Entertainment and media stock Roku (ROKU 1.87%) has been a hot buy this year, surging more than 115% year to date. The company is coming off an encouraging quarter that showed strong revenue growth of 11% from the same period last year. The business is doing well, but it's not quite a risk-free investment.

Here are three reasons it may not be too late to buy the stock, and one reason why Roku could disappoint investors in future quarters.

The writers strike may lead more users to opt for the Roku Channel

Inflation is putting pressure on consumers' wallets and if streaming services such as Netflix and Walt Disney's Disney+ aren't putting out new content on a regular basis, Roku could be a big benefactor. The ongoing writers strike means that content could soon become stale on those streaming platforms and at a time when consumers may not need an extra incentive to look for more cost-effective entertainment options, the Roku Channel could get a whole lot more popular.

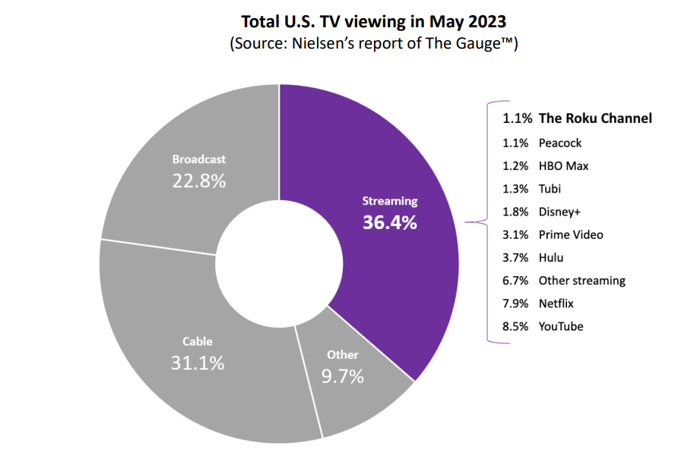

Even after the strike ends, the added exposure for Roku could mean more users end up opting for the free entertainment option rather than going back to a pay streaming service. While Roku is often associated with being a hub for streaming options, many consumers may not know that it also offers plenty of free content through its own channel. And in May, data from Nielsen showed that for the first time, the Roku Channel represented a respectable chunk of TV viewing hours:

Image source: Company's Q2 shareholder letter.

The company is diversifying its revenue streams

Roku has been working on ways to generate more revenue growth, including partnering with Shopify to allow viewers to purchase products directly from ads. In addition, the company has opened up Roku City (a screensaver displaying a city) to ads by major brands. Two big brands that are already advertising there are McDonald's and Mattel.

While these may not be huge opportunities on their own, by diversifying and giving advertisers more ways to reach consumers, Roku can be in a great position to benefit from a much stronger ad market. That's especially true as fears of a recession appear to be fading with the country coming off a solid second quarter, in which gross domestic product grew by 2.4%.

Roku could finally see profitability again

In the second quarter, Roku reported an adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) loss of $17.8 million. But the company is working on trimming costs and plans to be adjusted EBITDA positive for 2024. By improving its bottom line, Roku can become a safer, better buy overall.

The company was profitable prior to 2022 but with the downturn in the markets and advertisers scaling back on spending amid fears of a recession, Roku has struggled to stay out of the red.

ROKU Net Income (Quarterly) data by YCharts

By cutting costs and improved upon adjusted EBITDA, its net losses should also shrink, potentially getting the business back into the black.

One obstacle that could derail things

The one risk I see for Roku is its hardware business. While ad revenue growth can be great, if the company becomes too aggressive in trying to sell Roku TVs, that could negatively impact its gross margin, and make it difficult for the company to strengthen its bottom line.

In four of the past five quarters, the company's gross margin on devices was negative. And the one time it was positive, it was a modest 3.4%, barely above breakeven. In contrast, the gross margin on the platform business, which includes the company's ads, is normally above 50%. It's the ads that need to be strong for Roku's business to succeed. If the ad market struggles and the company has to rely too much on devices, then its losses could become larger, making the stock a less attractive buy.

Should you buy Roku's stock?

The economy looks to be on better footing of late and that's good news for the ad market, and, in turn, Roku's business. With more avenues to generate ad revenue from, Roku could be in great shape right now. While there may still be challenges ahead for the business, there's plenty of reason to be optimistic about its future. If you're willing to buy and hold for the long haul, this growth stock can make for an attractive investment.