Your Step-by-Step Checklist for Applying for an SBA 7(a) Loan

Running a small business isn't always easy. As rewarding as it often is, there are times where you might need extra cash to buy new equipment, expand your shop, or replenish your inventory.

However, finding loans can sometimes be challenging, especially if you're a new or non-traditional business owner. That can hamper your efforts to secure small business loans through conventional financial institutions.

To help ease the path, the Small Business Administration (SBA) has created various loan programs for small business owners. The most popular is the SBA 7(a) loan program.

If you're a small business owner trying to secure a small business loan -- from a microloan to millions of dollars -- keep this one on your radar. Here's what you need to know.

Overview: What is an SBA 7(a) loan?

The SBA 7(a) loan is the administration's most popular loan program. There's not just one type of SBA 7(a) loan; eight different loans are available within the program designed to cover a variety of needs.

What makes this SBA loan so popular among small business owners is that between 50 and 85% of the loans are guaranteed. For more traditional lenders, such as banks and credit unions, having a government guarantee to cover a loan helps reduce the risk of lending to people who might not usually get approved.

Who is eligible for an SBA 7(a) loan?

The SBA's loan programs often target small business owners who might struggle to get traditional financing. However, that doesn't mean there aren't some SBA loan requirements you need to meet to qualify.

For-profit

The SBA requires you to operate a for-profit business.

Located in the United States

Your business must also be located and do business within the U.S. (or territories), though that doesn't mean you can't also sell goods or services outside it.

Have owner equity

As the small business owner, the SBA wants you to invest your time and funds into the business.

Applied for other funding

The SBA doesn't want it to be your first choice for funding. It requires you to have already used your own funds or applied for other sources of money before coming to them.

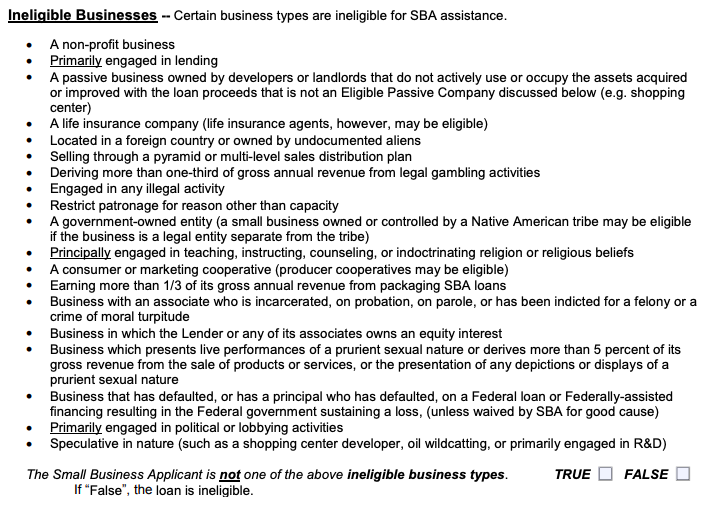

While most small businesses meet the qualifications for an SBA 7(a) loan, certain types of companies aren't eligible.

A list of businesses ineligible for SBA 7(a) loans. Image source: Author

How an SBA 7(a) loan works

As with the other loan programs it offers, the SBA doesn't directly provide funds to small business owners. Instead, the SBA works with pre-approved lenders to help facilitate the process.

For you, the process is relatively straightforward. If you meet the qualifications, the first thing to do is find a pre-approved lender. Lenders range from traditional banks to credit unions and private lenders, providing a range of options.

Once you have identified your lender, you can start working on your SBA loan application.

