In a matter of months, the metaverse went from a hazy concept to one of the biggest buzzwords in business.

Facebook's decision to rename itself Meta Platforms (META 2.33%) ignited interest in the virtual worlds that make up the metaverse, a space that Meta CEO Mark Zuckerberg has described as an "embodied internet." Along the way, sales of virtual real estate has boomed, creating a cottage industry with speculators scooping up parcels, and even big brands like Adidas and Nike are establishing their own virtual spaces.

Image source: Getty Images.

However, there are a number of signs that interest in the metaverse is already starting to wane. The chart below shows that general interest in the metaverse is declining as Google searches have fallen following a spike after Facebook announced its name change.

Image source: Google data. Chart by author.

As you can see, searches for "metaverse" have dropped off sharply since the new year and are down nearly 80% from their peak after Facebook announced its new name. In other words, the buzzword is losing its buzz. The general public seems to be losing interest.

At the same time, interest in the top virtual worlds seems to be fading as well, with the prices for metaverse tokens like Decentraland (MANA 1.78%) and The Sandbox (SAND 0.99%) also down sharply. In fact, they've trended similarly to metaverse searches.

Chart by author.

Chart by author.

The prices of Decentraland's and Sandbox's currencies have faded after an initial spike following Facebook's rebranding announcement. Since the value of the tokens are correlated to interest in the virtual worlds, it's not surprising to see both currencies declining along with search interest in the metaverse.

The Meta problem

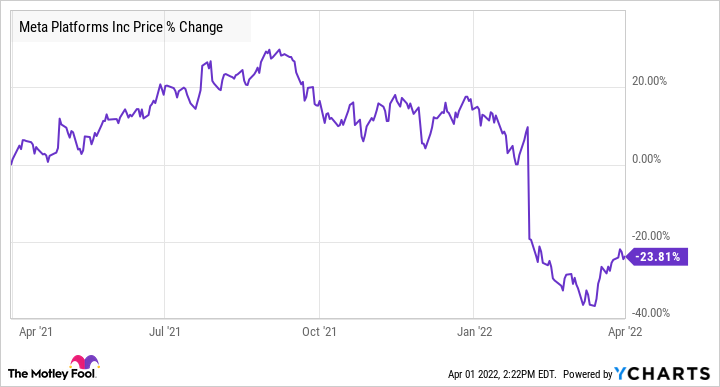

In addition to the evidence from those charts, Meta Platforms is off to a rough start since it rebranded. The company's fourth-quarter guidance called for just 3% to 11% revenue growth in the first quarter, well below its historical rate.

Meta shares fell sharply on the news and have yet to recover.

FB data by YCharts.

While that sell-off is more about the slowdown in its advertising business, it also shows that investors aren't convinced by the company's pivot to the metaverse. Meta had an operating loss of more than $10 billion in 2021 in reality labs, its division focused on virtual and augmented reality, and expects to lose even more than that this year.

Is the metaverse a fad?

Companies are still preparing for the metaverse, investing billions into virtual- and augmented-reality technologies, but the transition to a new computing platform, as Zuckerberg has described it, could take longer than expected. After all, there needs to be a compelling reason to join virtual worlds like Decentraland besides novelty interest. They need to make work easier, provide entertainment, or help us better connect with one another -- three reasons the mobile internet became so successful.

At this point, it's too early to call the metaverse a fad, but some of the buzz we saw around the time of Facebook's announcement doesn't align with where the industry is today. As a form of technology that provides real utility, the metaverse could still be several years away from reaching its potential.

Investors should keep their eye on search trends and other such indicators, since declining interest will signal more problems for companies betting on the metaverse.