What happened

Shares of Aemetis (AMTX 2.81%) traded up more than 13% on Thursday afternoon after the renewable-fuels company inked a big deal with Delta Air Lines (DAL 4.05%) to provide sustainable fuel for Delta's jets.

So what

Aemetis is in the business of producing green fuels for heavy transportation users using ethanol and other green inputs. The company is in its early days and results have been choppy to date, but the company scored a big win on Thursday.

Image source: Getty Images.

Delta has agreed to buy 250 million gallons of blended fuel containing sustainable aviation fuel to be delivered over the next ten years. Aemetis said the deal is worth about $1 billion, including tax credits.

Delta and other airlines are scrambling to reduce their carbon footprint, with Delta last year setting a goal to replace 10% of its conventional jet fuel consumption with sustainable fuel by the end of 2030. Aemetis will help it toward that goal with products to be produced at a plant under development on a 125-acre former U.S. Army site in Riverbank, California, with fuel deliveries expected to begin in 2024.

"When Delta committed to being carbon neutral, we also committed to continued investment and collaboration with others in the industry," Amelia DeLuca, Delta's managing director of sustainability, said in a statement. "This supply agreement is an important step toward the expansion of SAF, which is not only important in helping us achieve our net-zero aviation goals, but also in supporting our customers to achieve their own sustainability goals."

Now what

These are early days for Aemetis, and even with this contract real risks remain and the company's long-term future is not secured. But a deal with Delta if nothing else is an endorsement of the potential in Aemetis' product, and should provide much-needed validation that makes the company's task in selling to other potential customers easier.

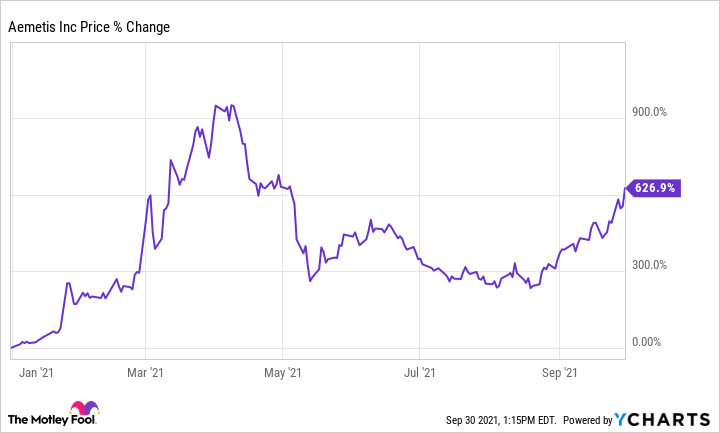

Aemetis shares are up 600% year to date, but down 30% from their April high. This is still a risky stock that is likely to be prone to volatility, but with the Delta deal arguably the risk has diminished somewhat compared to a few days ago. Investors are rallying to the stock as a result.