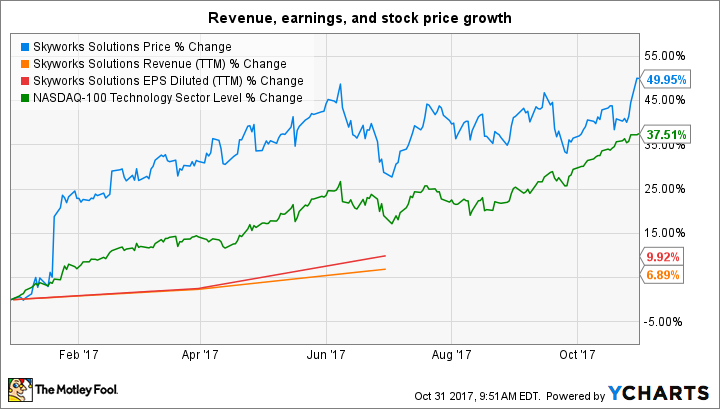

Skyworks Solutions (SWKS 1.81%) has outperformed the semiconductor market this year thanks to smartphone bellwethers such as Apple (AAPL 0.52%), Samsung, and Huawei choosing its chips to power their flagship devices. The strong clientele has helped the semiconductor specialist clock consistent growth, so it is not surprising to see its shares have shot up around 50% so far in 2017.

But will Skyworks be able to sustain its terrific momentum once it releases its fiscal fourth-quarter results after the market closes on Nov. 6? More importantly, is the stock still worth holding on to near its 52-week high? Let's find out.

Image Source: Getty Images

Skyworks' report could be a mixed bag

Wall Street expects Skyworks to earn $1.75 per share in the fourth quarter on revenue of $980.3 million, which is in line with the company's guidance. By comparison, the chipmaker earned $1.47 per share on revenue of $835.4 million in the year-ago quarter, indicating that its revenue and earnings will increase in the mid- to high-teens on a year-over-year basis.

Now, it is likely -- though not guaranteed -- that Skyworks will be able to at least meet expectations for the quarter because of the new generation iPhones.

Investment research firm B. Riley analyzed a teardown of the new iPhone 8 by iFixit, finding that Skyworks has supplied at least four new chips for the device. This is as good as Skyworks' content inside the previous generation iPhone 7. Additionally, the iPhone 8 Plus also reportedly uses four chips from Skyworks. And there's also the iPhone X, which hasn't shipped yet, but is already in production.

However, the company's outlook could turn out to be below expectations in light of recent reports that indicate weak iPhone demand and manufacturing problems.

Citing unnamed sources, Taiwan's Economic Daily newspaper recently reported that Apple has told suppliers that it will slash iPhone component orders in half for the final quarter of calendar 2017.

This might have something to do with weak demand for the iPhone 8, as consumers reportedly prefer last year's iPhone 7 over the new device. Meanwhile, the iPhone 8 is being sold at deep discounts in China, thanks to weak demand in anticipation of the launch of the more premium iPhone X.

And production snags related to the iPhone X could limit the device's shipments to just 20 million units this year, half of what Apple was said to be originally expecting. Given that Skyworks relies on Apple for around 40% of its revenue, the potential drop in iPhone production could severely cripple the company's outlook for the final quarter of the year.

Why investors shouldn't panic just yet

A weak iPhone tale might worry some Skyworks shareholders, but savvy investors should keep calm as there is more to the company than just Apple.

Skyworks management has been trying to aggressively diversify the business, hunting for opportunities in fast-growing areas such as Chinese smartphones and the Internet of Things. The company claims that it is supplying $9 to $10 worth of chips to Huawei's high-end smartphones such as the P9.

This could be a big deal for Skyworks thanks to Huawei's fast-growing clout in the premium smartphone market. The Chinese smartphone player has been gaining market share at an impressive pace, and is now looking to push sales of its premium devices. For instance, sales of the premium Mate 9 smartphone, launched in November last year, were 36% higher than its predecessor in the first four months.

The company recently started shipping its Mate 10 smartphone. It is trying to make a bigger dent in the premium market with this device by giving it features such as artificial intelligence. Moreover, there are rumors that Huawei could enter the U.S. market in the first half of next year in partnership with AT&T.

Therefore, Huawei's increasing importance in the global smartphone arena could go a long way in reducing Skyworks' dependence on Apple. On the other hand, Skyworks has started gaining traction in the Internet of Things space. Its chips were recently selected by ZTE to power the latter's connected car solutions, while it is also trying to make inroads into the smart-home market by providing solutions for virtual assistant devices.

The booming demand for Skyworks' Internet of Things products has driven the company's non-smartphone revenue to 27% of the top line, up from 25% at the end of fiscal year 2016. In fact, its revenue from broad market products, which exclude smartphones, is currently tracking an annual run rate of $1 billion.

Therefore, investors should look beyond Skyworks' Apple-related business when it releases its fourth-quarter report. The company's initiative to diversify its sources of revenue could help it mitigate the problems at Apple to some extent, as well as lay the foundation for long-term growth thanks to the increasing demand for Chinese smartphones and Internet of Things chips.