Investing generally won't make you a millionaire overnight -- and buying just a few stocks usually won't do the trick either. But if you build a portfolio of about 25 solid stocks and hold on to them for a decade, you could see your investing dreams start to come true. And today, a few stocks in particular -- for different reasons -- stand out as ones that could help make you a millionaire over time.

CRISPR Therapeutics (CRSP 0.34%) may advance significantly from here, as it's just started its growth story as a commercial-stage company. Teladoc Health (TDOC -2.40%) is ripe for a rebound after taking steps toward its profitability goal. And Johnson & Johnson (JNJ -0.46%) may contribute to your portfolio's gains through its growing dividend.

Let's take a closer look at these three stocks that, together and as part of a diversified portfolio, could help make you a millionaire over the long haul.

Image source: Getty Images.

1. CRISPR Therapeutics

CRISPR Therapeutics stock has advanced this year, but it's fallen more than 60% from its peak -- reached back in 2021, when we weren't yet sure about whether its technology would result in a commercialized product.

Today, though, the potential of the company's gene-editing technique is clear. CRISPR Therapeutics won authorization in the U.K. for its gene editing treatment, Casgevy, for sickle cell disease and beta thalassemia. And it earned approval in the U.S. for Casgevy for sickle cell -- and awaits a decision in March for the second blood disorder.

The treatment holds blockbuster potential, so even though CRISPR Therapeutics shares profit with partner Vertex Pharmaceuticals, its 40% share still could represent significant revenue. Meanwhile, the regulatory nods also serve as a vote of confidence in the company's gene-editing technology, which it uses across its pipeline.

All this means CRISPR Therapeutics' growth story is just getting started -- and there's plenty of opportunity for share price gains over the long haul.

2. Teladoc Health

Teladoc Health shares sank in recent years as investors worried about the company's lack of profitability. And billions of dollars in noncash goodwill impairment charges last year -- linked to the acquisition of chronic care specialist Livongo -- made matters worse.

But, today, Teladoc is ripe for a rebound. That's because the company has cut costs and balanced its quest for revenue growth, with the idea of working toward profitability. And this effort, launched earlier in the year, already is bearing fruit. In the most recent quarter, Teladoc reported results that met or beat its expectations.

And though the Livongo purchase was costly for Teladoc, this operation may pay off over time. Chronic care is a key market, with half of Americans suffering from at least one chronic illness. Teladoc said in the recent quarter that its chronic care business drove revenue growth.

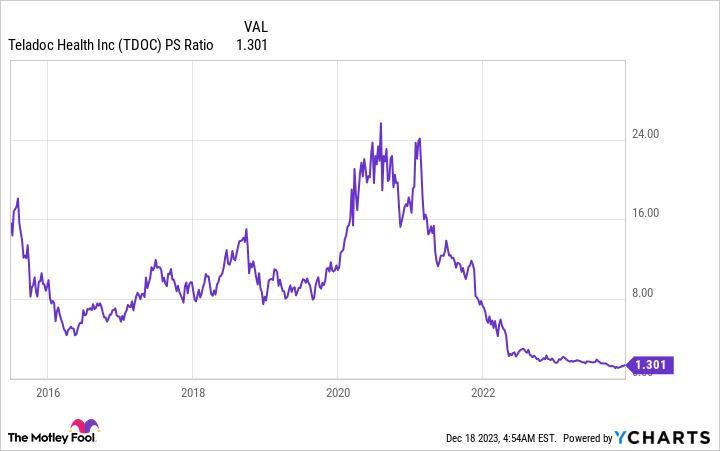

Most recently, Teladoc launched an operational review of its business to ensure its investments and services support its goals. If Teladoc continues along this path, the stock, trading near its lowest ever in relation to sales, could rebound in a big way.

TDOC PS Ratio data by YCharts

3. Johnson & Johnson

You can win over time with an investment in Johnson & Johnson -- even if the stock doesn't soar. That's because J&J offers you a dividend, and one that's increased over time.

The company makes the list of Dividend Kings, or those that have raised their dividends for at least 50 consecutive years. This solid track record shows rewarding shareholders is important to J&J, so it's likely the company will continue along this path. And that means you can count on your passive income growing year after year, adding to your gains from J&J stock performance.

This chart shows how dividends, seen as part of total return, can make a significant difference in returns from a particular stock over the long haul.

Today, J&J pays a dividend of $4.76 per share, reflecting a dividend yield of 3.07%, which tops the yield of the S&P 500. And J&J recently said that dividend growth is among one of its priorities.

Meanwhile, J&J may also offer you more growth than you might expect from a long-established healthcare giant. The company recently spun off its slower-growth consumer health business, collecting $13 billion in proceeds, and aims to focus on its higher-growth businesses of medtech and pharmaceuticals. All this means now is a great time to get in on this top dividend stock.