The world is transitioning to cleaner, more renewable forms of energy, and at this stage, the shift is no longer being driven by subsidies or government intervention. In electricity markets, wind and solar power are beating natural gas, coal, and nuclear because they cost less. And in the transportation sector, electric vehicles are taking market share, with more new models arriving in showrooms each year.

To capitalize on that transition, we've picked three of our favorite energy transition stocks to recommend: SunPower (SPWR -3.09%), Enphase Energy (ENPH 0.62%), and ABB (ABBN.Y 0.49%).

Image source: Getty Images.

The distributed energy future

Travis Hoium (SunPower): One of the leaders in residential and commercial solar is SunPower. It provides sales channels, technology, and even hardware to solar installers across the U.S. The company has had a hard time generating consistent profits, but following the recent spinoff of its manufacturing business, there are new reasons to be optimistic.

SunPower's business model allows it to generate revenue from installed solar, financing projects, and ultimately through virtual power plants. It's this last piece that is the most exciting one, considering that energy storage is being installed with more solar projects and the way those assets will be monetized.

The business model for energy storage is likely to rely on aggregators like SunPower, which will bid storage assets into the market and then control their charging and discharging. For home installations, that may mean that the system charges during the day when solar energy is abundant, and discharges in the evening when electricity demand spikes as the sun goes down. Utilities have been willing to pay for these services because they reduce the need for investments in new power plants, transmission, and distribution lines.

As solar installations grow on residential and commercial rooftops, and as the electrical grid adds more "virtual" assets like energy storage, there's a lot of room for SunPower to grow. The company has to prove it can be profitable in the long term, but its current asset-light strategy is one that I think can win.

Counting on renewable growth

Howard Smith (Enphase Energy): Enphase Energy has been benefiting from the growth in renewable energy for the past several years. The maker of microinverters -- the devices that convert the DC electricity generated by solar panels into the AC power that runs our homes, business, and most everything else -- spent much of 2019 adding production capacity to meet surging demand.

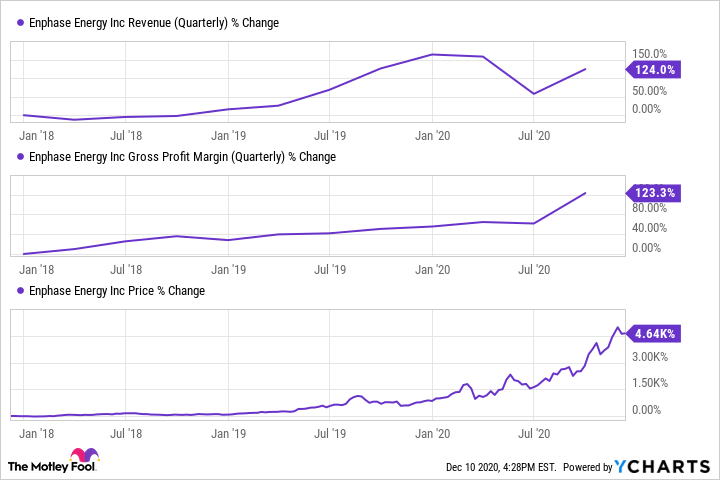

The pandemic caused sales to dip in 2020, but they've rebounded quickly. The company has also become more profitable along the way. These three-year charts show the increases in revenue and gross margins.

ENPH Revenue (Quarterly) data by YCharts

For investors, though, the issue is that the company's shares have risen even faster than the business metrics. Enphase shares are priced for growth in the residential and commercial solar markets. But as renewable energy growth continues, Enphase's business will grow with it.

The company announced a number of foreign partnerships in its recently reported third quarter, including several in Europe and one in Australia.

Interested investors should know the stock is volatile, and often moves in the short term based on news about the overall sector, not just the business itself. But it's not a speculative business like some new technology providers in the renewable sector. It has a proven product, with proven growth.

So what could derail Enphase? It has competitors, including some that offer an alternative approach to its microinverter systems. And as mentioned above, the share price has far outrun the underlying business's growth. So a slowdown that reduces the growth rate below expectations could knock the stock back. But with the transition toward renewable energy seemingly inevitable, Enphase Energy will surely continue to benefit.

A safer way to invest in the renewable energy transition

Jason Hall (ABB): Investors looking to profit from the transition to renewable energy are mostly focused on smaller, newer, pure-play companies. But if you fail to also consider an industrial giant like ABB, with more than $25 billion in annual sales and over 100,000 employees, you could miss out on profiting from a company that will play a huge role in the energy sector's future. That's because ABB manufactures many of the components that already make alternative energy a reality.

The company's electrification segment generated 44% of revenue and 43% of operating EBITDA last year, providing a wide range of products used to generate renewable energy, improve the reliability of the electrical grid, and boost energy efficiency. ABB says its "smart power" products generated over $2.75 billion last year alone, with 7% of segment revenue directly tied to renewables. ABB's motion segment is filled with high-growth potential, including supplying motors for electric vehicles of all sizes and applications.

For renewables to power the future, the electrical grid and power delivery must become more modern, automated, and smarter. The industry that supports those goals needs to significantly increase its scale. As a leader in smart technologies, ABB is already positioned to be a big beneficiary of this trend.

And ABB shares can be had for a reasonable price, trading for about 10 times trailing earnings, and yielding just over 3%. ABB might not have the same upside as smaller pure plays, but it's likely to prove much less volatile, and carry a lower risk of permanent losses.

Follow the energy industry's trends

Renewable energy installations are booming around the world, and that's creating a tailwind for these companies. What's most exciting is that these trends aren't going to reverse. With renewable energy now less expensive to produce than power from fossil fuels, the transition is only going to accelerate, which is why these are top stocks to buy today.