Running payroll for your business is one of the most important tasks you'll be doing. SurePayroll makes it easy, giving you the tools you need to process payroll in minutes, not hours.

- Self Service: $19.99/month, plus $4/employee/month

- Full Service: $29.99/month, plus $5/employee/month

-

Ease Of useRating image, 4.50 out of 5 stars.4.50/5 Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

= Best

= Excellent

= Good

= Fair

= Poor

SupportRating image, 4.00 out of 5 stars.4.00/5 Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

= Best

= Excellent

= Good

= Fair

= Poor

PricingRating image, 4.00 out of 5 stars.4.00/5 Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

= Best

= Excellent

= Good

= Fair

= Poor

FeaturesRating image, 4.50 out of 5 stars.4.50/5 Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

= Best

= Excellent

= Good

= Fair

= Poor

-

- Online access with a mobile app available

- Employee portal available

- Affordable for even the smallest business

- Does not include after-the-fact payroll capability

- Limited report customization

- Employee onboarding not available

SurePayroll is an online payroll service designed for small business owners who want to simplify the entire payroll process.

The payroll software also offers a reseller opportunity for accountants who wish to offer payroll services to their clients.

Who is SurePayroll for?

SurePayroll is specifically designed for small business owners, with a special version available for those who pay nannies or other household workers.

Ideal for small businesses, SurePayroll offers a self-service plan and a full- service plan, with add-on options available as well.

Completely cloud-based, SurePayroll allows you to easily enter the necessary pay information, and it does the rest, including unlimited payroll runs and multiple pay rates, as well as complete tax filing and payment remittance.

SurePayroll's features

Payroll processing can be overwhelming for new business owners, but SurePayroll offers numerous features designed with small business owners in mind.

1. Mobile functionality

Along with complete cloud access, SurePayroll includes a mobile app for iOS and Android devices, so you can complete payroll from anywhere, if necessary. SurePayroll lets you run an unlimited number of payrolls, with both same day and next day payroll options available.

You can track both time and attendance in SurePayroll, and a variety of employee benefit and insurance options are available in SurePayroll, including Workers' Compensation, 401(k) plans, health insurance, and pre-employment screening.

SurePayroll supports direct deposit at no additional cost, with direct deposit available for both employees and 1099 contractors. In addition to handling all tax-related forms, SurePayroll will handle all new employee reporting requirements for your business, another thing you can take off your plate.

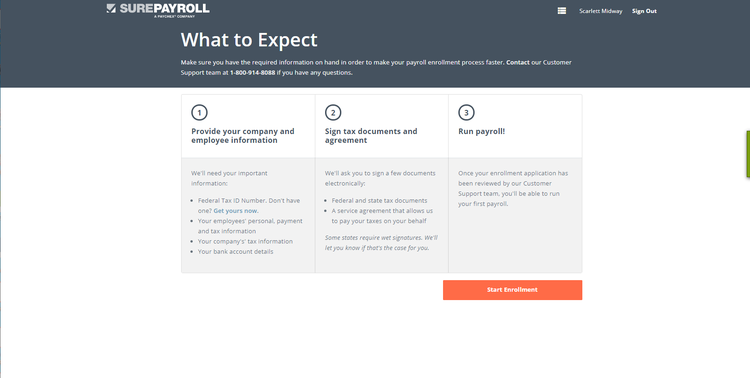

SurePayroll's initial setup screen. Image source: Author

To get started, you'll have to provide SurePayroll with the details about your company. You will also need to provide them with signed tax documents that give them the necessary permission to pay federal and state taxes on your behalf. Once this information is supplied, and examined by SurePayroll, you will be able to run your first payroll.

The SurePayroll dashboard is easily navigated, and provides you with access to the Account Center, Payroll, Reports, Employees, Company, and Tools and Resources tabs.

The dashboard will also display the current payroll status for your company, with the option to preview payroll, approve the payroll run, and print checks, if there are any.

2. Payroll step-by-step

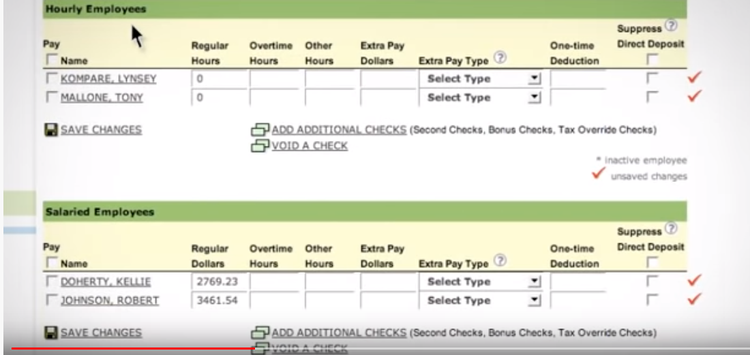

The payroll entry screen is designed for efficiency, so you can just click the box next to each employee and enter their hours for the pay period.

