The first quarter of 2022 was a big one for China's Aerospace Science and Technology Corporation (CASC), the biggest defense contractor servicing China's national space program.

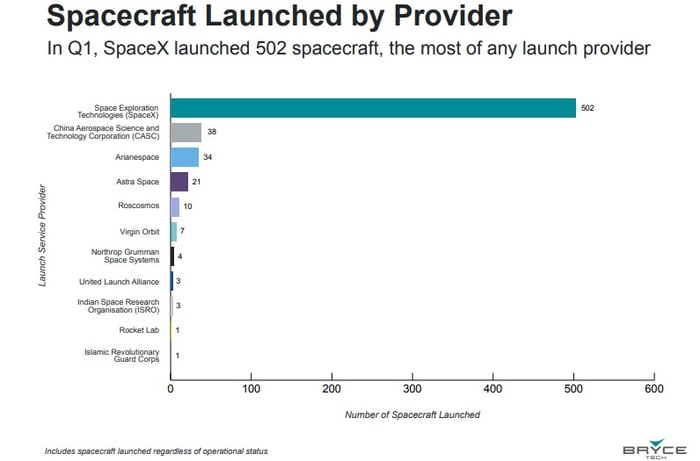

In Q1, CASC put 38 satellites into Earth's orbit, according to data from BryceTech, a space-focused analytics and engineering firm based in Alexandria, Virginia.

That was the same number Europe's Arianespace launched (38). More than Russia's Roscosmos (10). More than publicly traded space start-ups Astra (21), Virgin Orbit (7), or Rocket Lab (1) launched, either. Space giants Northrop Grumman (4) and the United Launch Alliance (3), the joint venture between Boeing and Lockheed Martin, likewise didn't come close to CASC's performance.

Image source: Getty Images.

But can you guess who launched even more satellites than CASC -- indeed, more satellites than all the companies named above combined?

That's right: SpaceX.

Light years ahead of the competition

Q1 2022 saw SpaceX launch 502 individual satellites to orbit as payloads on 11 separate rocket launches. Add up the payloads launched by literally every other space company in the world, both publicly traded and private, and they only put 122 satellites in orbit during the quarter.

SpaceX beat that number by a factor of four.

Small can be bigger than big

But satellites come in all shapes and sizes. So, what kinds of satellites is SpaceX putting into orbit?

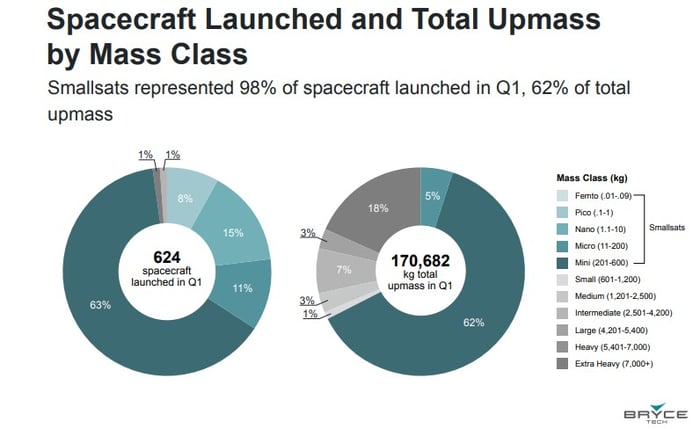

Some of SpaceX's launches were large, such as the "NROL-87" spy satellite launched on Feb. 2 -- big enough that the mission apparently didn't carry any secondary payloads. Most of the satellites SpaceX (and others) launched last quarter, however, were much smaller, such as the 105 smallsats carried on SpaceX's Jan. 13 Transporter-3 mission or the hundreds of SpaceX's own "Starlink" internet satellites deployed across eight separate dedicated Starlink missions.

It takes a lot of little commercial satellites to add up to the mass of just one single large satellite, like those the U.S. government likes to launch. But as it turns out, there are just so many small satellites going up these days that the balance in power has shifted. More "tons of satellite mass" are going into orbit in the form of small satellites these days -- 62% of all payloads deployed last quarter -- than in the form of large satellites.

And that's the real import of BryceTech's report. Yes, the headline is that one-time start-up space company SpaceX is now the dominant company in the space business -- but I think that's been obvious for a while. The real story is this: Smallsats are where it's at.

For four quarters in a row, more "mass" has launched into orbit in the form of smallsats than in the form of huge traditional government satellites. When you consider that as recently as 2019 (and in all previous years), large satellites out-massed smallsats by a factor of nearly 10 to 1, this is a sea change in the business of spaceflight.

And SpaceX is at the forefront of this sea change.