Stock market crashes tend to be painful, but they also create chances to invest in great companies at huge discounts. Nabbing the right stocks when these opportunities arise can be a path to life-changing returns.

With that in mind, a panel of Motley Fool contributors has identified three stocks that are worth going big on when the next crash hits. Read on to see why these companies top their "buy lists" for the next time the stock market goes on sale.

Image source: Getty Images.

CrowdStrike Holdings

Keith Noonan: CrowdStrike (CRWD 0.13%) provides cloud-based cybersecurity services that help prevent devices including laptops, mobile hardware, and servers from being exploited by hackers and other bad actors. The company, a leader in its corner of the industry, has a strong outlook for growth even if overall economic conditions should weaken.

The cybersecurity specialist has already been growing at a rapid clip, managing to increase its revenue 70% year over year last quarter and 82% in the last fiscal year. Impressive sales momentum has helped push CrowdStrike's share price up over 130% over the last 12 months, and the company looks poised to benefit from strong-demand tailwinds through the next decade and beyond.

As business and communications are increasingly carried out through digital channels, the risks and damages caused by cyberattacks are soaring. Cybersecurity services will only become increasingly important as bad actors have rising incentives to exploit vulnerabilities and gain access to network systems, and CrowdStrike's AI-powered software is providing best-in-class solutions. The company's Falcon platform learns from each new threat that it encounters, creating a service that offers improving value for customers.

Valued at roughly $59 billion and trading at approximately 43 times this year's expected sales, CrowdStrike has a highly growth-dependent valuation. That suggests the stock could be primed for a substantial pullback when the next market crash rolls around. But demand for the company's service expertise should remain pretty healthy and help the stock bounce back and reach new heights.

Jamal Carnette: Big Tech's relationship with Washington lawmakers can best be classified as "it's complicated." Just a few years ago politicians were trumpeting the "new economy"; now companies like Facebook (META -10.56%) are firmly in DC's crosshairs. Last month, the House of Representatives voted on six bills designed to regulate the tech industry.

Understandably, Facebook investors are worried about increased regulatory and legal risk, but proper perspective is warranted. Generally, less than 5% of all bills become laws, and most tend to be less impactful than the initial versions. Additionally, Facebook will have the ability to fight legislation through the court system. Recently, it did just that and scored a win against the Federal Trade Commission.

Facebook is primed for growth. Last year grew revenue 22% as the pandemic slammed digital advertisers from the travel and leisure industries. The overall digital-marketing industry grew 7%. This year, the industry expects growth rates three times last year's figure, which will disproportionally benefit Facebook and Alphabet, and both will continue to win share by growing at higher rates than the overall market.

Despite its recent performance, Facebook stock still trades at a reasonable valuation. Currently, shares trade at 29.6 times earnings versus 27.3 times from the greater S&P 500. The price/earnings-to-growth (PEG) ratio -- which factors in the expected earnings growth to the figures above -- is 1.2, a figure in value stock territory. When a crash comes, investors should use the opportunity to pick up Facebook shares on the cheap.

The Trade Desk

Jason Hall: It's been an incredible run for The Trade Desk (TTD -0.54%) investors, with the ad-tech stock generating almost 2,500% in total returns since going public less than five years ago.

Yet even with this incredible run, I expect that The Trade Desk will continue to deliver market-beating returns for years to come as more and more advertising dollars shift away from linear TV and other platforms and move to programmatic ad platforms. And that's a huge tailwind for the company, which is partnered with some of the world's largest ad agencies, positioning it for plenty more growth to come.

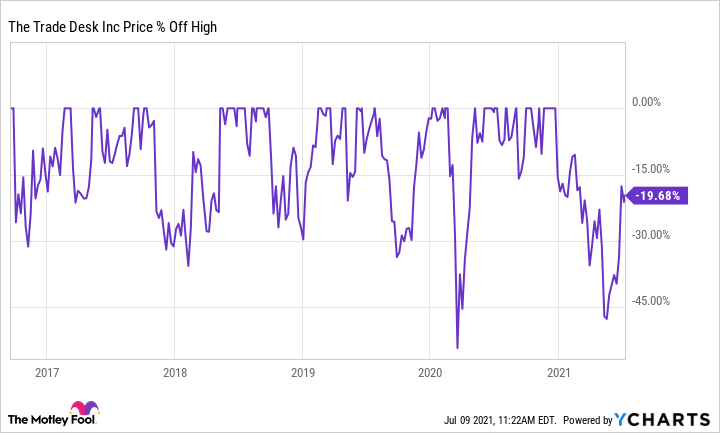

On the other side of the coin, The Trade Desk has been and is likely to remain a very volatile stock. We saw this play out to the extreme during the 2020 coronavirus crash when shares plummeted more than 50% in less than two months:

As the chart above shows, it's not uncommon for The Trade Desk stock to fall more than 30% from its recent high; shares are actually still down about 20% from the recent high as of this writing.

Add it all up, and The Trade Desk is a great growth stock because of its prospects. But it's also one that's worth adding to your portfolio over time when Mr. Market gives you opportunities to buy. There's a very good chance that the next market crash will prove to be one of those opportunities.