SurePayroll's payroll dashboard offers easy access to numerous features. Image source: Author

The same process is followed for salaried employees, though you only have to check the box next to their name in order to process payroll. There is also an option for an extra pay type, if you wish to add a bonus or commission payment, and on-time deductions can be added as well.

SurePayroll's entry screen is designed for efficiency. Image source: Author

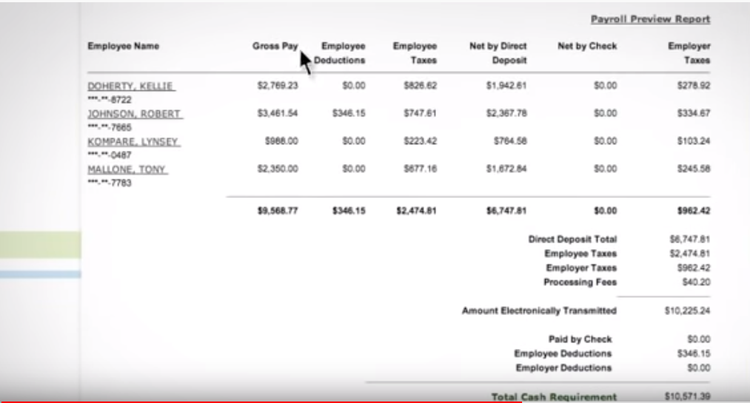

Once payroll information has been entered, you can view details, including direct deposit totals, and the amount necessary to fund payroll, including all the necessary taxes.

SurePayroll's Payroll Preview Reports provide you with all the details you need to fund payroll. Image source: Author

Once payroll is approved, you can process payroll and run all of the necessary reports.

3. Auto Payroll

Do you still stress about processing payroll late or even missing a pay date? If so, Auto Payroll is for you.

Auto Payroll allows you to enter default hours or salary amounts for your employees, with SurePayroll taking over and doing the rest. SurePayroll will send you a reminder that payroll will be processing soon, providing you with a deadline for making any changes.

When the payroll date arrives, Auto Payroll takes control, processing the payroll automatically without you having to do anything. Once payroll has been processed, you'll also receive a confirmation from SurePayroll that processing is complete.

4. Calculates payroll taxes

The primary reason why businesses, and small businesses in particular, turn to payroll services is that they are not comfortable calculating and filing all of the necessary payroll tax forms, which include Form 940, Form 941, and Form 943.

No worries with SurePayroll, as all the necessary reports and remittances are completed for you, with SurePayroll guaranteeing that they will be done accurately. If you dread completing and filing reports and calculating remittance totals, fear no more.

5. Process year-end forms and reports

In addition to filing quarterly tax reports, SurePayroll also processes W-2s for your employees and 1099s for any contract employees you may have paid throughout the year.

In addition to providing these forms to your employees and contractors, SurePayroll also processes and electronically submits W-2, W-3, and 1099 year-end reports, eliminating the need for you to process these reports manually.

6. Pay 1099 contractors

Today, small businesses use outside contract employees just as frequently as they hire employees.

SurePayroll allows you to pay your 1099 contractors from the same screen you use to pay your employees, with direct deposit available for contractors as well.

7. Employee self-serve

SurePayroll offers a convenient, secure online portal for your employees, providing them with access to payroll related information such as current and historic paystubs and W-2s.

Contractors can also access their 1099s through the online portal. The portal can be accessed from a desktop or laptop computer, or employees can use the mobile app to access their payroll documents at any time. SurePayroll also sends a notification email to all employees when a new payroll stub is available to view.

8. Reporting variety

SurePayroll offers a good selection of payroll reports, including an Employee Detail report, a New Hire report, a Check Register, and a Deductions report.

Report customization is limited in SurePayroll, though you can export any report to Microsoft Excel for customization, if desired. Reports can also be saved as a PDF.

9. Integration with time clock software and accounting applications

SurePayroll integrates with a variety of time clock applications, including SpringAhead, Homebase, and Inception.

Integration with popular accounting software applications such as AccountEdge, QuickBooks Online, Sage 50, and Xero is also available.

