Sometimes investors become convinced that a stock is more likely to fall in value than to rise. If that's the case, investors can potentially make money when the value of a stock goes down by using a strategy called short selling. Also known as shorting a stock, short selling is designed to give you a profit if the share price of the stock you choose to short goes down -- but can also lose money for you if the stock price goes up.

Why would you short a stock?

Typically, you might decide to short a stock because you feel it is overvalued or will decline for some reason. Since shorting involves borrowing shares of stock you don't own and selling them, a decline in the share price will let you buy back the shares with less money than you originally received when you sold them.

However, there are some other situations in which shorting a stock can be useful. If you own a stock in a particular industry but want to hedge against an industrywide risk, then shorting a competing stock in the same industry could help protect against losses. Shorting a stock can also be better from a tax perspective than selling your own holdings, especially if you anticipate a short-term downward move for the share price that will likely reverse itself.

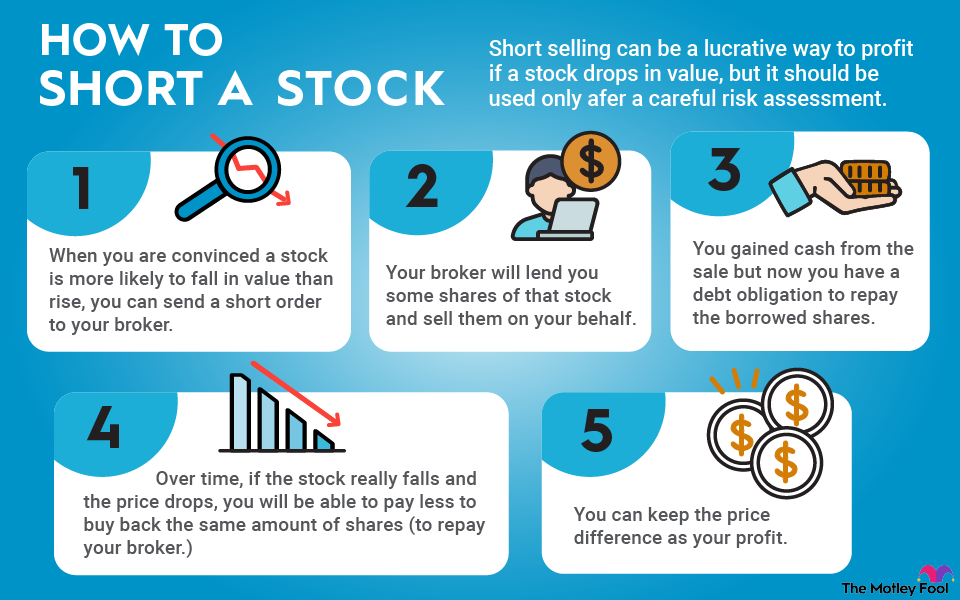

How to short a stock: 5 steps

In order to use a short-selling strategy, you have to go through a step-by-step process:

- Identify the stock that you want to sell short.

- Make sure that you have a margin account with your broker and the necessary permissions to open a short position in a stock.

- Enter your short order for the appropriate number of shares. When you send the order, the broker will lend you the shares and sell them on the open market on your behalf.

- At some point, you'll need to close out your short position by buying back the stock that you initially sold and then returning the borrowed shares to whoever lent them to you, via your brokerage company.

- If the price went down, then you'll pay less to replace the shares, and you keep the difference as your profit. If the price of the stock went up, then it'll cost you more to buy back the shares, and you'll have to find that extra money from somewhere else, suffering a loss on your short position.

A Short-Selling Example

Here's how short selling can work in practice: Say you've identified a stock that currently trades at $100 per share. You think that stock is overvalued, and you believe that its price is likely to fall in the near future. Accordingly, you decide that you want to sell 100 shares of the stock short. You follow the process described in the previous section and initiate a short position.

When you sell the stock short, you'll receive $10,000 in cash proceeds, less whatever your broker charges you as a commission. That money will be credited to your account in the same manner as any other stock sale, but you'll also have a debt obligation to repay the borrowed shares at some time in the future.

Now let's say that the stock falls to $70 per share. Now you can close the short position by buying 100 shares at $70 each, which will cost you $7,000. You collected $10,000 when you initiated the position, so you're left with $3,000. That represents your profit -- again, minus any transaction costs that your broker charged you in conjunction with the sale and purchase of the shares.

What are the risks of shorting a stock?

Keep in mind that the example in the previous section is what happens if the stock does what you think it will -- declines.

The biggest risk involved with short selling is that if the stock price rises dramatically, you might have difficulty covering the losses involved. Theoretically, shorting can produce unlimited losses -- after all, there's not an upper limit to how high a stock's price can climb. Your broker won't require you to have an unlimited supply of cash to offset potential losses, but if you lose too much money, your broker can invoke a margin call -- forcing you to close your short position by buying back the shares at what could prove to be the worst possible time.

In addition, short sellers sometimes have to deal with another situation that forces them to close their positions unexpectedly. If a stock is a popular target of short sellers, it can be hard to locate shares to borrow. If the shareholder who lends the stock to the short seller wants those shares back, you'll have to cover the short -- your broker will force you to repurchase the shares before you want to.

Related investing topics

Be careful with short selling

Short selling can be a lucrative way to profit if a stock drops in value, but it comes with big risk and should be attempted only by experienced investors. And even then, it should be used sparingly and only after a careful assessment of the risks involved.