Artificial intelligence (AI) is more advanced than ever and could have a tremendous impact on the world over the next decade. But AI doesn't seep out of the ground like oil. Instead, it requires enormous computing power because of how much data it must process quickly.

Advanced Micro Devices (AMD 1.33%) should have many opportunities as a leading semiconductor company. Semiconductors are essentially the building blocks of computing systems and will play an important role in building out AI.

The growing demand for AI chips could fuel exciting growth for AMD over the coming decade. Here is what investors can expect.

AMD is leaning heavily into AI

AMD is one of the world's leading semiconductor companies. The company designs central processing units (CPUs), the main brains inside a computer, and GPUs. AMD holds roughly 30% market share in the CPU market and just under 20% in the discrete GPU market. AMD's strong presence across the chip market should give it broad exposure to the growth in demand AI will create for chips.

Experts believe that AI could add $13 trillion in economic output to the global economy by 2030. That could translate to big growth in semiconductor stocks, and analysts see years of strong growth ahead for AMD. The average estimate has revenue nearly doubling by 2027 and earnings-per-share (EPS) almost tripling.

AMD acquired programmable-chip specialist Xilinx over a year ago for $49 billion, a company known for its advanced designs. Xilinx should give AMD options in designing products specialized for AI applications. It has an investor event planned for next month to unveil several new products aimed at the data center and AI markets.

Fundamentally similar to Nvidia

AMD's most direct competitor is Nvidia, which specializes in discrete GPUs and has roughly 80% market share. Nvidia has garnered a lot of hype recently, largely due to the AI catalyst; the stock has doubled since the beginning of the year.

Investors must sometimes compare industry peers to identify the best investment opportunity for their money. Consider Nvidia and AMD below. You will notice that the companies have some similar financial metrics:

AMD revenue (TTM) data by YCharts. TTM = trailing 12 months; EPS = earnings per share.

For instance, both companies are similar by revenue, generate free cash flow at roughly the same conversion rate, and have similar expectations for long-term earnings growth.

For a much better price

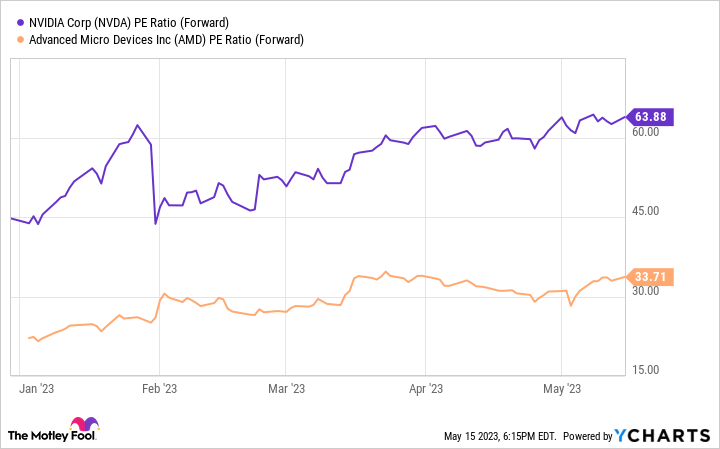

But if you look at each stock's valuation, you'll see that the market is paying a significant premium for Nvidia versus AMD. With a price-to-earnings (P/E) ratio nearly twice that of AMD, investors are implying that Nvida's earnings are of higher quality and deserve a premium. Is that the right call? You might like AMD or Nvidia for one reason or another, but from a pure numbers standpoint, it's hard to see what justifies Nvidia carrying a valuation twice that of AMD.

NVDA PE ratio (forward) data by YCharts.

For investors looking for the best long-term returns, it seems like AMD has fallen into Nvidia's shadow. Meanwhile, the company is putting up competitive financial numbers and has exposure to AI's game-changing upside. For the money, AMD seems like a potential winner for the upcoming decade.