IRS Form 4562: What Is It Used For?

IRS Form 4562 is used to claim depreciation and amortization deductions. Form 4562 is also used when you elect to expense certain property under Section 179 or to provide additional information on the business use of automobiles and other properties that will need to be included on the depreciation form.

If you’ve purchased a tangible or intangible asset during the tax year and want to take a deduction against depreciation or amortization expenses, Form 4562 will need to be completed and included with your annual tax return.

Overview: What is IRS Form 4562?

Depreciation and amortization are used to expense a big-ticket item over its useful life. For example, if you purchase new equipment for your factory, you won’t expense that item in full when it’s purchased. Instead, you’ll want to depreciate it, taking a monthly expense by using an accumulated depreciation account throughout the useful life of the equipment.

Amortization, like depreciation, expenses an asset over its useful life. Amortization is used for intangible assets, such as copyrights, trademarks, and other goodwill you may purchase. And, like depreciation, you’ll need to amortize the intangible asset over its useful life.

If you have a depreciation schedule in place, you can use the schedule when completing Form 4562. However, if you’re using a different schedule, such as a federal depreciation schedule, your totals will differ from your book schedule, which is used when preparing financial statements.

The bottom line: If you’re deducting depreciation or amortization expenses on your tax return, you’ll need to complete Form 4562.

Form 4562 contains six parts that you should be aware of.

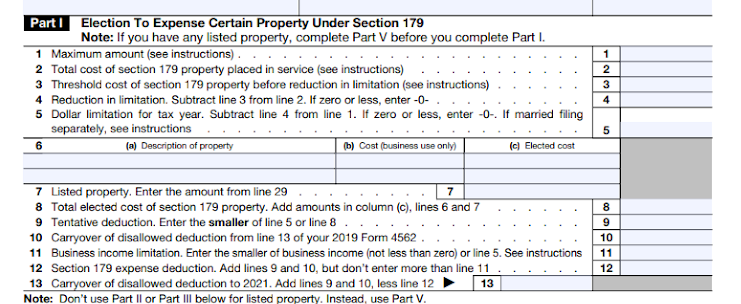

Page 1 of Form 4562 is where you list any assets purchased during the year. Image source: Author

Part I: Section 179 deductions

If you’ve purchased a large item but decide that you would rather write off a large chunk of the expense rather than depreciate it in full, you need to complete Part I. The IRS allows you to write off up to $1 million under Section 179, with any total above that amount depreciated over several years.

You can enter Section 179 information in Part I of Form 4562. Image source: Author

While choosing to write off a large purchase under Section 179 can certainly reduce your tax liability for the year, unless your asset cost is more than $1 million, you won’t be able to depreciate the asset for tax purposes.

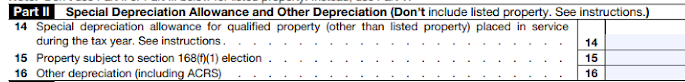

Part II: Special depreciation allowance

Qualified property purchased during the tax year may be eligible for an additional depreciation allowance, such as bonus depreciation.

Special depreciation allowances, such as bonus depreciation, is entered in Part II. Image source: Author

Types of property eligible for bonus depreciation include the following:

- Second-generation biofuel plant property

- Water utility property

- Computer software

- Qualified film, television, and live theatrical productions

- Reuse and recycling property

- Certain fruit-bearing trees and plants

Keep in mind that there are a lot of exceptions to the special depreciation allowance, so it’s best to run this by your CPA before you send it to the IRS.

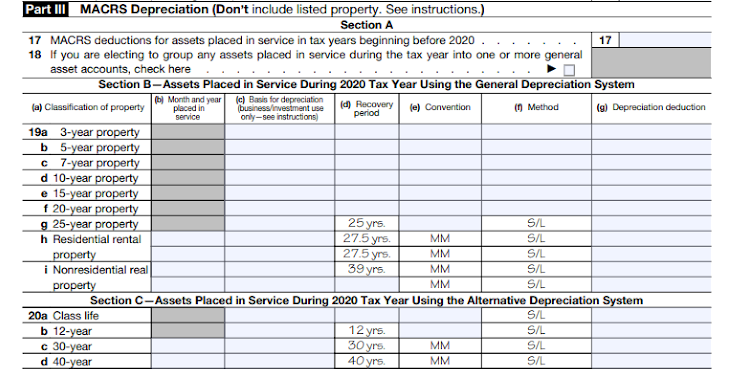

Part III: MACRS depreciation

If you decide to depreciate your assets rather than write them off using Section 179 or bonus depreciation, you’ll need to complete this section for the tax year in which the asset(s) are purchased. You’ll also need to provide the IRS with the total modified accelerated cost recovery system (MACRS) deductions for items placed in service prior to the current tax year.

