Following along with Warren Buffett and what his team at Berkshire Hathaway trade in has been a fairly strong investment strategy, as the holding company's track record speaks for itself. But not every Buffett stock is always a great buy at any given time. So, which stocks in Berkshire's portfolio make the most sense to buy in December?

Given the holiday shopping season now well underway, the answer should be pretty clear: credit card companies. In Berkshire's portfolio, the company owns three of the four major U.S. credit card companies: American Express (AXP -0.62%), Visa (V -0.23%), and Mastercard (MA 0.07%). A closer look at this trio of stocks makes it clear that right now could be a great purchasing point.

The credit card companies are having a strong 2023

So, why does Buffett like the credit card companies so much? Well, he's a big fan of the "toll booth" business model, where companies generate revenue by charging fees each time their essential products and services are used. For this trio of credit card companies, that's a lot of usage. A 2023 survey by Forbes Advisor found that only 9% of Americans typically pay for purchases with cash. That means the other 91% of the billions of transactions going on every month are paid with some form of plastic, and it's a good bet that each swipe generates money for one of these three.

While some people pay off their credit card balance each month, not everyone does. According to the Federal Reserve Bank of New York, credit card debt hit an all-time high in Q3 2023, reaching $1.08 trillion. Furthermore, with a high Federal Reserve interest rate, this debt is racking up a lot of interest. Of the three companies featured here, only American Express is responsible for the debt.

Visa and Mastercard are only processors; their systems are used to process transactions. The banks they partner with are the ones that manage (and potentially profit from) the debt. American Express is different because it manages the debt on the cards it issues. While this gives American Express an additional income source, it can also be a massive risk if mismanaged. However, American Express's customer base is still quite strong, as only 1.2% of accounts are more than 30 days past due, which is lower than its pre-2020 figure of 1.5%.

Furthermore, all three companies are growing at an above-market pace.

V Revenue (Quarterly YoY Growth) data by YCharts. YoY = year over year. EPS = earnings per share.

In addition to these companies growing faster than a 10% benchmark, each also pays its shareholders a dividend. American Express's yield is 1.4%, Visa's is currently 1.1% and Mastercard comes in at 0.6%.

While none of these are earth-shattering yields, they add to the stocks' total return potentials. Each of these companies has a strong future and is doing well right now. But what makes these top Buffett stocks to buy in December?

The stocks are cheap from a forward-looking perspective

From a valuation perspective, these companies all trade around their five-year average trailing price-to-earnings (P/E) ratio.

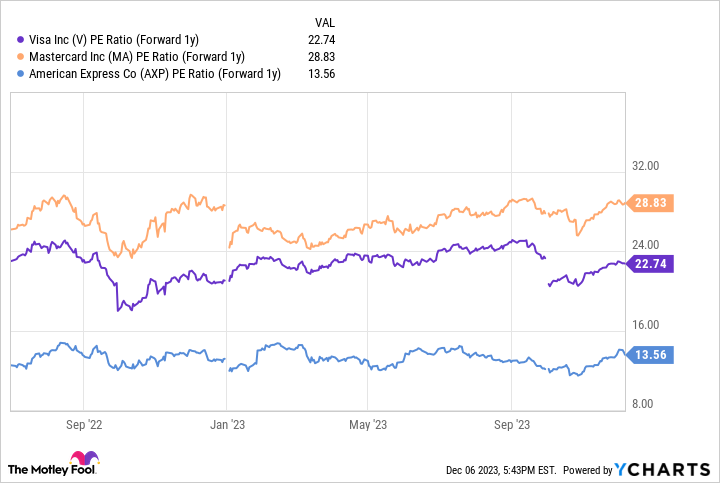

V PE Ratio data by YCharts. PE Ratio = price-to-earnings ratio.

That tells you these stocks aren't overvalued, but when you look at their forward one-year P/E ratio (which considers 2024's earnings estimates), it's clear these stocks have some room to run.

V PE Ratio (Forward 1y) data by YCharts. PE Ratio = price-to-earnings ratio.

By using the average P/E ratio and the forward P/E ratio, you can get an estimated upside for the stocks as long as estimates hold and the stocks end up at their average valuation. The odds of that happening aren't high, but it at least gives investors an idea of what performance they can expect.

| Company | Implied 2024 Upside |

|---|---|

| American Express | 17% |

| Visa | 32% |

| Mastercard | 23% |

Data Source: YCharts.

Throw in each company's dividend, and you've got a recipe for a group of stocks that won't just beat the market -- they'll crush it.