What happened

Clean energy stocks continued to bounce back on Thursday after some positive results from Wall Street and a drop in interest rates early in the day. The biggest movers were FuelCell Energy (FCEL 3.38%) and ReneSola (SOL 4.42%), which were both up as much as 12.3% in early trading. The stocks gave back most of their gains later in the day and were up 1.2% and 0.3%, respectively, at 12:30 p.m. EDT.

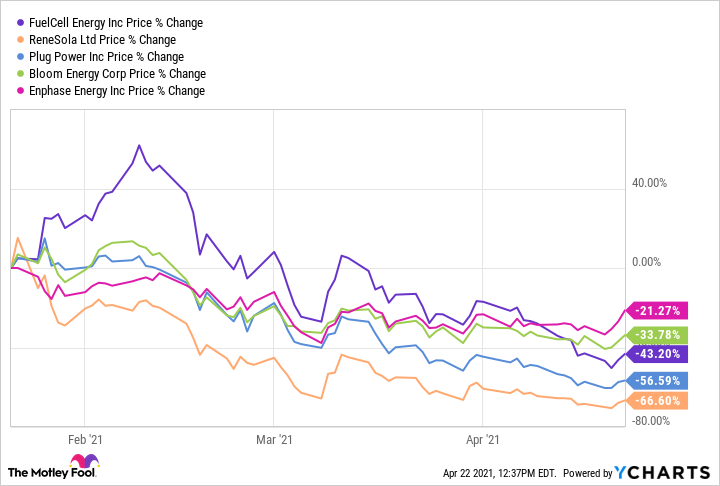

Coming along for the ride were Plug Power (PLUG 1.26%), which rose as much as 5%; Bloom Energy (BE 10.99%), which was up 7.4%; and Enphase Energy (ENPH 3.80%), with a 7.8% increase at one point. But the three stocks are now down 1.7%, and up only 2.4% and 4.2%, respectively, as I'm writing this.

Image source: Getty Images.

So what

Analysts from Goldman Sachs and Morgan Stanley gave positive notes on the sector to investors over the last day, and that's helping renewable energy stocks. Goldman's analyst said the bar for earnings season, which begins in earnest next week for the industry, is relatively low. Morgan Stanley said there are "excellent buying opportunities," which include Enphase Energy.

Renewable energy stocks started to drop rapidly three months ago as investors feared a fall run-up had gone too far and rising interest rates caused concerns for the industry. So a bounce off lows today still leaves all of these stocks down significantly over that time.

FCEL data by YCharts.

I'll also note that a drop in the 10-year Treasury rate early in trading today could have helped renewable energy stocks. The 10-year rate ended up trading higher midday only to trade lower near the end of the day. Rising rates end up lowering returns for renewable energy suppliers and project developers, so a drop in rates would be good news for the industry.

Now what

Sometimes entire industries pop or drop on very little news or simply a sentiment change in the market. That's what's happening today with clean energy stocks, as nearly the entire industry moves higher. But this is also a reversal of the negative sentiment we've seen in the market the last few months.

As Foolish investors, these are good times to take a step back and look at where industry trends are headed. We know that renewable energy investment is growing, electric-vehicle adoption is up, and new energy sources like hydrogen are being tested at more and more sites around the world. Long term, that should be good for the industry overall, even if it doesn't tell us who the winners will be.

Those are tailwinds I want to have behind my investments, which is why I'm a renewable energy investor. But remember that this is still a volatile industry, so even if wind, solar, and hydrogen continue to be adopted at a higher rate, shares of related stocks may swing wildly in the short term. Today just happens to be an up day for investors.