The renewable energy industry is no longer a nascent industry driven by environmental concerns and subsidized by governments. It's a real force in energy that could disrupt a multi-trillion dollar market.

As investors, we can't ignore renewable energy stocks and their impact on energy. Here are the three biggest reasons to be bullish on the industry long-term.

Image source: Getty Images.

A $130 trillion opportunity

Renewable energy is already disrupting most parts of the energy industry, from electricity generation to transportation. According to Bloomberg New Energy Finance, $501.3 billion was invested in the industry in 2020 -- including building renewable power plants, producing electric vehicles, and heat pumps -- and that may just be the start. The International Renewable Energy Agency says it will take $131 trillion in investment to meet the 2050 Paris Agreement targets, or $4.4 trillion per year.

No matter how you slice it, the opportunity in renewable energy is enormous. Wind and solar are disrupting power generation, EVs are disrupting transportation, and heat pumps and energy efficiency are impacting how we heat and cool homes. Few areas of the energy sector will go untouched by the disruption renewable energy is bringing.

Winning on cost

To beat fossil fuels, renewable energy can't just be clean -- it has to be cost-effective. And it's winning on that front today.

According to investment bank Lazard, new utility-scale solar energy power plants now produce energy for as little as $29 per megawatt-hour (MW-hr), well below the $44 per MW-hr for a new natural gas power plant and beating nuclear ($129/MW-hr) and coal ($65/MW-hr) by wide margins. Wind is also less costly at as little as $26 per MW-hr. Costs will vary by region, but wind and solar developers regularly win contracts in competitive markets, and that's why they're growing more quickly.

US Wind Energy Production data by YCharts

In transportation, EVs are now becoming cost-competitive with traditional gasoline vehicles on an upfront cost basis, and costs continue to come down. And powering a vehicle with electricity is less costly than using gasoline. Batteries and hydrogen fuel cell installations aren't always driven by cost savings alone, but we see a fast cost reduction trend in both technologies like we saw in wind and solar a decade ago, which will open up energy storage markets in renewable energy.

The costs of wind turbines, solar panels, batteries, fuel cells, and nearly every other part of the renewable energy supply chain are coming down rapidly, and as they do the industry will continue to take market share from fossil fuels.

A great industry for dividend investors

It's clear that renewable energy is a huge market that's growing and becoming more cost-effective, but did you know it's a great place to find dividends as well?

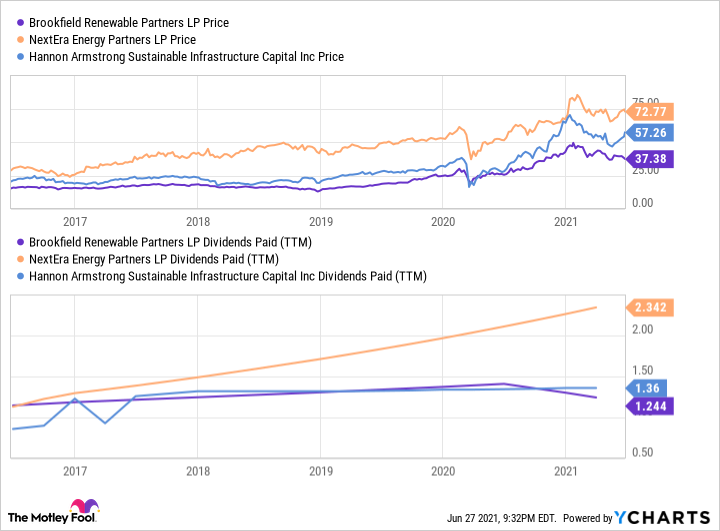

Wind, solar, and energy storage projects require large upfront investments, and then generate returns over decades. That's enabled specialized finance companies like Brookfield Renewable Partners (BEP -1.66%), NextEra Energy Partners (NEP -1.49%), and Hannon Armstrong Sustainable Infrastructure (HASI -2.00%), which acquire and operate renewable energy projects, to pay out some of their cash flows as dividends to investors.

Unlike previous renewable energy companies (commonly referred to as yieldcos) that promised too much growth and relied on stock sales to finance operations, these companies can grow organically and in NextEra's case is backed by one of the nation's biggest utilities, so they're learning from mistakes that others made in the market. These stocks aren't going to crush the market when stocks are hot, but they're stable dividend stocks to hold long-term, and are built to thrive even in a recession.

What's unique about these renewable energy dividends is that most cash flows from projects are contracted for years, or even decades. This gives their dividends stability that few companies have.

Renewable energy is worth a fresh look

The entire renewable energy industry has a lot to like for investors. It's a multi-trillion dollar opportunity each year, it's beating fossil fuels on the cost of energy, and investors can find great dividend-paying stocks. Those are great reasons to be bullish on renewable energy stocks for the next decade or longer.