In this article, we are not going to look at the four highest dividend yields among companies in the S&P 500. For that, the reader could easily use a stock screener and have the answer within minutes.

Rather, in this article, I'll explain why discount retailer Dollar General (DG -0.03%), financial markets company Nasdaq (NDAQ -0.10%), coffee titan Starbucks (SBUX 0.76%), and rural lifestyle chain Tractor Supply (TSCO 1.74%) are top dividend payers.

By top dividend payers, I mean companies with steady business prospects and an outsized chance to grow their dividends over time. Here's why all four of these S&P 500 companies fit those criteria for me.

1. Dollar General

Investors are uncertain about the health of the U.S. economy. So if you want a sure thing in unsure times, you might consider an investment in Dollar General. The company is on pace to grow same-store sales by at least 4% this year -- the 32nd year it's done so in the past 33 years. I'd say that's a spectacularly predictable performance.

Dollar General is still growing its business. In 2022, it's on pace to open over 1,000 new locations in the U.S., and it expects to open over 1,000 more in 2023. And it's even wading into international expansion with hopes of having 35 stores in Mexico by the end of next year.

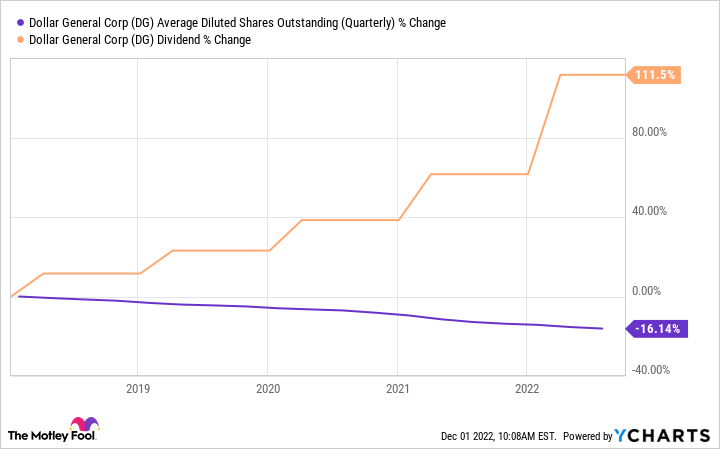

However, more than growth, Dollar General is at the stage of its business lifecycle where it's turned its attention to shareholder returns. As the chart below shows, the number of shares outstanding is dropping rapidly as management repurchases shares. And the dividend is trending significantly higher as well.

The share repurchases and dividend increases look poised to continue. Dollar General reported financial results for the third quarter of 2022 on Dec. 1. As of Q3, the company has spent more than $1.6 billion repurchasing shares in 2022 but expects to spend $2.75 billion for the entire year, implying over $1 billion in the upcoming fourth quarter. And if it does that, it will still have $1.5 billion left in share repurchase authorizations going into 2023.

For the dividend, Dollar General just declared a quarterly dividend of $0.55 per share, its fourth consecutive quarter at that amount. The company has raised its dividend for seven consecutive years and typically increases it when it announces Q4 results. Therefore, I'd expect an eighth consecutive year of dividend increases when Dollar General reports next quarter.

2. Nasdaq

Nasdaq not only operates its namesake exchange for listing and trading stocks, but it also has other revenue streams, such as providing anti-money-laundering software to banks and packaging market-research data for institutional investors. The barriers to entry for business ventures like these insulate Nasdaq from the competition.

Over the next five years, Nasdaq is aiming for a double-digit annualized shareholder returns, or at least a 60% gain over that period when factoring in dividends. Nasdaq's goal looks credible when you consider its businesses and plans.

The company's core exchange business is rock solid. For growth, it's prioritizing its R&D budget for higher-potential areas, such as the anti-money-laundering software. Management hopes that its software-as-a-Service (SaaS) revenue -- which has better profit margins -- will make up a greater portion of its overall revenue mix. And this would help deliver on its earnings goals.

