When Eldorado Resorts (ERI) announced its plan to acquire Caesars Entertainment (CZR) back in June, it felt eerily familiar to those of us who have watched the casino industry for a long time. The last big buyout was the private equity takeover of Harrah's in 2007, which ironically became Caesars Entertainment. That deal piled on $21 billion of debt and ultimately led to the bankruptcy of Caesar's biggest subsidiary and the reorganization of the entire company.

Eldorado is taking on a total debt load of about $15.5 billion, which is even higher than it may seem because the company has already sold off most of its real estate -- which Harrah's hadn't in 2007. The final deal sounds strangely familiar to the disaster that ultimately befell Harrah's.

Image source: Getty Images.

Eldorado's big buyout

In total, Eldorado's buyout of Caesars Entertainment is worth $17.3 billion. About $7.2 billion will be paid in cash, and another 77 million shares will go to Caesars shareholders. Roughly $3.2 billion of the cash portion will be paid for by VICI Properties, Inc. (VICI -0.29%) through the sale of real estate and increased rent at existing properties. Eldorado will also assume $6.3 billion of existing Caesars debt, and through a series of financing moves will add enough debt to finance the acquisition.

What's worth analyzing today is what the post-acquisition Eldorado (which will actually be called Caesars after a name change) will look like as a company. It may be in a more precarious position than you might think.

Debt is piling up

Between assumed debt and new debt to fund the acquisition, Eldorado expects to have about $15.5 billion of debt on its balance sheet once the Caesars deal is closed. In addition, don't forget that $1.4 billion of the financing package being used to pay for Caesars Entertainment is coming from VICI in return for a $98.5 million increase in fixed rent payments. This isn't technically debt, but it's an increased operating payment that will live on in perpetuity.

The debt load may not seem onerous if you look at the projected $3.6 billion in annual EBITDA after the deal is closed, which includes $500 million of assumed synergies, but we shouldn't assume that EBITDA will remain where it is now forever. And this is where history can be a guide to the risks facing the casino industry.

How this deal went wrong last time

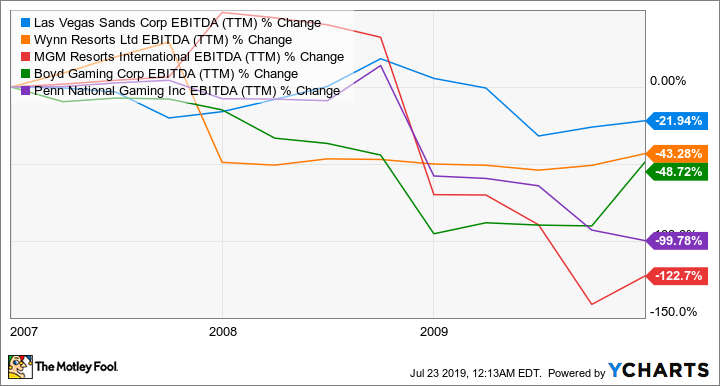

When Harrah's was bought out in 2007, it wasn't any operational flaw that crushed the company -- it was the recession in 2008 and 2009. EBITDA dropped at every casino company, and in some cases fell to zero. That left little money to pay down debt, refinance, or fund any improvements. Casinos companies went into survival mode.

LVS EBITDA (TTM) data by YCharts

If we just take the projected EBITDA of $3.1 billion without synergies and assume a 30% drop, the result in a recession would be $2.17 billion of EBITDA left at Eldorado and a suddenly precarious financial situation. $15.5 billion of debt is a debt to EBITDA multiple of 7.1, which is much higher than where competitors are trading. And remember that Eldorado will have sold a vast majority of its real estate, so it doesn't have that cookie jar to dip into in hard times.

LVS Financial Debt to EBITDA (TTM) data by YCharts

Why this buyout looks familiar

Companies don't normally get in financial trouble when the economy is roaring and consumers are spending money freely. They run into trouble when the economy slows, interest rates rise, and they find out they don't have enough money to pay off debt or refinance. That's what caused the former Harrah's and others in the casino industry trouble in the financial crisis. Eldorado is setting itself up to be highly leveraged both financially and operationally after buying Caesars. If the economy slows down the company could be in real trouble.