One of the attractive ways to invest in the oil and gas industry is in oil services companies. These picks-and-shovels businesses -- or, in some cases, guns for hire to do a job -- can generate great returns and can allow investors to target a specific trend in the industry like shale drilling or offshore development. When it comes to oil services giant Baker Hughes, a GE Company (BKR -0.51%) and specialist Core Laboratories (CLB), chances are you're betting on the same trend in the industry even though the businesses themselves are so different.

Let's take a look at some of the reasons investing in these two companies is a play on the same theme and why one of them is likely a better bet right now.

Image source: Getty Images.

Two very different ways of investing in the same trend

In terms of what Baker Hughes and Core Laboratories offer to the oil and gas industry, you couldn't find two companies further apart. After the merger between General Electric's oil and gas unit and Baker Hughes last year, the company is now the world's second-largest oil services firm by market capitalization and provides both services and equipment to every part of the oil and gas value chain. The size and diverse offerings from Baker Hughes allowed the company to start marketing what it calls a fullstream services package, which is an all-in-one service-and-equipment package that will see a project from well appraisal all the way through development and operations.

Conversely, Core Laboratories is a niche player that focuses specifically on analyzing core samples from drilling operations. Core's role is to provide producers with data that will enable them to improve the performance of a well by optimizing production and extending the life of a reservoir. According to management, the data sets it provides can increase recovery rates for a conventional oil and gas reservoir by 40%. This service is incredibly valuable to producers and allows management to focus solely on its main job and command a decent price on its products in an industry that is largely cyclical and subject to wild swings in pricing.

Even though the companies have radically different approaches to the oil services industry, both of them are betting heavily on one trend: the return of investment in international oil and gas, especially offshore.

Ever since oil prices crashed in 2014, the amount of investment going into the exploration and development of oil and gas sources has fallen off a cliff. In 2017, total conventional oil discoveries were 6.7 billion barrels of oil equivalent, which was 78% less than five years prior. This lack of investment and the natural decline in production means that there is a need to invest heavily in new resources over the next few years.

A large portion of the money spent on exploration and production over the past few years has gone to shale drilling in North America, but shale by itself won't be able to satisfy the need to replace natural decline and growing global demand for long. Eventually, producers are going to start opening up their checkbooks and developing resources in the offshore environment.

Many of the services and equipment both Baker Hughes and Core Labs provide are best suited for offshore development. Baker Hughes' fullstream service is geared for offshore developments in which the company provides the equipment, like subsea production infrastructure and blowout preventers, and the large investments needed to develop an offshore field mean Core's services are that much more valuable than a smaller shale well.

According to Core's management, about 15 major capital projects have received final investment decisions (FID) so far in 2018, with another 10 to 15 scheduled to get an FID by the end of the year. Both Baker Hughes and Core Labs will likely be bidders on this work, looking to capture significant business over the next few years.

It all comes down to execution

Both companies have a large market opportunity ahead of themselves that could significantly boost revenue. So from an investment standpoint, what really matters is how well management can execute its business plan and turn that opportunity into returns for investors.

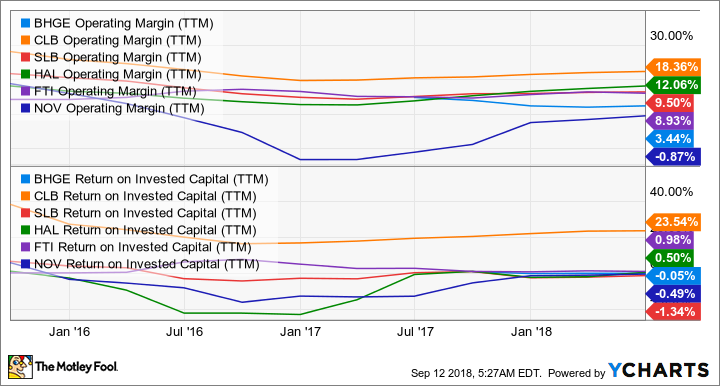

This is where the argument really leans in Core Labs' favor. Even before the merger, Baker Hughes had typically underperformed its larger oil services peers in terms of operating margin and generating returns. Now the company is trying to integrate the services and equipment components of the two business units and generate operational synergies. While Baker Hughes CEO Lorenzo Simonelli has said that the company has made considerable progress integrating over the past year, the company is still way behind Core and several other oil services peers.

BHGE Operating Margin (TTM) data by YCharts.

Generating margins and returns is one of Core's strengths from an investor's perspective. Since so much of its business is based on data analysis and intellectual property, it is a much more capital-light business in an industry that typically has to invest billions in building and maintaining equipment. As a result, Core can convert its revenue into free cash flow at much higher rates than its peers can, and management routinely uses it to buy back stock and pay a modest dividend.

A bird in the hand

Baker Hughes has an opportunity to do great things with this pending surge in spending set to hit the oil and gas industry, but it will be predicated on management being able to streamline the business. That is a monumental challenge considering the size and diverse offerings the company has and puts it at risk of becoming a perpetual underperformer.

For those looking to invest in the oil services industry today, Core Labs is a much surer bet. It has proven to have a valuable service that gives it pricing power, and the capital-light nature of the business means it can generate great returns and throw off cash to investors. You'll have to pay up for the performance -- shares of Core Labs trade at an enterprise value-to-EBITDA ratio of 33 times compared to Baker Hughes' 28 times -- but it is probably worth the premium for the more certain outcome.