When the market is moving a few tenths of percentage points on a weekly basis, it's easy to practice patience and a methodical investment process. It's times like this, though, when 5% swings seem to happen on a daily occurrence, where your temperament is put to the test. These are the times where people can make rash decisions to exit the market entirely or jump into questionable companies because they look "cheap".

The best thing any investor can do now is maintain composure and continue to look for great companies at good prices, as our hero Warren Buffett would put it. So we asked several of our contributors to each highlight a great company that could be a good buy this month. Here's why they picked CareTrust REIT (CTRE 1.94%), Lululemon Athletica (LULU 1.13%), Amazon (AMZN 3.52%), Waste Management (WM -1.16%), and Teladoc Health (TDOC -2.96%)

Image source: Getty Images.

My top risk-reward stock right now

Jason Hall (CareTrust REIT Inc): Few industries make investors as fearful right now as skilled nursing facilities. Washington State has seen several nursing homes ravaged by the effects of COVID-19; the residents of these facilities are far more likely to have the risk factors that put them more at risk of dying.

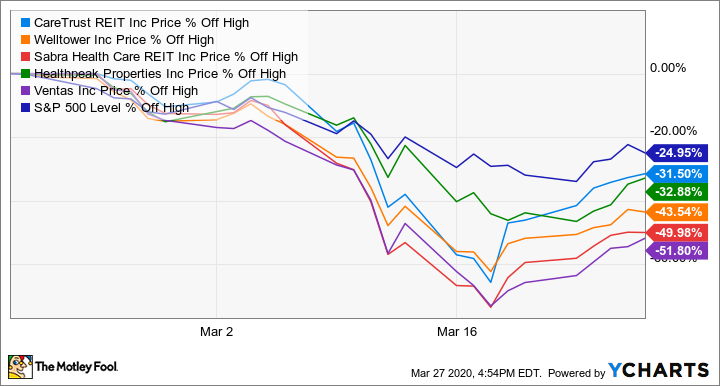

In the past few weeks, investors have heavily sold out of healthcare REITS that own skilled nursing facilities:

Even with most having bounced back over the past week, the entire class stays far more beaten-down than the broader market. Of this group, CareTrust has recovered the fastest, but it still down more than 30% since stocks started falling in earnest in late February.

So why CareTrust over "cheaper" peers? Because this is a time to prioritize quality. CareTrust is one of the best-run REITs out there, and its management has a proven track record of delivering solid returns without adding more risk; that should prove invaluable over the next year.

Nursing homes are already facing more restrictions, and will likely suffer from a slowdown in admissions as families become more cautious about letting a loved one move into one of these facilities. Many facilities have already stopped taking new residents for now, and it's possible that if we see more outbreaks of COVID-19 in nursing homes, a large number of people could move elderly family members home.

CareTrust is better-prepared than most of its peers to deal with that reality. Its balance sheet is less leveraged, giving it a wider margin of safety between its cash flows and its debt and dividend obligations:

CTRE Financial Debt to EBITDA (TTM) data by YCharts

That's not to say the dividend is perfectly safe: A worst-case situation of large numbers of residents moving out of its facilities would require a cut the payout, but its balance sheet would help it ride out that unlikely situation.

And once we beat COVID-19, the reality of America's demographic shift -- 80 million Boomers will be over 65 in 2029 -- will lead to a return to industry growth. CareTrust is best-positioned to ride out the current uncertainty and profit from future demand. Today's price is a steal for this excellent business.

Looking to stretch higher throughout 2020 and beyond

Dan Caplinger (Lululemon athletica): The fitness trend has become increasingly popular in recent years, and it's helped to ignite an entire retail category geared toward athletic apparel and accessories. Among major players in the industry, Lululemon Athletica roared out to a large head start, as its focus on yoga-related clothing and gear resonated well with a core group of loyal customers.

Unfortunately, Lululemon's ascent didn't come without big bumps in the road along the way. A quality control problem created a scandal that almost destroyed the company, making customers question Lululemon's commitment to making premium products worth paying higher prices to buy. It took several years for Lululemon to bounce back from its setback, rebuild its reputation, and convince shoppers that they could trust its products.

Now, Lululemon's back in growth mode. The yoga specialist posted a 21% rise in revenue in 2019, driven by comparable-store sales growth of 9% and direct-to-consumer sales gains of 35% year over year. Earnings growth came in at 28%, and Lululemon has been able to increase both gross margin and operating margin to become more efficient from an operational standpoint.

