For long-term investors, there are not many things better than finding a profitable company paying you to hold shares. Yes, I'm talking about dividends. The best companies can give you annual raises, which can add to substantial investment returns over time. If a company in the S&P 500 can pay and raise its dividend annually for 50 consecutive years, it earns a designation as a Dividend King.

Healthcare is one of the most essential industries in the global economy, and it's a multitrillion-dollar industry. So why not combine these two ideas? Here are three Dividend Kings in the healthcare industry that you can own and sleep well at night while building wealth simultaneously.

1. Johnson & Johnson

Healthcare conglomerate Johnson & Johnson (JNJ 0.04%) is a dividend legend. The company has posted 60 years of consecutive increases, truly creating generational wealth. The company has a three-legged business that consists of consumer products, medical devices, and pharmaceuticals. The business makes more than $94 billion in annual revenue.

The company has a lot going on; it has some very public lawsuits hanging over its head regarding adverse health effects allegedly caused by some of its talc-based products. There are more than 40,000 pending suits against the company, which could be very expensive if things don't go Johnson & Johnson's way. Management is spinning off its consumer products business as Kenvue in November, in part, as a way to help shield itself from some of the liability from these pending lawsuits. Shareholders could see the dividend divided between Kenvue and the remainder of Johnson & Johnson.

So why should investors buy Johnson & Johnson now instead of running away from the stock? The current lawsuits will have short-term implications but shouldn't affect it all that much long term; The company has a sparkling balance sheet, which carries a rare AAA credit rating from S&P Global. Cash profits surpassed $17 billion over the past year alone. Even in a worst-case scenario with billions in liabilities, Johnson & Johnson is financially prepared to absorb those expenses without disrupting its overall business. Shareholders will have shares of both Johnson & Johnson and Kenvue after the spin-off. But the J&J shareholders will own a company with segments that are more geared toward growth that won't be hampered by the slower-growing consumer segment.

JNJ Revenue (TTM) data by YCharts

Looking past the lawsuits, you can see Johnson & Johnson's consistent growth in the above chart, which could continue. Analyst estimates call for earnings-per-share (EPS) growth averaging 5.5% over the next three to five years, which gives investors potential total returns of 8% to 9% when factoring in the dividend's 2.8% yield. The stock's forward price-to-earnings (P/E) ratio of 15 offers a potentially attractive entry point for long-term investors, given the company's dependability and near-market average return potential at a less expensive valuation. Investors may not have the buying opportunity of today if not for the lawsuit drama hanging over the company.

2. Abbott Laboratories

Fellow conglomerate Abbott Laboratories (ABT 0.07%) has made many changes over the past decade -- the company's main pharmaceutical business was spun off, and some big mergers have rebuilt Abbott around nutrition products, diagnostic and medical devices, and generic pharmaceuticals. The dividend has continued rising through all of this, on a 51-year streak that continues today.

Abbott has grown revenue by an average of nearly 10% annually over the past five years, thanks to its focus on cardiovascular disease and diabetes. The company benefited from the pandemic with a COVID-19 testing device it brought to market, but that multibillion-dollar opportunity has almost run its course. Abbott's growth could slow over the next several years as the company works to backfill that revenue hole. Analysts believe EPS will average 5% annual growth over three to five years.

ABT Revenue (TTM) data by YCharts

Shares trade at a forward P/E of 24, below the stock's average P/E of 32 over the past decade. However, the decline of COVID-19 testing equipment sales will be a headwind that will slow growth for a little while. Investors should temper expectations for the short term, but Abbott's track record of solid performance remains intact for the years beyond.

3. AbbVie

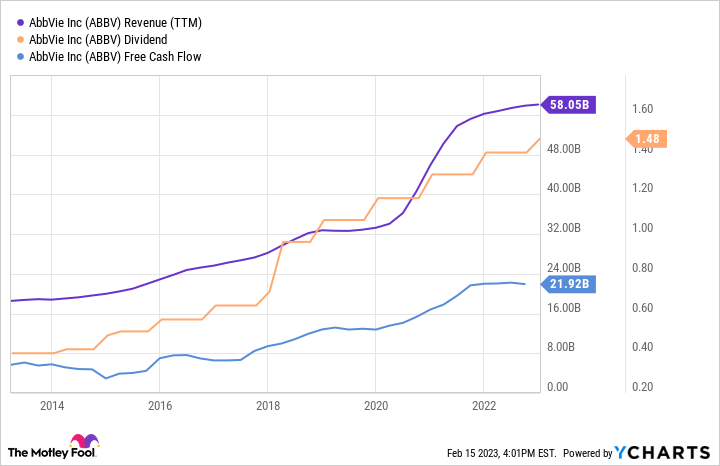

Pharmaceutical company AbbVie (ABBV 0.22%) has grown by leaps and bounds since splitting from Abbott a decade ago. AbbVie is known for its best-selling drug Humira, the Botox brand, and several others that add up to $58 billion in annual sales. AbbVie has continued its dividend-growing tradition, now at a 51-year streak (when including its days as part of Abbott Labs). The stock's 3.9% dividend yield is a great way to earn passive income from investing.

Humira, AbbVie's top-selling drug, recently lost patent exclusivity in the U.S. market. Generic competitors called biosimilars have begun entering the market, which will cause a drop in Humira's sales. While not ideal, AbbVie's strong pipeline and financials should keep the dividend intact.

ABBV Revenue (TTM) data by YCharts

However, growth could slow in the years ahead; analysts are looking for EPS growth averaging 4% annually over the next few years. That's a notable slowdown from the 8% earnings growth AbbVie averaged over the previous decade. The stock's valuation has come down as a result, with shares trading at a forward P/E ratio of 13, far below the median P/E of 21 in the past decade. But even if the valuation remains depressed, the stock's dividend and mid-single-digit growth could generate solid total returns.