Not too long ago, Walgreens (NASDAQ: WBA) was the highest-yielding stock in the Dow Jones Industrial Average. Then, the pharmacy operator cut its dividend. That's a warning that investors need to keep in mind as they look at the current top three highest-yielding stocks: Verizon (VZ 1.17%), 3M (MMM 0.46%), and Dow (DOW 1.51%). Here's a quick look at each of these Dow Jones income stocks.

Verizon has a lot of debt

Verizon is one of the largest telecommunications companies in the United States, operating a large cellular network. The stock currently yields around 6.7%, which is notably more than you'd collect from the "average" company, noting that the yield on the S&P 500 index is a paltry 1.4% or so. Verizon has increased its dividend annually for 19 consecutive years, which is a good sign but not enough to make the stock a buy.

Operating a telecommunications business requires a huge amount of capital investment. As such, companies in the industry tend to carry a lot of debt on their balance sheets. Verizon's leverage, however, is higher than that of its two main competitors. Verizon's leverage has fallen dramatically over the past decade, so it is moving in the right direction on this front. Given the importance of mobile phones and the growth of connected devices, the stock is probably worth a look. However, investors should still keep a close eye on the balance sheet here. A material deterioration in leverage from current levels would indicate a potentially worrisome increase in risk.

VZ Debt to Equity Ratio data by YCharts

There's a lot of uncertainty at 3M

Iconic industrial company 3M has a widely diversified business and a long history of annual dividend increases behind it, at 65 years. That makes the company a Dividend King. The yield is an attractive 6.5%. There are a couple of big problems that suggest 3M isn't appropriate for most investors.

First off, the company is dealing with several legal and regulatory issues that will lead to billions of dollars in legal expenses. Management is working through the issues, including product liability related to military earplugs and the environmental impact of its production of forever chemicals. The big problem for investors is that the company can't discuss these topics in any detail until they have been resolved, leaving shareholders in the dark as to what is going on (and the ultimate risk that the headwinds pose). Second, the company is in the process of spinning off its healthcare business. It has little choice because it needs the cash that this transaction will create to pay its legal bills. A lot is going on, making this a special-situation stock right now that only more aggressive investors will want to own.

Dow's dividend isn't moving

Dow is a large and diversified chemical manufacturer. Its dividend yield is around 5.2%. But, unlike Verizon and 3M, the company's dividend has been static for a number of years, and there's no sign that this trend is going to change anytime soon. That's a strike against the stock, given that inflation will slowly erode the buying power of a dividend that doesn't grow over time.

From a business perspective, there's another notable risk that investors need to consider. Much of what Dow produces comes from processing natural gas, which is a highly volatile commodity. So, the company's costs are volatile. Now add to this fact that a lot of the products Dow produces are themselves commodities, which means what it charges customers can be volatile, too.

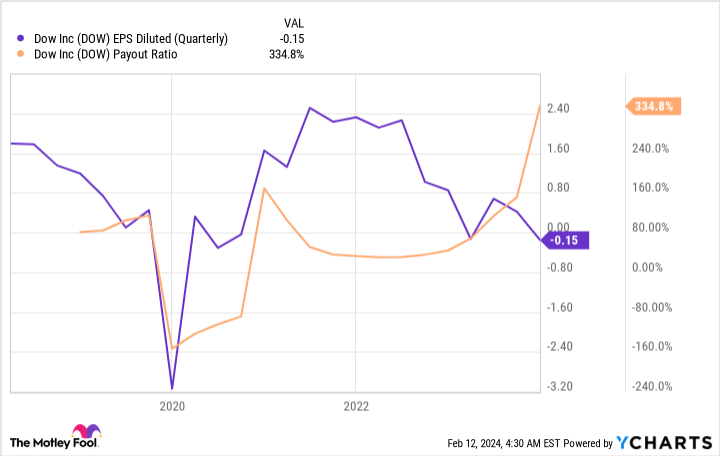

DOW EPS Diluted (Quarterly) data by YCharts

As the above chart highlights, earnings can be pretty volatile, as well. So can the payout ratio. Add in the lack of dividend growth, and most investors will probably be better off looking at other high-yield stocks.

One maybe and two probably nots

Investors looking at high-yield stocks need to be very careful not to get lured into a dividend trap like Walgreens turned out to be. That suggests that caution should be the first order of business. On this list, the risks at 3M and Dow appear like they outweigh the potential dividend rewards. And while Verizon seems like it is in a better position, investors should still make sure to pay close attention to its leverage, which is higher than that of its peers. That may even dissuade more conservative types from buying it in the first place.