What happened

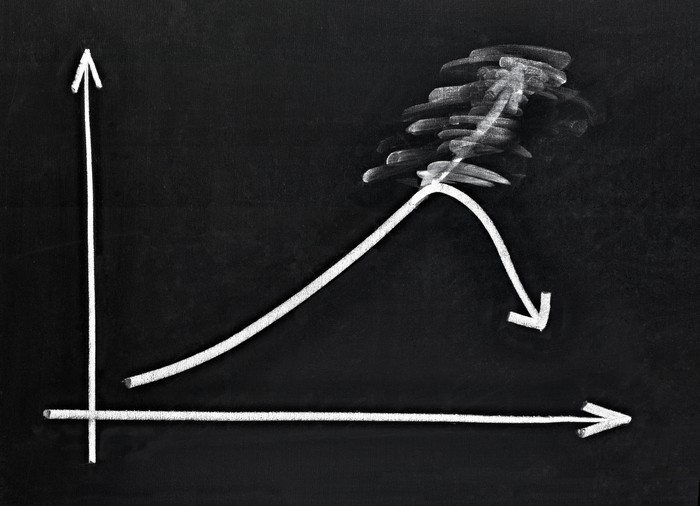

Shares of natural gas-powered-engine maker Westport Fuel Systems (WPRT -7.46%) shot out of the gate Friday morning, rising as much as 11.5%...before turning tail and giving up nearly all their gains later in the day. By noon, Westport shareholders were seen despondently examining profits that amounted to less than 2% -- 1.6% at noon EST to be precise.

So what explains investors' quick round of applause for Westport, and why did it fade even quicker?

Image source: Getty Images.

So what

If your answer was "earnings," go ahead and take a gold star.

Westport Fuel reported its fiscal Q3 financial results yesterday after close of trading, and at first, it all sounded like good news. Q3 earnings came in at $0.04 per share versus the $0.09-per-share loss Wall Street had anticipated. Sales were $75.4 million for the quarter, nearly $10 million more than Wall Street was looking for. What's more, these were actual GAAP results -- not the small-beer pro forma profits that companies have often preferred to emphasize in recent years.

Sales increased 15% year over year. EBITDA sextupled. And Westport swung from a Q3 loss a year ago to a Q3 profit this time around.

Now what

Management even raised its guidance for the rest of this year, saying revenues will probably come in somewhere between $295 million and $305 million, which at the midpoint is slightly more than the $299 million that Wall Street is expecting.

And yet that right there might be the problem. If Westport brought in $10 million more in sales in Q3 than Wall Street was expecting it to, shouldn't full-year sales estimates rise by a similar $10 million? Shouldn't Westport be en route to a full-year sales beat to cap its quarterly beat?

In a perfect world, the answer to both those questions would be yes, but Westport seems to be shaking its head no. Hence investors' disappointment today and the quick evaporation of the gains racked up earlier in the day.