Part-time work is on the rise, part of a wider trend toward more fluid work arrangements. Some workers desire a part-time schedule for work-life balance or flexibility.

Others want full-time hours but can't get them. These workers are classified as "involuntary part-time employees" by the U.S. Bureau of Labor Statistics (BLS).

For employers, part-time workers can help to meet seasonal demand, provide specialized skills, manage one-off projects, and provide scheduling flexibility. Many businesses rely on a mix of part-time and full-time workers to meet their staffing needs.

But how many hours can an employee work before qualifying as full-time? Whether you're an employer or employee looking for clarity, here's what you need to know about full-time versus part-time work.

What classifies full-time employment?

You may have heard of average part-time hours being 30 or 35 hours per week, or 500 hours per year, or 1,000 hours per year. That's because there is no uniform definition of full-time hours. Each of those standards applies depending on which benefits and laws you're talking about.

The U.S. Department of Labor doesn't define full-time employees because there aren't any special requirements for treating them under the Fair Labor Standards Act (FLSA) and other key wage and hour laws. When it comes to pay and overtime, part-time workers have the same rights as full-time workers.

In some states, overtime is calculated on a daily as well as weekly basis. For example, in Alaska, California, and Nevada, workers must receive overtime pay for working more than eight hours a day.

In Colorado, overtime kicks in after 12 hours. In these states, you might have part-time employees who earn overtime based on their daily schedules, but the overtime rules still apply uniformly to part-time and full-time employees.

The same is true of many state labor laws. For example, numerous states and cities have passed paid sick leave laws in which employees earn one hour of sick leave for every 30 hours worked.

The distinction between full-time and part-time workers does matter when it comes to benefits, however. Several federal laws governing health care and retirement benefits hinge on knowing how to classify workers, as part-time or full-time.

While payroll software is generally configured to meet federal and state requirements, it's important to understand the laws to ensure compliance.

The Affordable Care Act

Knowing how to count full-time employees is critical for compliance with the Affordable Care Act (ACA) because the law:

- Provides a small business health care tax credit to businesses with fewer than 25 full-time employees.

- Requires applicable large employers (ALEs) with more than 50 full-time employees to offer them basic health care insurance or make an employer shared responsibility payment to the Internal Revenue Service (IRS).

When determining workforce size, the ACA counts full-time employees including full-time equivalents (FTEs). FTE is a way to convert a workforce of full-time and part-time employees into an equivalent number of full-time employees based on full-time work hours.

Generally, FTEs are calculated for a given period as:

# full-time employees + [ # part-time employees during period × total # hours worked by part-time employees ÷ # full-time hours for the period]

The ACA defines a full-time employee as one who averages at least 30 hours of service per week or 130 hours per month. Under the ACA, you would count each employee who meets the threshold as one full-time employee. Then you would add FTEs to determine your workforce size.

Under the ACA, employee counts are averaged monthly and then annually. Your monthly FTE is calculated as follows:

# average hours of service for all part-time employees for one month ÷ 120

The 120 represents four weeks of work at 30 hours each, the ACA's weekly measure of a full-time employee. When calculating FTE, no more than 120 hours are included per employee.

For example, a construction company has:

- 41 full-time employees who work more than 30 hours per week

- 12 part-time workers who average 100 hours per month each

- 2 part-time workers who average 60 hours per month each

- 1 bookkeeper who averages 40 hours per month

The company's FTE count is:

[ ( 12 × 100 ) + ( 2 × 60 ) + 40 ] ÷ 120 = 11.3 FTEs

Partial FTEs are disregarded, so the company has 11 FTEs plus 41 full-time employees for a total workforce of 52 for the month. If the numbers hold steady throughout the year, the company would be an ALE because it exceeds the 50-employee threshold.

The IRS's ACA guidance for ALEs contains detailed instructions for calculating FTEs, including special rules for new employers and businesses with seasonal workers.

Under the ACA, FTEs are only relevant for determining whether an employer is large enough to qualify as an ALE. Part-time employees counted in FTEs are not considered full-time employees for the purpose of deciding who must be offered coverage.

The Consolidated Omnibus Budget Reconciliation Act (COBRA)

COBRA requires companies that offer group health plans to continue coverage for certain employees after they leave their jobs. COBRA applies to employers with at least 20 employees on more than 50% of its typical business days.

Like the ACA, COBRA uses FTEs to include part-time workers in a company's employee count. For COBRA, you calculate each employee as a fraction of a full-time worker based on your company's full-time working hours.

For example, if your employees work a 40-hour week, an employee who works 20 hours would be counted as 0.5 FTE. Once again, these part-time FTEs are added to the full-time count to come up with a total.

Employee Retirement Income Security Act (ERISA)

Under ERISA, employers cannot exclude employees who work more than 1,000 hours over a 12-month period from retirement plans such as 401(k)s. That averages out to around 20 hours per week, so many part-time employees qualify for retirement benefits.

While companies do have some flexibility in setting eligibility standards, requirements that screen out part-time workers may prompt the IRS to require corrective contributions or jeopardize your plan's tax-preferred status.

