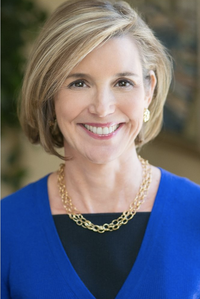

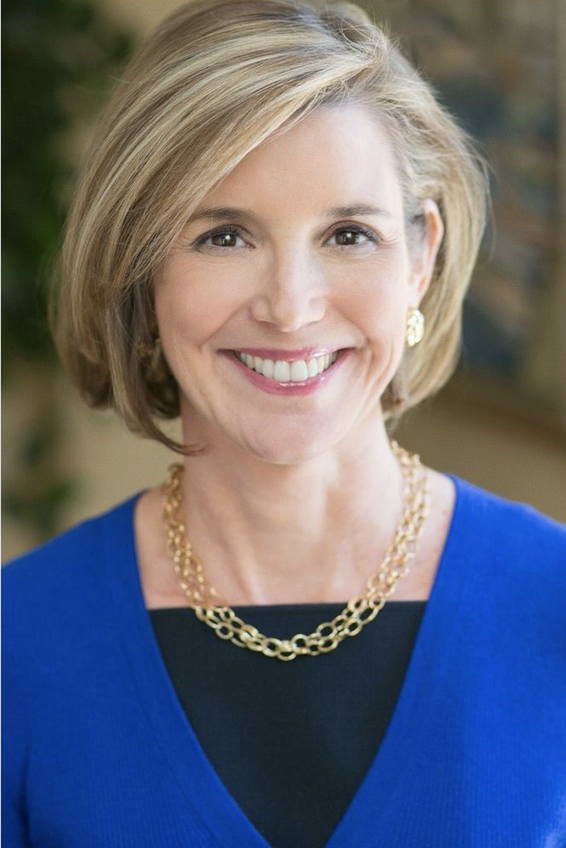

Gargi Chaudhuri, managing director, is head of iShares Investment Strategy, Americas, at BlackRock. Based in New York, she and her team primarily focus on delivering global macro thought leadership, investment insights, and content to both retail and institutional clients. With more than 20 years of experience in the financial services industry, Gargi has built her career around portfolio management in the fixed-income markets, trading, and macro strategy.

Prior to joining BlackRock in 2010, she spent nine years on the sell side at Jefferies and at Merrill trading government bonds and inflation-linked securities. She graduated magna cum laude with a bachelor's degree in accounting and psychology from Ohio Wesleyan University in 2001.

Chaudhuri is an avid runner, hiker, and a triathlete and has completed multiple marathons, ultra-marathons, Half Ironmans, and the New York Ironman.

Gargi’s Investing Style

How many years of investing experience do you have? 20+ years

What is your investing risk tolerance? High

What is your portfolio size? 20+ stocks

What are your favorite investing sectors? Energy, materials, financials, informational technology

Before diving into our Q&A with Gargi, get more insight on her investing style and experience in this interview on Motley Fool Live below.

When did you get started in investing and why?

Despite being immersed in the world of finance right after college, I didn’t invest my own money until my late 20s. I, mistakenly, thought that I needed a lot of money saved to get started, and that I needed to be a subject matter expert on every stock I owned. As I learned later, neither of those things are true. You can start investing with a very small amount of money, and, if you diversify and invest for the long term, you don’t need to know every detail about every stock in your portfolio. ETFs, for example, offer diversified, low-cost, and tax-efficient access to the world’s investment markets.

I started investing during the summer of 2007 when the news of Bear Stearns shook the market. It was the first time I felt that I had enough disposable income to invest, and I understood the implications of market moves on my portfolio. I invested in a low-cost, diversified fund that gave me access to international developed market equities.

Can you tell us a little bit about your relationship with money at an early age?

My parents had successful careers and instilled in us the value of money and saving. A Bengali saying was often repeated in our household that roughly translates to, “If you work hard and study hard, you can achieve greatness.” Even at age 5, I fully understood that money was valuable, needed to be saved, and the way to achieve wealth was through education, hard work, saving, and investing.

What has your journey been like as an investor? What are some of the challenges you’ve had to overcome?

My investing journey has been an interesting one, given that I started right before the greatest financial crisis in the markets. It taught me the most important lessons of investing at an early age: 1) You can never time the markets; and 2) You need to stay invested through the volatility because your time period of investing is not months but decades.