The coronavirus pandemic has created some problems for Lululemon, and it's uncertain just how large an impact it could have on the company. Yet CEO Calvin McDonald noted that stores that had been temporarily closed in China have largely reopened, and he's hopeful that a similar experience could help it reopen recently closed stores in North America and Europe soon.

Lululemon has been a strong performer for years, and its history of overcoming adversity is admirable. Even with COVID-19 posing a big threat to retailers across the globe, Lululemon has the staying power necessary to make it through a tough retail environment and continue to deliver the clothing and accessories that its customers want.

A no-brainer buy during the COVID-19 crisis (and beyond)

Chris Neiger (Amazon): The spread of COVID-19 has forced most of us to spend our days at home, which has increased the demand for products that can be purchased online and delivered right to our doorsteps. As one of the largest online retailers in the U.S., Amazon is experiencing a surge in online shopping demand and is hiring 100,000 workers to keep up.

E-commerce was already rapidly becoming a normal part of Americans' lives, but the current crisis has accelerated that demand and will likely make online shoppers out of those who previously resisted e-commerce platforms. All of which means that Amazon's platform is sure to benefit.

But Amazon's potential goes far beyond its e-commerce business. The company's Amazon Web Services (AWS) currently holds 32% of the cloud computing market right now and is a key profit generator for the company. In the most recent quarter, AWS cloud revenue jumped 34% year over year, and the segment brought in $2.6 billion in operating income (more than its domestic and international e-commerce operating income combined). The public cloud computing market is expected to grow to $355 billion by 2022, up from $266 billion this year. With Amazon currently leading the pack, there's no reason why it won't continue benefiting from this market.

With the company's dominant position in both e-commerce and cloud computing, Amazon is poised to continue growing for years to come.

A solid company getting thrown out with the rest

Tyler Crowe (Waste Management): It's safe to say that almost every company is going to see some ill effects from this recent virus outbreak. Even some of the most stable businesses and the ones deemed essential services will see declines in revenue and earnings in the coming quarters. While it wouldn't be surprising if Waste Management saw some declines, the company's business is well suited to handle it, and it could be a great stock to pick up now selling at a modest discount.

One of the benefits of being in the waste collection business is that a majority of the company's business comes from contracts with customers for scheduled collection and disposal. About 70% of its revenue from collection comes from contracts with an average length of three years or more. That bakes in quite a bit of stability into the company's revenue stream. Some of the places where Waste Management will most likely see a pullback in revenue is in its shorter-term collection agreements with construction sites and manufacturing facilities. Also, chances are its recycling business -- a business that has been under strain for a while -- will stumble.

Longer-term, though, Waste Management is one of the most durable businesses out there. The barriers of entry to this business are incredibly high. Not only is it capital intense to build out a fleet of collection vehicles and landfills, but also the permitting process related to setting up a new landfill is incredibly hard. That gives existing assets near geographic monopolies. What's more, big players have the advantage when establishing new landfills because they have the resources to work through the lengthy permitting and assessment process. These factors, along with a management team that has been acutely focused on lowering operational costs and returns on capital, have created a wealth-compounding machine.

Trying to value Waste Management on earnings right now is futile because we can generally assume that earnings will decline. How much, though, is still uncertain. With its dividend yield at 2.3% right now -- near its highest in three years -- this is an opportune time to look at an incredibly durable business. It is by no means cheap, but this is a business built to generate returns for decades to come that can be had for much cheaper than it was just a month ago.

A business that's going viral

Keith Speights (Teladoc Health): Most stocks are getting hammered by the coronavirus pandemic. Not Teladoc Health. Instead, the stock has soared in 2020, extending an impressive gain achieved last year. Business is booming for the telehealth services provider, with Teladoc recently announcing a 50% surge in daily patient visits.

All of this makes sense, of course. With the COVID-19 outbreak, no one wants to go sit in a doctor's waiting room if they're sick. And with Teladoc, the doctor is always in -- 24 hours a day, seven days a week. Patients can visit qualified healthcare professionals virtually from anywhere at any time.

But I don't think Teladoc Health is a stock to buy just because of the additional business it's getting while the COVID-19 crisis continues. I fully expect that the global pandemic will be the catalyst that makes telehealth a part of everyday life for many people from now on.

Teladoc should be the prime beneficiary of this trend. The company ranks as the largest telehealth services provider in the world. It offers the broadest array of services. Its customer base already includes 40% of the Fortune 500. Teladoc's current market cap of around $12 billion isn't anywhere close to the size the company could and should be over the long run.