Setting Every Community Up for Retirement Enhancement (SECURE)

The SECURE Act, signed into law in December 2019, is further legislation aimed at helping part-time employees save for retirement. The Act requires employers to allow long-term part-time employees to participate in 401(k) plans.

To qualify, employees must be age 21 or older and work 500 or more hours per year for at least three consecutive years.

The Act takes effect with plan years beginning in 2021. Service hours from prior years will not be counted toward qualification, so the first year when you would be required to admit new part-time workers under SECURE would be 2024.

Paycheck Protection Program (PPP) Loans

Implemented this spring to help businesses weather the COVID-19 crisis, PPP loans administered by the Small Business Administration (SBA) may qualify for forgiveness based on numerous factors including the borrower's full-time employee count.

Final rules for obtaining forgiveness were enacted on June 5, 2020 in the Paycheck Protection Program Flexibility Act. Its measures include provisions based on average FTE count and reductions in FTEs during the covered loan period.

PPP calculations are based on a 40-hour workweek. You may simplify calculations by counting employees with 40 or more hours as 1 FTE and those working fewer hours as 0.5 FTE. The full calculations are spelled out on the PPP loan forgiveness application.

What classifies part-time employment?

As you can see, the definition of a part-time employee varies based on the laws and the authorities enforcing them. The BLS considers anything under 35 hours part-time.

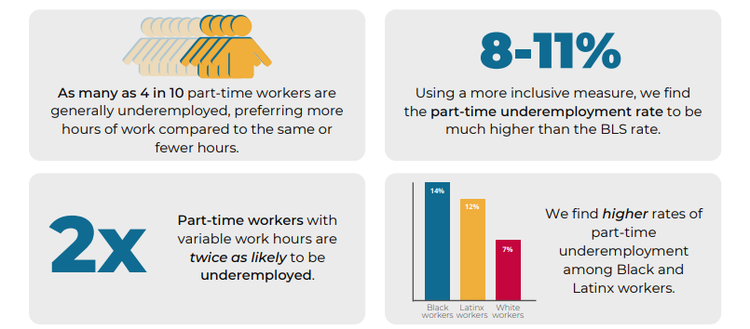

The Center for Law and Social Policy estimates that 4 out of 10 part-time workers want full-time work. Image source: Author

Legal implications of misclassifying full-time and part-time employees

Misclassifying workers as part-time can bring administrative and legal headaches your way, including these three.

Loss of favored tax status

Misclassifying employees as part-time can result in excluding them from benefit plans. That can jeopardize your plan's tax-preferred status or lead to corrective measures from agencies such as the IRS.

Lawsuits

Failing to provide pay or benefits when required can lead to lawsuits and penalties for noncompliance. A recent example is Marin v. Dave & Busters, a class action lawsuit claiming the restaurant chain reduced employees' hours to jettison them from the company's group health plan.

The company settled the lawsuit for more than $7.4 million in July 2019.

Citations and penalties

Federal laws such as ERISA and the ACA have teeth. Noncompliance can bring penalties of up to $3,860 per employee and penalty taxes of up to $100 per day. The laws also provide for criminal charges in cases of willful violations.

Full-time vs. part-time: Which is right for your small business?

Ideally, part-time employment is a mutually beneficial arrangement that enhances flexibility and efficiency for both parties. Cutting full-time jobs into part-time ones to save money, on the other hand, can be a losing proposition.

The Center for Law and Social Policy (CLASP) reports that:

- 4 in 10 part-time workers want more hours.

- Widespread underemployment among part-time workers leads to low job satisfaction and stress.

- A higher share of involuntary part-time workers are from historically marginalized groups.

A tiered workforce with involuntary part-time workers handling entry-level tasks can damage retention, morale, quality, and productivity. It can also prevent you from developing entry-level talent to its full potential.

Whenever a company hires a part-time worker to limit its employee spend, both parties come up short.

When full-time is the right choice

Full-time employment makes sense for companies when:

- You have a full-time need: As your business grows, your capacity and needs grow with it. Suddenly, you might have enough bookkeeping work to create a new position.

- You need a commitment: A full-time workforce can provide the skills and stability you need to support customer service, productivity, and quality goals.

- You have the right talent: Offering full-time positions can help you attract and keep top performers.

When part-time is the right choice

Part-time employment can work for both parties when:

- You have seasonal demands: Part-time work can be ideal for meeting seasonal demand and erratic schedules.

- You want to test the relationship: Depending on your business, it might make sense to hire someone part-time to see whether a full-time position is a good fit.

- You need part-time skills: Employees with specialized skills that aren't needed full-time can work part-time hours as needed.

- Employees desire part-time work: Many employees want part-time work for work-life balance or personal reasons. Accommodating those requests can help you retain good employees.

All business is people business

The employment relationship is just that: a relationship. How much you're willing to invest and commit has everything to do with the results you achieve.

When companies use a mix of part-time and full-time workers as part of a comprehensive strategy to optimize their talent and drive growth, they can bring out the best in their people and their business.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.