SurePayroll's ease of use

SurePayroll is designed for efficiency, with a streamlined user interface available that requires little data entry, and payroll dashboards providing easy access to all of the necessary payroll-related features you'll need to process payroll.

If your business has a limited number of employees and their hours don't vary, or you pay your employees a salary, you can save even more time and data entry by choosing to use the Auto Payroll option, which requires no action on your part.

If you do have any changes, you are given more than enough time to make those changes prior to payroll processing.

SurePayroll's pricing

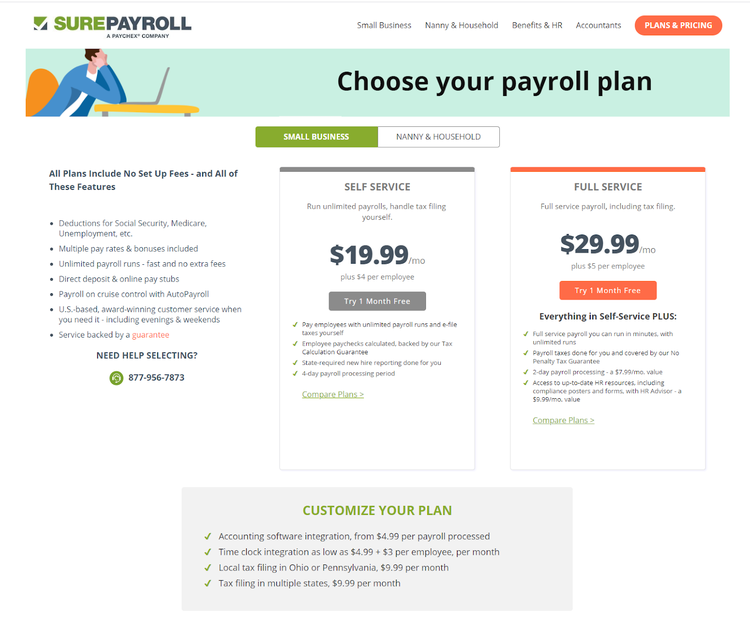

SurePayroll offers two plans: Self Service, which is $19.99/month, plus a $4 per- employee charge, and Full Service, which is $29.99/month and has a $5 per-employee charge. The Full Service plan includes all the features in the Self Service plan, along with complete tax filing and a two-day payroll processing time.

SurePayroll offers two pricing plans, plus custom add-on options. Image source: Author

Custom add-on options available in SurePayroll include:

- Accounting software integration: $4.99/per payroll

- Time clock integration: $4.99/month, plus $3/per employee

- Local tax filing in Ohio or Pennsylvania: $9.99/month

- Tax filing in multiple states: $9.99/month

Working with SurePayroll support

Live customer support is available in SurePayroll, with evening and Saturday support as well. Support is available via a toll-free line, or by email.

In addition, all new SurePayroll customers are assigned an account representative who can assist in initial payroll setup and answer any questions that may arise.

Along with product support, SurePayroll offers easy access to product help resources from anywhere in the application, including a comprehensive FAQ page.

You can also view the Payroll Terminology page, Payroll by State, and Payroll and Tax Calculators, and the SurePayroll blog offers valuable information on payroll in general, as well as SurePayroll features and benefits.

Benefits of SurePayroll

Small business payroll can be complicated -- or at least it used to be.

Using SurePayroll removes a lot of the headaches associated with payroll preparation, allowing you to enter limited payroll data and let SurePayroll handle the rest. Easy anytime/anywhere system access allows you to process payroll from wherever you are, and the handy mobile app offers an even greater level of flexibility.

Eliminate the stress of payroll preparation

If payroll preparation has been stressing you out, you may want to take a look at SurePayroll.

A perfect fit for those who wish to step back and let someone else do the heavy lifting, SurePayroll is also affordably priced, with payroll for a staff of five running under $50 monthly, including all tax filing, direct deposit capability, and live telephone support.

How SurePayroll Compares

| Online Access | Direct Deposit | Prepares Federal Tax Forms | Employee Access to Payroll Documents | |

|---|---|---|---|---|

| SurePayroll |

|

|

|

|

| Gusto |

|

|

|

|

| Payroll4Free |

|

|

|

|

| Payroll Mate |

|

|

||

| RUN Powered by ADP |

|

|

|

|

FAQs

-

SurePayroll offers a mobile app for both iOS and Android devices at no extra cost.

-

If you subscribe to the Full Service plan, SurePayroll will handle the entire process from form preparation to filing and remittance.

-

Yes. SurePayroll offers unlimited payroll processing, so you'll be able to run an extra payroll if necessary at no additional cost.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.