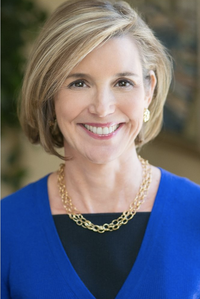

Former Wall Street trader-turned-expert, educator, public speaker, host, female entrepreneur, and media powerhouse Vivian Tu is now the founder and CEO of the financial equity phenomenon Your Rich BFF.

In January 2021, Vivian developed and launched the @yourrichbff blog and social media handles as a passion project to destigmatize personal finance advice and make it accessible and digestible to non-experts and marginalized communities. In just over two years since her first video, her dedication to promoting financial literacy has earned her cross-platform notoriety, having garnered over 4.5 million followers and counting across socials, as well as honors on both the Forbes 30 Under 30 -- Social Media (2023) and inaugural Top Creators (2022) lists.

Vivian's Investing Style

How many years of investing experience do you have? 5-10 years

What is your investing risk tolerance? High

What is your portfolio size? 20+ stocks

What are your favorite investing sectors? Environmental, Social and Governance (ESG); Index-Tracking ETFs

What makes those sectors so interesting to you? While I'm largely a set-it-and-forget-it type of investor who mostly invests in index-tracking ETFs, I do love the ESG sector because it combines investing and doing good. Enriching myself while enriching the planet, the causes I believe in, and marginalized communities is a win-win.

Can you tell us about your relationship with money at an early age?

I grew up in a Chinese immigrant family with two loving but very frugal parents. I was never taught about investing, but a massive emphasis was placed on saving and spending my money wisely. Allowance wasn't really a thing for me, so when I wanted something, I essentially had to pitch it to my parents Shark Tank-style and hope they would buy it for me. Books and experiences were easy yeses, but things like ripped jeans were almost always a no.

When did you start your investing/personal finance journey and why?

I started investing after my first summer as an intern on Wall Street. For the first time, I felt really confident about my understanding of the market. I had also seen real wealth for the first time. Everyone chalked up their success to making good money and investing as much as possible, so I knew I had to get into investing, too.

What has your journey been like as an investor? What are some of the challenges you’ve had to overcome?

My journey as an investor is probably a little more tumultuous than most folks. After my summer internship, I thought I understood everything there was to know about financial markets. And I immediately invested in some single stock equities I liked. I had to learn a hard lesson that investing in individual companies can be quite risky. That said, after a pricey lesson, I pivoted my strategy to be much more of that of a long-term investor. It bruised my ego a bit but was a valuable lesson to learn early on.

In what ways has your cultural identity and lived experiences positively impacted your financial journey?

I am so proud to be a young Asian woman. And I feel really lucky that, coincidentally, my first manager and mentor at work was an Asian woman. Because we had that shared identity, we got close very quickly. She ended up taking me under her wing and provided me with an education around money, finance, and investing, which I never got from either my parents or school.

What advice would you give to someone who may be experiencing market volatility for the first time?

Do not look at your portfolio every day. You will hurt your own feelings. If you are a long-term investor with a diversified portfolio that makes sense for your risk tolerance, feel confident in riding out the volatility. You don't need to check your investment performance daily. In fact, getting wound up over unrealized losses can often drive people to make unwise decisions. So just stay the course and don't panic.

What really excites you about the future of investing/personal finance?

Young people are so much more interested in finance than they ever have been in the past! Unfortunately, part of that is due to the rising cost of living and people feeling like they need to get a handle on their finances sooner rather than later. But I'm happy there is a newfound interest in the space. On top of that, good financial literacy education is more accessible than ever.

What scares you about the future of investing/personal finance?

There is so much hype and FOMO (fear of missing out). So many people don't fully understand how investing works and what strategy they should be taking. So instead, they chase the newest, hottest trend, which has, frankly, never worked out. Whether it's an obscure cryptocurrency or dabbling in options before fully understanding how equity markets work, getting in too deep too fast can be dangerous.

Who are some leaders in the financial industry you admire and why?

Cathie Wood: Whether or not you agree with her investment strategy, it's awesome to see a woman leading a major investment management firm.

Suze Orman: She's the OG. She pioneered the personal finance space for my mom's generation, and I hope to do the same for mine.

What are some of your favorite educational resources (books, podcasts, websites, etc.) that you’d recommend for investors of all ages?

Investopedia, How I Built This podcast, Planet Money podcast, Broke Millennial by Erin Lowry, Get Good with Money by Tiffany Aliche

What's one quote or saying that inspires or challenges you?

My mentor gave me the best piece of money advice ever. She said, "You can only save as much as you make, but you can always make more money."