Turning to the dividend, Nasdaq's dividend yield is modest at 1.2%, but it's only paying out about 30% of its earnings, which is a low payout ratio. Over the next five years, the company expects to both grow its earnings and bump up the payout ratio to over 35%. Therefore, Nasdaq's dividend could be almost twice as big as it is today by 2027 if it hits its goals, making this a great idea for investors looking for stability and dividend growth.

3. Starbucks

Starbucks' fiscal 2022 came to a close on Oct. 2, and it was a bad one. Yes, revenue was up 11% from fiscal 2021. But operating income was down 5% for the year, and earnings per share dropped 20% to just $2.83.

Even on the heels of a tough year, Starbucks is still a top company to invest in. The company's profitability is slipping because of ongoing lockdowns in China. This is a big market for Starbucks and one where it's investing substantially.

Consider that at the end of the second quarter of fiscal 2020 (close to the start of the COVID-19 pandemic), Starbucks had 4,351 locations in China. Now, it has more than 6,000 stores in China, roughly 17% of all Starbucks worldwide. However, same-store sales in China were down 24% in fiscal 2022, disproportionately impacting Starbucks' profitability as a whole.

It's reasonable to assume that lockdowns in China will eventually abate and profitability for Starbucks will consequently recover as sales rebound. In the meantime, the company plans to open about 9,000 new locations in China and around the world over the next three years, which could be a big boost to revenue and earnings.

On Nov. 25, Starbucks paid a dividend of $0.53 per share, 8% more than its dividend in the previous quarter. With that payment, the company increased its dividend for the 12th consecutive year, keeping it on the path toward becoming a Dividend Aristocrat. And with management's plan to return $20 billion to shareholders over the next three years, I believe Starbucks will keep marching toward Dividend Aristocrat status for the foreseeable future.

4. Tractor Supply

Like Starbucks, Tractor Supply has also paid and raised its dividend for 12 consecutive years. And there's no reason to believe the streak can't continue. Here's why.

TSCO Dividend data by YCharts.

Tractor Supply's sales are resilient. First, its customers tend to be loyal to the Tractor Supply brand. In the third quarter of 2022, the company's loyalty program had over 27 million members, up 23% year over year. And these customers accounted for a whopping 75% of overall sales.

Moreover, Tractor Supply sells a variety of products that could be considered essential, including feed for livestock. This is comforting, considering there's a possibility of a U.S. economic recession in 2023.

Simply put, I expect Tractor Supply's business to perform well regardless of economic conditions. Consider how the company did during The Great Recession. As the chart shows, profit growth was lackluster for a couple of years before accelerating as economic conditions improved. But revenue continued going up the whole time.

TSCO Revenue (TTM) data by YCharts.

Tractor Supply's dividend payout ratio is below 40%, which gives management room to increase future payouts even if sales and profits go sideways for a period of time.

That said, I wouldn't expect profits to go sideways for Tractor Supply for too long. The company is spending almost $700 million this year in capital expenditures -- more than double its previous annual record -- as it builds infrastructure to support growth. And management says 2023 will be the peak for this spending. Profits will likely improve as expenses come down.

Moreover, Tractor Supply's profits have come down slightly because of increased supply chain expenses, which are now starting to normalize. Management expects this to work itself out in less than a year. In summary, the drags on profitability from capital expenditures and supply chain challenges should improve over the next 12 months.

As I said at the start, I believe Tractor Supply's dividend streak is safe for the foreseeable future, and it's why this stock makes my list of top dividend payers.

I believe all four of these companies -- Dollar General, Nasdaq, Starbucks, and Tractor Supply -- are great investments today, especially for those seeking dividend income. As stated at the beginning, these aren't the highest-yielding dividends in the S&P 500. But in my opinion, they're among the highest opportunities for dividend growth and market-beating returns for the long haul.