What happened

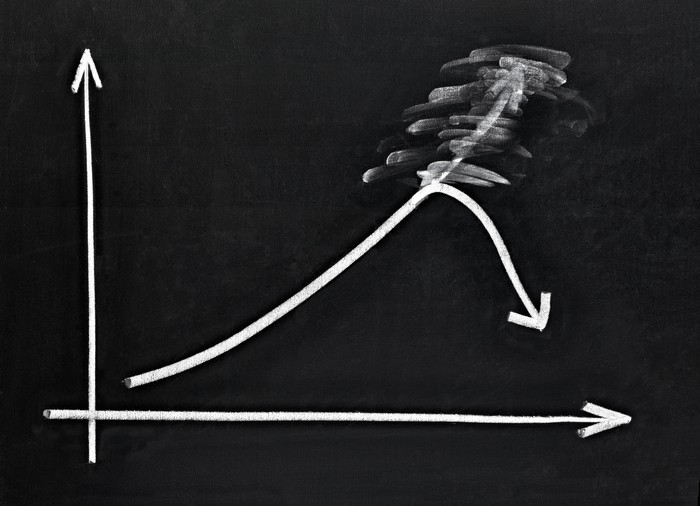

After an irrationally exuberant run on Monday that sent its stock up 84% in a day, shares of Chinese lithium battery maker CBAK Energy Technology (CBAT -1.91%) are succumbing to gravity this morning, falling 20.3% through 10:30 a.m. EST.

And just like yesterday, there doesn't seem to be any news to explain the price movement.

Image source: Getty Images.

So what

With no news on CBAK today, it could be that the stock is down today simply because it was up so much yesterday. In the absence of other evidence, I would conclude that this is exactly what is happening. Traders piled into the stock on Monday, they made a lot of money doing so -- and now they're cashing out and taking their winnings, with dramatic consequences for the stock's price.

Now what

Over the weekend, J.P. Morgan released a stock report predicting 43% annualized growth in Chinese electric car sales over the next five years. Assuming the analyst sticks to its guns, and repeats this assertion in coming weeks and months, that could provide fuel for a revival of CBAK stock. So what was up yesterday and down today could go right back up tomorrow. If China sells a lot of electric cars, someone will have to sell a lot of batteries for them.

Or, a renewal of the short squeeze we seemed to see yesterday could turn around and bite investors who are selling CBAK stock short today. Either way, I expect this stock to remain volatile. Profitless small caps with minimal revenue often are.