Oil services and equipment companies will be watching the upcoming third-quarter earnings season with a lot of interest. It's very difficult to predict where the price of oil and demand trends will be in the future. However, it's possible to get a good handle on the near-term outlook for services and equipment companies by looking at the capital spending plans of the major oil companies. In this context, let's take a look at the evolution of their capital spending plans in order to gauge trends and focus on what to look out for in the reports.

Energy companies continue to cut budgets

Unfortunately, the near-term outlook is not good, and there could be some near-term disappointments. It's well known that the COVID-19 pandemic caused many oil exploration and production companies to cut spending plans, not least because end demand got destroyed with the lockdown measures imposed on the economy. However, it's worth pointing out that spending plans continued to be cut in the second quarter as well.

Image source: Getty Images.

As you can see in the table below, the oil majors continued cutting 2020 capital spending plans through the second quarter. That doesn't bode well for companies with significant exposure to the energy industry. Indeed, an industrial supply company, MSC Industrial (MSM 0.48%), referred to "acute weakness" in oil and gas spending in the second quarter.

Meanwhile, Caterpillar's (CAT 1.68%) retail sales data continues to paint a dismal picture for its energy-related sales. In fact, Caterpillar's oil-and-gas-related equipment sales were down 30% on a three-month rolling basis in September -- a new low for the company in 2020.

|

Company |

Guidance/ Commentary at Second Quarter |

Guidance/Commentary at First Quarter |

|---|---|---|

|

ExxonMobil |

Planned reductions to the company's capital investment program for 2020, from $33 billion to $23 billion |

"evaluating all appropriate steps to significantly reduce capital and operating expenses in the near term" |

|

Chevron |

"Full year capital guidance remains unchanged at $14 billion as we will need to see sustained economic recovery and much lower inventories before considering raising activity levels." |

Cut to $16 billion from previous guidance of $20 billion |

|

ConocoPhillips |

Cut to $4.3 billion |

Cut to $5.8 billion-$6 billion from a previous range of $6.5 billion-$6.7 billion |

|

EOG Resources |

Cut to $3.5 billion |

Cut to $4.3 billion-$4.7 billion from a previous range of $6.3 billion- $6.7 billion |

|

Occidental Petroleum |

Cut to $2.4 billion to $2.6 billion |

Cut to $2.7 billion-$2.9 billion from a previous range of $5.2 billion -$5.4 billion |

|

Shell |

Maintained $20 billion plan |

Cut to $20 billion from previous guidance of $25 billion |

|

BP |

"2020 organic capital spending is expected to be around $12 billion, a reduction of around 25% on full-year guidance given in February." |

Could cut capex by 20% in 2020 according to recent Bloomberg article |

Data source: Company presentations.

A weak near-term outlook

If the oil majors continued to dial back spending plans in the second quarter, then it's highly likely that this will be felt in the oil services and equipment sector in the third quarter. However, the question is how companies will adjust their outlooks for 2020 and what the commentary will be, if any, on 2021.

Unfortunately, the omens don't look good. The price of oil has dipped below $40 a barrel, and leading industry bodies like the International Energy Administration have recently lowered their forecasts for oil demand in 2020 and 2021 while pointing out that oil supply has been increasing.

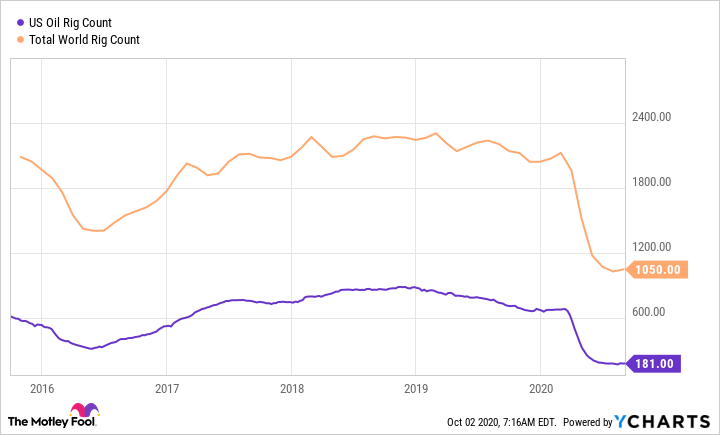

Meanwhile, oil rig counts continue to decline.

Data by YCharts

What to expect

In this environment, it's highly unlikely that oil exploration and production companies will be rushing to increase their spending plans in 2020 or even give bright outlooks for 2021. Companies with exposure to oil and gas operating spending, like MSC Industrial, are unlikely to see much cheer. Similarly, companies exposed to capital spending, like Caterpillar, are highly unlikely to see much positive news from the industry in the third quarter.

All of this is not to say the oil markets can't recover over time. They can, but just don't expect a lot of good news in the coming quarter, and especially from the companies that sell into the oil majors.