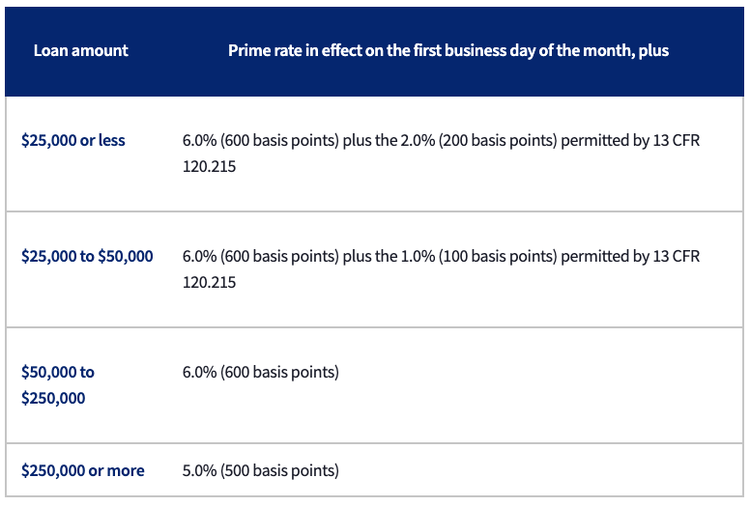

A list of the interest rates for fixed-rate SBA 7(a) loans. Image source: Author

SBA loan terms, including funding limits, interest rates, fees, and how the funds can be used, are pre-set.

Generally, you can use the funds for the following:

- Real estate: including buying new land or new facilities, upgrading or building a new facility, or improving a property that you currently lease.

- Capital needed to run your business: including buying inventory, hiring new employees, accounts payable, and other types of ordinary operating expenses.

- Startup costs: the costs related to starting your company, including business improvement efforts, and equipment purchases.

Once approved, the turnaround time for funding is quick, usually between five and ten business days. For SBA 7(a) Express Loans, you can get funding in as little as 36 hours. Depending on the type of loan you get, the repayment terms are typically between 10 and 25 years.

The 8 types of SBA 7(a) loans

You might not know that the 7(a) loan program is an umbrella term for eight distinct types of loans. You might find that your needs are best met with one kind of loan over another, so do your research into the available loans before you dig into the process.

1. Standard 7(a)

This is the most common loan. Many small businesses will meet the qualifications for the standard 7(a) loan, and it covers the widest range of needs. It allows you to borrow up to $5 million and can be used to fund a variety of needs, from real estate to startup costs.

2. 7(a) Small Loan

The small business loan offers the same features as the standard loan, except the maximum loan limit is $350,000. Lenders also prescreen these loans based on your business's financial documents. If you pass, your application will get expedited.

3. SBA Express

If you need a quick turnaround, consider the Express loan. You'll have a decision within 36 hours. The maximum loan is $350,000. The SBA only guarantees up to 50% of this loan, the lowest of the 7(a) program.

4. Export Express

This loan offers a line of credit up to $500,000 for export businesses. As with the standard Express loan, it also provides a quick turnaround on funding.

5. Export Working Capital

The Export Working Capital loan is another for export businesses. With this loan, the SBA allows companies to borrow up to $5 million for working capital to facilitate more export sales.

6. International Trade

The International Trade loan is a long-term loan for businesses trying to improve to compete with foreign organizations. The maximum loan is $5 million.

7. Veterans Advantage

The VA small business loan is for businesses with at least 51% veteran ownership. An eligible company can apply for any SBA 7(a) loan and have the Veteran Advantage benefits, including lower fees, applied.

8. CAPLines

The CAPLines program offers lines of credit up to $5 million to qualified small businesses. It's designed to meet short-term, seasonal, or cyclical needs.

Tips for getting an SBA 7(a) loans

If you're considering applying for an SBA 7(a) loan, keep these tips in mind before you start. They can help improve your chances.

1. Make sure you qualify

While you'll need to meet the main requirements set by the SBA, you'll also want to check the specifications set by your lender. Lenders look at some basic criteria, including your credit score, fiscal projections, business plan, and revenue. Some might also ask about collateral, which can help improve your application.

2. Start with your current lender

If you're already banking with a financial institution, it's a good idea to find out if you can get an SBA through it. Discuss your needs with the small business lending department. You might find your relationship can help during the application process since the bank is already familiar with you and your business. That can help smooth the path if your application runs into any bumps along the way.

3. Get your documents in order

Before you apply for an SBA loan, have all the required documentation in order. Many lenders will want a lot of paperwork to complete your loan, ranging from formal financial statements to your business plan and incorporating documents. Prepare that ahead of time to help keep the process rolling.

Explore your options with SBA 7(a) loans

As a small business owner, you're probably already familiar with the ups and downs of keeping your company going. When there comes a time you need extra help or the funds to keep your business growing, don't forget to explore the SBA's options. You might find a 7(a) loan that fits the bill for exactly what your business needs.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.

Related Articles

View All Articles