Under Armour's (UA -1.35%) (UAA -1.18%) stock plummeted this week after the athletic footwear and apparel maker posted its third-quarter earnings Monday. At first glance, its headline numbers looked stable. UA's revenue dipped 1% annually to $1.43 billion, beating estimates by $10 million, as its net income rose 36% to $102.3 million, or $0.23 per share -- which also beat expectations by four cents.

However, those headline numbers were overshadowed by four major problems:

- Regulatory probes regarding the company's accounting practices

- The deterioration of its North American business

- Its poor growth in DTC (direct-to-consumer) revenue

- Its dismal guidance for the full year.

Let's take a closer look at these four issues.

Image source: Getty Images.

1. Dual probes from the DOJ and SEC

Under Armour is currently under investigation by the Department of Justice (DOJ) and the Securities and Exchange Commission (SEC) for possibly inflating its revenue figures, according to a report in The Wall Street Journal. UA subsequently admitted that it had been responding to "requests for documents and information" related to its accounting practices from both agencies since July 2017, but that it "firmly believes" that those practices and disclosures "were appropriate."

UA had three different CFOs between 2016 and 2017, so the problems could have stemmed from those abrupt changes. Nonetheless, UA's failure to disclose these probes to investors raises concerns about current CFO David Bergman, who has held the role since late 2017. UA's revenue rose 22% in 2016, 3% in 2017, and 4% in 2018. That deceleration is disappointing, but it could look even worse if UA is forced to restate its revenue.

2. Still losing consumers in North America

UA's North American revenue fell 4% annually to $1 billion, or 71% of its top line, during the third quarter. That marked UA's fifth consecutive quarter of year-over-year revenue declines in its biggest market.

|

N. America |

Q3 2018 |

Q4 2018 |

Q1 2019 |

Q2 2019 |

Q3 2019 |

|---|---|---|---|---|---|

|

Revenue |

$1.1 billion |

$965 million |

$843 million |

$816 million |

$1.0 billion |

|

YOY growth |

(2%) |

(6%) |

(3%) |

(3%) |

(4%) |

YOY = Year-over-year. Source: UA quarterly reports.

UA attributed the decline to lower traffic in outlet stores and weak conversion rates on its e-commerce platform. However, another major issue -- which UA often glosses over -- is intense competition from Nike (NKE -2.62%) and Adidas (ADDYY 0.36%).

Nike's North American sales rose 4% annually to $4.3 billion last quarter, while Adidas' North American sales grew 12% (6% in constant currency terms) to 1.2 billion euros ($1.35 billion). UA is clearly struggling to keep pace with those bigger rivals.

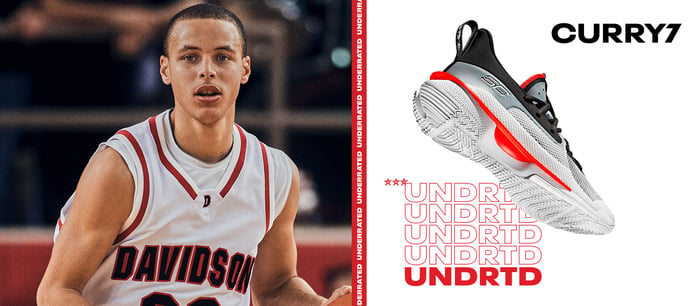

Image source: Under Armour.

3. A dying DTC business

Nike and Adidas are currently executing multi-year growth plans that focus on boosting DTC sales via first-party brick-and-mortar stores and e-commerce platforms. As a result, both companies' DTC revenue grew by double digits annually in their latest quarters.

Yet Under Armour's DTC revenue fell 1% annually to $463 million during the third quarter, continuing its streak of sluggish growth over the past year.

|

DTC |

Q3 2018 |

Q4 2018 |

Q1 2019 |

Q2 2019 |

Q3 2019 |

|---|---|---|---|---|---|

|

Revenue |

$465 million |

$577 million |

$331 million |

$423 million |

$463 million |

|

YOY growth |

0% |

0% |

(6%) |

2% |

(1%) |

YOY = Year-over-year. Source: UA quarterly reports.

UA mainly attributed that softness to its aforementioned challenges in outlet stores and e-commerce, but it claimed that its DTC revenue would improve "slightly" for the full year.

4. Dismal guidance for the full year

Under Armour also lowered its full-year revenue guidance from 3%-4% growth down to just 2%. It blamed that reduction on "lower than planned" excess inventory for its off-price channel, "ongoing traffic and conversion challenges" in the DTC channel, and currency headwinds.

By comparison, Wall Street expects Nike's revenue to rise 8% this year, while Adidas expects its full-year revenue to grow 5%-8%. In other words, UA is smaller than its biggest rivals and growing at a much slower rate.

Is it time to give up on Under Armour?

I've been bearish on Under Armour for a long time, and I still think it's in serious trouble. Its core growth engines have sputtered out, its CEO is stepping down, and it now faces tough questions about its accounting practices.

To top it off, UA's stock still looks expensive at over 30 times forward earnings. Therefore it might be smarter to cut your losses in this wounded underdog and invest in market leaders like Nike and Adidas instead.