Investing isn't just about picking the right stocks; it's also about avoiding the wrong ones. Big losers can do more than just get under your skin. They can eat away at your returns. What's worse, it's often these loss leaders that are the hardest to sell from a psychological standpoint.

So, avoiding them in the first place becomes even more important. With that in mind, let's have a look at three stocks worth avoiding in 2023: Meta Platforms (META 0.43%), Affirm (AFRM 5.31%), and Palantir Technologies (PLTR 3.73%).

Image source: Getty Images.

What's Wrong With Meta Platforms?

Jake Lerch (Meta Platforms): What's wrong with Meta? Maybe the better question to ask right now is, "What isn't the problem?" Simply put, the company finds itself in a world of hurt and faces a long list of challenges:

- Shares have shed 65% of their value year to date.

- E.U. regulators have threatened the company with antitrust fines that could total up to 10% of the company's annual revenue, amounting to $11.8 billion based on the past 12 months.

- In the last two years, Meta spent over $19 billion on its Reality Labs segment (the company's metaverse initiative). The unit is enormously unprofitable, and the company says it will be years before it is profitable.

- Key executives such as Sheryl Sandberg have left the company.

- 2022 saw Meta's first-ever decline in revenue.

- Meta's operating margin shrank to its lowest level in the past decade.

- Global ad spending is expected to slow as the Federal Reserve continues to hike interest rates, and the economy teeters on the verge of recession.

Those are formidable challenges to say the least. And for Meta to overcome them, its management will need to rise to the occasion.

The company already announced it was laying off 11,000 employees in November (company headcount has nearly doubled from 45,000 in Jan. 2020 to 87,000 today). Moreover, legislation aimed at limiting or banning TikTok has been floated on Capitol Hill, and that might act as a catalyst for Instagram Reels -- a short-form video app that competes with TikTok.

Data by YCharts.

However, there is one change that investors want to see more than any other: An end to the limitless spending on Meta's Reality Labs. So far, Zuckerberg has shown no sign of altering course. And given Meta's governance structure, which hands all voting power to Zuckerberg, he's under no obligation to change his mind.

Until he does, I'm staying away from Meta.

A weak competitive moat is not affirming for this stock

Will Healy (Affirm Holdings): Affirm provides buy now, pay later (BNPL) services, allowing shoppers to buy a product and pay it off with regular installments (often without interest costs). By some measures, consumers have taken to the product quickly. Gross merchandise volume of $4.4 billion in the first quarter of fiscal 2023 (which ended Sept. 30) was up 62% year over year. Additionally, its customer base increased 69% to nearly 15 million over the same time frame.

The problem for Affirm is it competes against more established fintechs like PayPal and Block, companies whose ecosystems reach well beyond the BNPL business. Since PayPal and Block's customers already use their other services, they have little reason to turn to Affirm for BNPL services, especially if industry growth rates slow.

Affirm's growth has also come at a high cost. In its fiscal first quarter, its revenue of $362 million was up 35% year over year. Unfortunately, operating expenses rose 49%, and the company reported a $251 million net loss during the quarter.

Amid such conditions, investors have turned on the stock. The stock has fallen almost 95% from its 2021 high, bringing its price-to-sales (P/S) ratio under 2.

Admittedly, compared to its record-high price of $177 per share and peak P/S ratio of 47, the current levels may seem like a bargain. However, with a narrow competitive moat and the company unable to earn an operating profit, it will need more than a discounted share price to convince investors to pour back into the stock.

Palantir's short-term problems could dent your investment returns

Justin Pope (Palantir Technologies): There are some excellent reasons to like Palantir Technologies -- the company's software platforms create custom solutions for the government (Gotham) and commercial customers (Foundry). Palantir's technology helps break down and analyze data, and it's used for various applications, from military operations to supply chain management. A study by research company IDC estimates the global amount of data will double between 2022 and 2026, which could underline the need for solutions like what Palantir builds. So why avoid the stock in 2023?

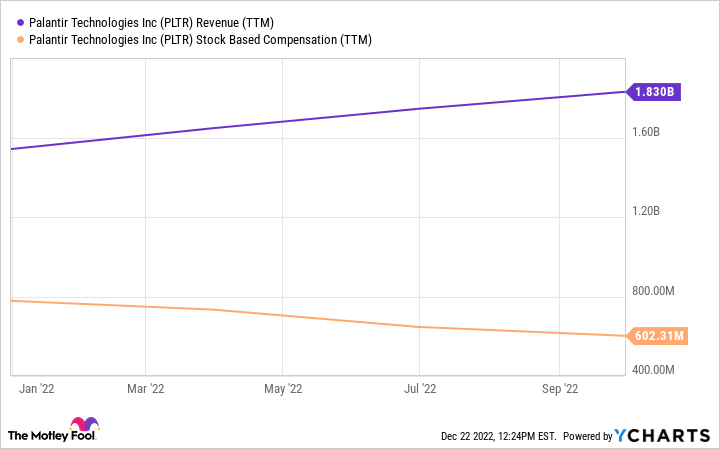

A great business doesn't always make for a stellar investment. Palantir's compensation structure seemingly hurts shareholders. The company issues new shares of stock to employees to avoid cash expenses from large salaries. Over the past year alone, Palantir paid out $602 million in stock-based compensation, about 33% of its revenue.

Data by YCharts.

Palantir has increased revenue 67% since the beginning of 2021 and free cash flow by 102%. That's great, but factoring in the additional shares from compensation heavily dilutes that progress. Revenue per share has grown just 6%, and free cash flow per share has risen 51%.

One hopes that the business continues growing and compensation becomes an increasingly smaller percentage of revenue. But Palantir's revenue growth has also slowed in recent quarters. Investors may want to see either growth pick back up or stock-based compensation dramatically shrink before considering the stock, which has fallen nearly 85% from its peak.