Costco Wholesale (COST 0.01%) is in a class of its own in brick-and-mortar retail.

The company reigns supreme in the membership-based warehouse retail segment. It's significantly bigger than rivals like Walmart-owned Sam's Club and BJ's Wholesale, and generates about double the sales per square foot that these two competitors do.

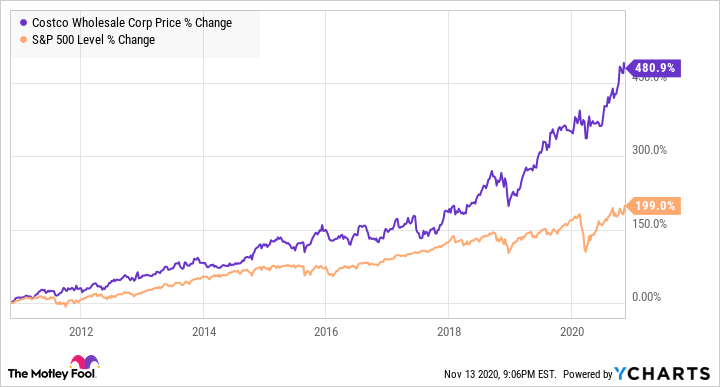

Costco has also been a consistent winner for shareholders over the last decade, as you can see from the chart below.

However, despite its impressive track record and set of competitive advantages, there may be better investments in the retail sector today. For instance, investors looking for growth, income, and value are likely to have more success with Target (TGT -0.51%).

As essential businesses, both Costco and Target have been among the rare retail winners this year, but Target looks better positioned to build on that momentum going forward, and the stock is significantly cheaper today. Let's take a look at a few reasons why Target looks like the better bet.

Image source: Target.

A better e-commerce strategy

E-commerce has taken center stage during the coronavirus pandemic, and every retailer has realized that it's essential to be able to meet customers online. According to eMarketer, Costco and Target generate the same amount of e-commerce sales with an estimated 1.2% in market share, but the companies are moving in opposite directions. Costco's share slipped from 1.3% in 2019 to 1.2% in 2020, while Target moved into the top 10 e-commerce sites this year, raising its share to 1.2%.

Costco has been reluctant to offer services like curbside or in-store pickup that have become commonplace at retailers like Walmart and Target because the company's model works best when customers come inside the store and shop for themselves. Most of its e-commerce business comes from offering free two-day delivery on non-perishables with a $75 order minimum and free same-day delivery on perishables through Instacart. It also acquired Innovel Solutions in March to help it with big, bulky deliveries like appliances. Costco's e-commerce sales have nearly doubled during the pandemic as shoppers look to avoid stores, but those sales could move back to the retailer's stores once the pandemic is over.

Target, on the other hand, is meeting online shoppers on multiple fronts with same-day delivery with Shipt, free two-day delivery, and pickup options like Drive Up and in-store pickup. While Costco's e-commerce sales nearly doubled in its most recent quarter, Target's nearly tripled, and the company is leveraging its store base, which originated more than 90% of its second-quarter sales. That strategy helps the company save money on shipping costs, and that's one reason why Target's profit margin is significantly wider than Costco's, Walmart's, or Amazon's.

Both companies continue to open new stores, but Target is focused on opening small-format stores in underserved urban neighborhoods and college towns that complement its e-commerce strategy. Costco, on the other hand, has shown little interest in leveraging e-commerce in its new-store opening strategy.

The valuation question

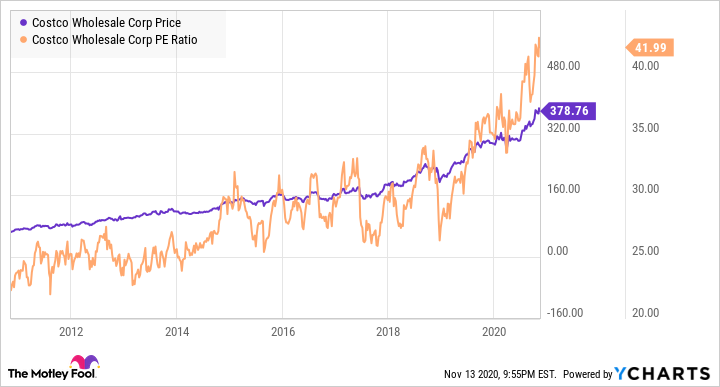

The impressive gains in Costco stock over the past decade haven't come solely from earnings growth. As the chart below shows, multiple expansion has played a big role.

Costco's price-to-earnings ratio has essentially doubled in the past decade even as the company has become much bigger. At 42, its P/E ratio is significantly higher than any other large brick-and-mortar retailer, meaning Costco trades at a significant premium to its peers.

Target, by comparison, trades at a price-to-earnings ratio of 23, suggesting that Target's profits are nearly half as cheap as Costco's are. Target also outgrew Costco in the most recent quarter, and looks primed to outgrow Costco over the coming years as, in addition to e-commerce, the company is making smart investments in private brands, small-format stores, and forming partnerships with companies like Ulta Beauty, helping its stores evolve and leverage the company's "cheap chic" image. With its diverse product line, Target is also well-positioned to capture market share from faltering retailers, especially as rivals like Gap shutter locations. In fact, Target said it had gained $5 billion in market share through the first half of the year, and it's likely to retain much of those gains.

Costco, meanwhile, has a track record of steady growth, but there's little reason to expect its growth rate to accelerate beyond the pandemic.

Finally, Target is a Dividend Aristocrat and pays a higher dividend yield between the two, offering a yield of 1.7% compared to just 0.8% for Costco. Though the warehouse retailer has a history of paying out special dividends, Costco management has seemed hesitant to do so again, and the uncertainty around the pandemic makes it less likely.

The takeaway

While Costco is rock-solid business that should be able to consistently grow profits, its price tag seems to be higher than it deserves. Target has a more flexible business model and better growth potential, and the stock is significantly cheaper than Costco's. It should outperform the warehouse retailer for the foreseeable future.