.

Individual federal income tax rates are bracketed, while higher income is taxed at a higher marginal tax rate. Most state income taxes operate similarly, but a handful -- eyes on you, Pennsylvania -- apply a flat rate at all individual income levels. Nine states have no state income tax.

Individual taxpayers are required to make income tax payments as they earn income. Employees meet this requirement by having a portion of each paycheck withheld for income taxes. Unlike payroll taxes, employers never contribute to employees’ income tax liabilities.

Employees fill out Form W-4 and a state withholding certificate during the onboarding process to tell their employers how much to withhold for income taxes. Employers then send these payments to tax authorities and issue a Form W-2 every January to recount employees’ compensation and tax withholdings from the previous year.

Non-employee business owners don’t receive paychecks like employees, so they can’t withhold pay for income taxes in the same way. Instead, they make quarterly tax payments to the IRS and state tax authorities to cover both SECA and income taxes.

Most small businesses are pass-through entities, meaning owners’ small business income is taxed at their individual tax rates. However, C corporations pay a flat 21% federal corporate income tax.

How to calculate payroll tax and income tax

Like every area of taxes, payroll and income taxes come with a slew of rules and exceptions. Before processing payroll manually, have a tax accountant walk you through the calculations specific for your business and its employees.

Say I employ Kimberly, who earns a $144,000 salary paid out semi-monthly at my limited liability company (LLC). On top of her salary, she also enjoys a $100 monthly gym membership and $200 in employer-paid monthly health insurance premiums. She contributes 5% of her salary to a 401(k) plan, with no employer match.

Let’s compare income versus payroll taxes for Kimberly’s first paycheck of 2021.

Calculating payroll tax

For this example, I’m just going to go through calculating FICA taxes, but the same process applies to most payroll taxes, whether it’s FUTA, SUTA, or some other unrhymed taxes.

1. Determine gross wages for the period: Kimberly gets paid twice per month, 24 times per year. Her annual salary is $6,000 each pay period ($144,000 yearly salary ÷ 24 pay periods).

Add in one-half of her monthly fringe benefits -- $50 for a gym membership and $100 for health insurance premiums -- and you arrive at her gross pay of $6,150. Kimberly’s retirement contributions don’t affect the gross pay calculation since they’re included in her $6,000 salary.

2. Calculate taxable wages for each payroll tax: Each tax defines taxable wages slightly differently. For example, some taxes allow you to exempt particular types of income, such as health insurance premiums and retirement contributions.

Employer-paid health insurance premiums are exempt from the FICA calculation, so Kimberly’s FICA-taxable wages are $6,050 ($6,150 gross pay - $100 health insurance premium). FICA considers gym memberships and employee retirement contributions taxable, so they remain.

FICA refers to two taxes: Social Security and Medicare taxes, and they each come with more rules.

Employees and employers each pay 6.2% of an employee’s eligible wages in Social Security taxes until the employee's earnings reach the annual limit. In 2021, the Social Security tax limit is $142,800.

The Medicare tax rate for employees and employers is 1.45% of eligible wages and doesn’t have a maximum. In fact, employees must pay an additional Medicare tax of 0.09% after earning $200,000 for the year if they’re single and $250,000 if married filing jointly. Employers don’t pay the additional Medicare tax.

Since this is Kimberly’s first paycheck of the year, we aren’t yet worried about reaching these limits.

3. Identify who pays the payroll tax: Some payroll taxes, such as FUTA, are entirely employer-paid and therefore don’t come out of an employee’s paycheck. Other taxes, such as FICA, are split between employees and employers.

4. Calculate the payroll tax: Kimberly’s FICA taxes for the first paycheck of the year amount to $463.83, based on $6,050 in taxable wages times the 6.2% Social Security tax, plus the 1.45% Medicare tax. As Kimberly’s employer, my business owes another $463.83 in FICA taxes.

Calculating income tax

I’m focusing this section on calculating federal income tax withholding for employee paychecks. If you’re looking for information on calculating your self-employed income tax, check out our guide to calculating your business tax liability.

As an employer, you’re required to withhold federal income taxes according to the employee’s Form W-4. Tax withholding depends on a series of factors, including the taxpayer’s earnings, marital status, and number of dependents. Whatever comes from the form goes into your payroll software.

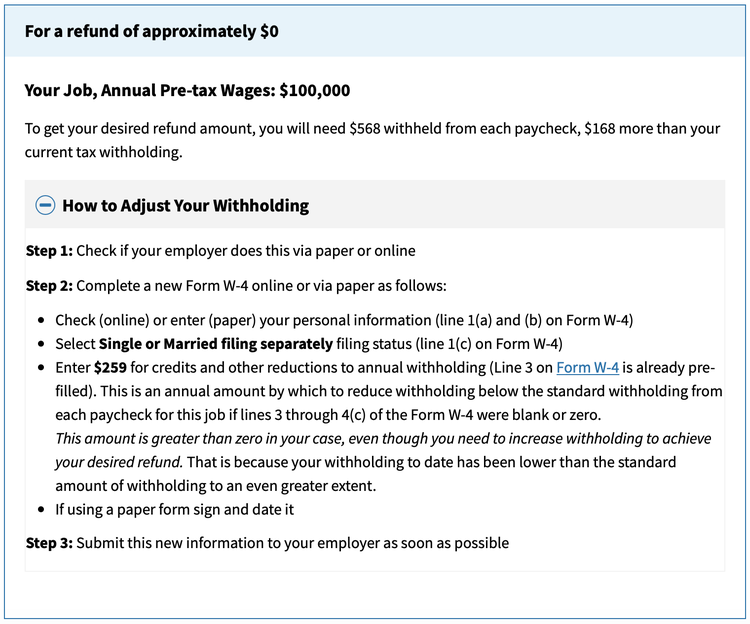

You should encourage employees to consult the IRS tax withholding estimator before filling out the Form W-4. The calculator is also an excellent tool for the self-employed when figuring out how much to remit for quarterly federal income tax payments.

I filled in Kimberly’s details in the IRS withholding calculator, and it told me that she should withhold $568 per paycheck for federal income taxes.

The IRS tax withholding estimator can help employees fill out their W-4s. Image source: Author

2 best practices when filing payroll and income taxes

What more does an entrepreneur need to run a business than a tax professional and some software?

1. Invest in payroll software

Investing in payroll software not only makes for a more efficient payroll system, but it also puts software in the driver’s seat for filing employment tax forms. Start thinking of hobbies you can pursue with the time you’ll save on running payroll and filing employment tax forms.

2. Have a tax professional on speed dial

Let’s admit it: Taxes are complicated. Having a reliable tax attorney or CPA in your corner to guide you through uncharted tax waters is invaluable. Professionals can wind up paying for themselves by helping you avoid penalties for incorrect filings.

Don’t forget about sales, excise, and property taxes

And we’re only just getting started. While you don’t have to be a tax expert to be a business owner, it’s helpful to be aware of the taxes that walk away with your business profits. Keep reading up on small business taxes.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.