When it comes to tobacco stocks, one of the first things that generally draws in investors is their high yields. However, Philip Morris International (PM -0.83%) offers investors an attractive dividend yield and one of the biggest underappreciated growth stories for consumer products.

Phillip Morris International just posted another terrific quarter and raised its guidance when it reported its first-quarter earnings results. These results were once again led by Zyn, which saw its volume surge nearly 80% year over year in the U.S. to 131.6 million cans. Overall, Phillip Morris saw its revenue increase 11% on an organic basis to $8.8 billion and organic operating profit climb 22% to $3.0 billion.

What is Zyn?

Zyn is a nicotine pouch product that Philip Morris acquired as part of its acquisition of Swedish Match at the end of 2022. The product is made of nicotine powder and flavorings such as mint or cinnamon and does not contain any tobacco. Since the product does not contain tobacco, users don't have to spit like they do with traditional chewing tobacco.

While the product is being sold in the U.S., it is still currently being reviewed by the Federal Drug Administration (FDA). Philip Morris touts it as a safer alternative to smoking and other tobacco products that can help wean people off tobacco products.

The product has become a bit of a hot-button political issue, with Democratic Senator Charles Schumer asking regulators earlier this year to investigate whether the product was being promoted to teens.

For its part, the FDA said the use of Zyn among high school and middle school students was low, at only about 1.5% compared to 10% of students that vaped. This is important, as vaping company Juul Labs went from being valued at $38 billion to trying to stave off bankruptcy after being beset by legal challenges and settlements over marketing its products to children. At its height, 28% of high schoolers had vaped, compared to only 3% of adults. Zyn appears to be very careful in its marketing and does not appear to have these usage issues with children.

How is Zyn driving growth at Philip Morris?

While Zyn has been in the U.S. since 2014, it was primarily located in western markets and only launched nationally about five years ago. The product's popularity really took off after Philip Morris's acquisition, as it was able to increase its distribution.

Zyn has become very popular with Gen-Z adult males, and this demographic is marketing the product for the company free of charge through social media and other outlets. The political sparring between political parties surrounding it seems to have only added to the product's appeal among some users.

Given that Philip Morris does not sell cigarettes in the U.S., every smoker it can convert to Zyn is a big win for the company. In fact, the company has said that the product contribution level of Zyn in the U.S. is 6 times that of its cigarette products. So not only is Zyn seeing explosive sales growth, but it comes with a much higher margin as well.

Given the demand for Zyn and the market penetration it has seen in early western U.S. markets, the company is spending money to increase Zyn's production capacity in the U.S. to meet expected demand. This should help fuel growth in the years to come.

Image source: Getty Images.

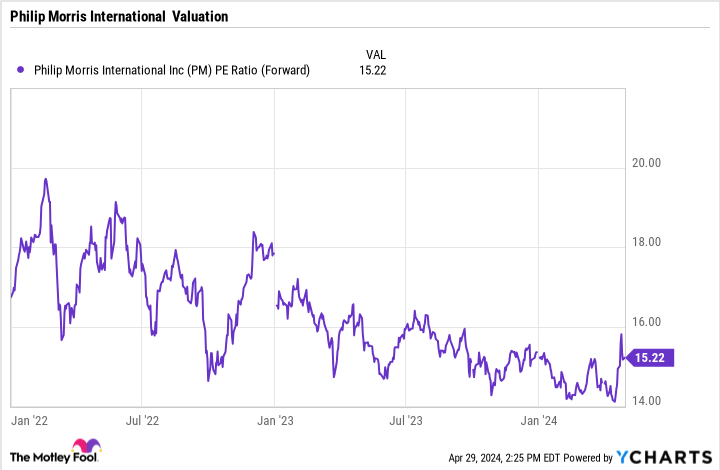

Inexpensive stock

Zyn is one of the fast-growing consumer goods products around, yet Philip Morris stock has barely budged over the past few years. With the company trading at about 15 times forward earnings and growing revenue by double digits, the stock is cheap. It also has an attractive 5.5% dividend yield, and the company has grown its dividend every year since it was spun off from Altria Group in 2008, nearly tripling it during that span.

PM PE Ratio (Forward) data by YCharts

Philip Morris offers both a high yield and one of the best growth stories around with Zyn at an attractive valuation. For investors looking for income and growth, this appears to be a great stock to buy right now.