Part III is where you will need to include any assets placed into service during the year. Image source: Author

If you’re using tax preparation software, the previous year’s depreciation will be automatically carried forward.

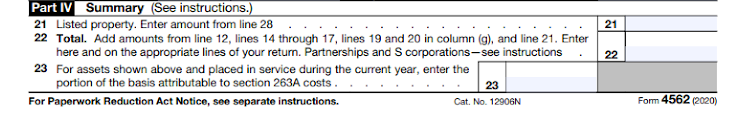

Part IV: Form summary

Strangely enough, the IRS has placed the form summary in the middle of the form rather than at the end. In any case, this is where you would need to add your totals from Parts I, II, and III, as well as any listed property included in Part V.

Part IV is where you will summarize information entered on Form 4562. Image source: Author

However, if your business is a partnership or S corporation, you can skip this since the totals will be entered on each shareholder’s tax return rather than on Form 4562.

Part V: Listed property

Part V is where you list automobiles, other vehicles, and property that are used for both business and personal purposes.

Part V is where you’ll enter listed property, such as vehicles, aircraft, and other recreational vehicles. Image source: Author

You’ll have to split the assets out between those used more frequently for business and those usually used for personal reasons and only occasionally used for business purposes. You can also enter mileage information for all listed vehicles in this section.

Part VI: Amortization

If you have recently purchased patents, copyrights, or other goodwill, you’ll include that information in Part VI.

If you have any intangible assets that need to be amortized, you enter them in Part VI. Image source: Author

Remember that any property that you amortize will not be eligible for a Section 179 deduction or a depreciation deduction.

Examples of property you can depreciate with Form 4562

If it’s expensive, and it’s used for business, chances are that you can depreciate it using Form 4562.

1. Vehicles

Any vehicle that you purchase that is used in your business should be included on Form 4562. The vehicle does not have to be used exclusively for the business, but you need to detail both business and personal use on the form.

2. Office equipment

Computers, laptops, printers, copiers, and even computer hardware and software should be included on Form 4562.

3. Manufacturing equipment

If you own a factory, your manufacturing equipment should be included on Form 4562.

4. Real estate

Real estate can also be included on Form 4562, although the cost of land should be excluded since land does not lose value and should not be depreciated.

5. Patents and copyrights

If you purchase copyrights or patents from another company, you will need to amortize the value on Form 4562.

What is bonus depreciation?

The Tax Cuts and Jobs Act allows for the temporary expensing of business assets at 100%. Deemed first-year bonus depreciation, the Tax Cuts and Jobs Act temporarily increases the bonus depreciation percentage from 50% to 100% for qualified property placed in service after Sept. 27, 2017, and before Jan. 1, 2023. However, not all assets are eligible for bonus depreciation, so check with your accountant or CPA for clarification.

4 best practices when filing Form 4562

The best thing you can do when filing Form 4562 is to have your depreciation information in place. Review the form and instructions to see exactly what information is required, and then pull that information together before attempting to complete the form. Check out these tips for making the form completion process a little easier.

1. Read the instructions

IRS Form 4562 instructions are available to download, along with Form 4562 itself. The instructions provide detailed information about what should and should not be included on the form, as well as tips on how to complete the form properly. Be sure to take a look at the instructions before attempting to complete the form. It will save you a lot of time and aggravation.

2. Have the needed information at hand

If you’re properly tracking depreciation, you should have all of the necessary information at hand. If not, you’ll need the following:

- The total cost of the asset

- The receipt for the purchase of the asset

- The date you began using the asset

- Any depreciation schedules you may have created

Once you’ve assembled this information, you can move on to the next step.

3. Know your recovery periods

Once you have your asset cost and the date the asset was put into service, you’ll also need to determine your recovery period. The IRS uses the recovery period to determine how long an asset should be depreciated.

Similar to the useful life of an asset used when calculating the book value of your depreciation, the IRS has a table you can reference to determine the recovery period for any assets that you will be depreciating.

4. Be sure to separate business and personal use items

When completing Part V of Form 4562, you’ll need to be able to differentiate between personal use and business use of equipment, machinery, or vehicles. If the items you’re depreciating are only used for business purposes, you won’t need to worry about completing this. But, if any depreciated asset is used for both, you’ll have to provide the IRS with a breakdown of personal and business use.

If you have depreciable assets, get acquainted with Form 4562

If you’re depreciating or amortizing any assets and deducting that expense on your tax return, you will need to complete Form 4562. While reading the instructions can help, it may be a good idea to enlist the help of an accountant or CPA to provide some assistance.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles