Dividend investors like reliable businesses, and the alcohol and spirits industry has been a reliable producer of profits for centuries. Brown-Forman (BF.A -0.08%) (BF.B 0.04%) isn't a household name in itself, but the products it makes are among the best-known in the business, including Jack Daniel's whiskey and Finlandia vodka. Even with its past success, Brown-Forman still has to compete against many rivals, and investors looking for sustainable income want to make sure they can count on the company to come out a winner.

Let's look more closely at Brown-Forman and how it's positioning itself for the future.

Dividend stats on Brown-Forman

|

Current Quarterly Dividend Per Share |

$0.1825 |

|

Current Yield |

1.4% |

|

Number of Consecutive Years With Dividend Increases |

33 years |

|

Payout Ratio |

43% |

|

Last Increase |

November 2016 |

Data source: Yahoo! Finance. Last increase refers to ex-dividend date.

Dividend yield

Brown-Forman's dividend yield is below the average of the overall market by a wide margin, with the typical stock in the S&P 500 weighing in a lot closer to 2%. The current yield is closer to the middle of its range throughout the 2010s, which has ranged from as little as 1% to as high as 2.25%. A soaring stock price has made it difficult for Brown-Forman's dividend to keep pace, and that explains much of the decline in the yield over nearly the past decade.

Image source: Brown-Forman.

Payout ratio

Brown-Forman's payout ratio of just over 40% leaves it squarely within its typical range in recent years. Occasionally, substantial earnings declines have pushed the payout ratio above the 100% mark, signaling sustainability issues. Yet subsequent recoveries have taken the ratio back to values of between 25% and 60%, and the current level is consistent with Brown-Forman's performance in recent years.

Dividend growth

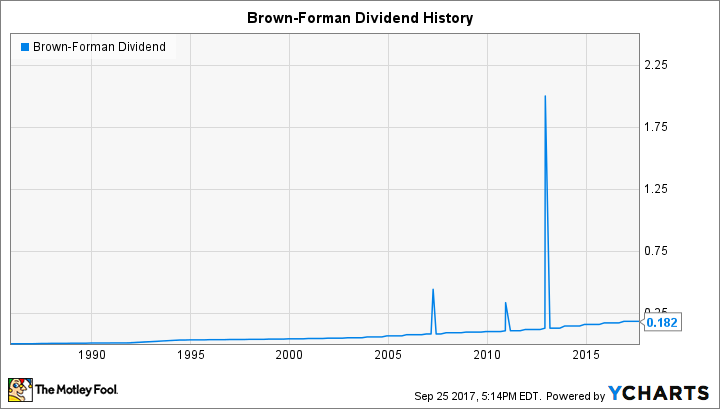

Brown-Forman has an excellent history of dividend growth. The spirits specialist has boosted its payout for 43 consecutive years, including a healthy 7% boost late last year. It has also managed to grow its dividend consistently over the decades. The following chart masks some of the dividend growth that Brown-Forman has delivered to shareholders because of the spikes related to special dividend payments. Yet the company's willingness to share greater amounts of capital with shareholders on an occasional basis further heightens its commitment to making income a key part of its capital allocation strategy.

BF.B Dividend data by YCharts.

What's happened with Brown-Forman lately?

Brown-Forman has done extremely well for shareholders, with sixfold gains since the early 2009 bear market lows. Jack Daniel's is a big part of the company's success, with the whiskey commanding top market share in recent years in the whiskey category. The popularity of spirits in general has risen, and that trend has supported Brown-Forman in its efforts to retain and build its share of the business.

Some have feared that rising trade tensions could hurt Brown-Forman. With Jack Daniel's having become one of the most popular brands in the world, exports have made up an increasingly important part of Brown-Forman's overall business strategy. Any threat to favorable trade conditions between the U.S. and key trade partners could put a crimp in Brown-Forman's ability to keep capitalizing on demand for whiskey and other spirits, and that in turn could make it harder for the company to keep sharing its success with shareholders through increased dividends.

Another danger is that consumer interest is tempting spirits companies to make decisions motivated by short-term popularity rather than long-term business sense. Some believe that rival Diageo's (DEO 0.24%) recent bid to pay $1 billion for the Casmigos tequila brand dramatically overvalues the upstart, and Brown-Forman will have to avoid falling prey to competitive pressures to answer in kind with an overpriced acquisition of its own.

What to expect from Brown-Forman

Brown-Forman has done a good job in the past of maintaining a disciplined approach to building up its spirits portfolio while still making the most of the opportunities it has in front of it. Even as the industry evolves, Brown-Forman is in a good position to take advantage of consumer demand and stay ahead of the curve in terms of popularity.