Since the crisis, the path toward investing has been smoother, and I have tried to rotate in and out of sectors/industries/asset classes as I see opportunities unfold. My personal challenge has been “analysis paralysis,” which is when I spend too much time thinking about where to invest, ultimately inhibiting my ability to be nimble. I am trying to overcome it by always starting broad (investing in broad market indices) and then being more selective when the time allows so that I always stay invested.

In what ways has your social or cultural identity and lived experiences positively impacted your investing journey?

As an Indian student who moved to the U.S. for college at age 18, I have always had what I describe as “immigrant insecurity,” or the need to know that I did the right thing by moving so far away from home and family. This insecurity drives me to work harder than everyone I know whether it is at work, during my evening runs, or in my investing journey. Growing up in a home where I saw both my parents work hard, have successful careers, and invest wisely, I realized how incredibly rewarding investing from a young age can be and how beneficial it can be in your retirement years.

With so many new or younger investors dipping their toes into investing, what’s the best advice you have for someone who may be looking to start investing or who may be newer to the industry?

- You don’t need a lot of money to start investing. A few hundred dollars can get you started on your investment journey.

- Don’t worry about knowing it all. What matters is investing in a diversified way and staying invested even when markets get rocky. Once you start investing, seek educational courses to expand your knowledge. Through our recent partnership with Public.com's “Learn and Earn” experience, investors can complete education courses to manage their portfolios (sustainable investing, investing amid volatility, etc.) and even claim a free slice of a stock or ETF as a reward for leveling up.

- Do not set it and forget about it. Check your statements every month. Read about the markets. Follow market leaders on social media. If what you are hearing about markets resonates, rotate your investments to reflect a changing world.

- For women, treat investing as another way of achieving equality. If you aren’t investing in the markets, you are missing out on an opportunity to gain wealth and power.

What advice would you give to a newer investor who may be experiencing market volatility for the first time?

Market volatility isn’t unique, but our reaction to it is. While it is easy for me to say, “Stay invested,” I know that sometimes your individual risk tolerance won’t allow it. Remember that staying invested in a diversified portfolio over the long term has generally yielded better results than cashing out completely during volatile times.

However, if you do feel the need to stay on the sidelines during volatile periods, promise yourself that you will reinvest and reenter the market as soon as it stabilizes.

You juggle so many tasks and wear so many hats. How do you manage the balance between your work life and your personal life and still manage to meet your investment goals?

Compartmentalize -- when you are at work, think about the task at hand. When enjoying dinner with friends and family, put your work phone away. When you are thinking about your investments on a Sunday morning, set aside time to properly assess your financial goals and your progress toward them.

Do a financial health checkup every six months -- starting from looking at credit card statements, to 401(k) allocations, to your investment account. Make sure that everything on there still makes sense for your current goals and needs.

If you could go back in time and change one thing about your investing strategy, what would you change and why?

I didn’t invest in my 401(k) until my late 20s because retirement felt far away and living in NYC was expensive! I gave up “free money” for those first few years as I missed out on employee matching, and, in retrospect, also missed out on strong equity market returns. Start as soon as you can, and, if you have big debts to pay off, you can start small.

What are three things that really excite you about the future of investing?

- The ability to invest in the powerful and transformational themes impacting our daily lives. Whether it is the future of robotics, the future of infrastructure in an emerging market country, or the future of food, there is a way to invest in the topics that interest you most. Thematic ETFs target stocks positioned to benefit from potential shifts in technology, society, the environment, and demographics over time.

- The ease of investing on digital platforms with low-cost indices. This has lowered barriers to entry as it is simple and easy to start with a small amount of money.

- The ability to customize our investments and build personalized portfolios. The power to choose means that people can invest in companies that meet their needs -- whether it is looking at companies that have more women on their boards or companies that are making progress on their path to net zero.

What about three things that scare you about the future of investing?

- Increasing geopolitical risks and the resulting volatility in the markets.

- Increased reliance on central banks to “bail out” economies whenever there is any trouble.

- Increased concentration of wealth and rising inequity.

Who are some leaders in the investing industry you admire and why?

- Janet Yellen for her leadership at the helm of the Fed and the way she guided the economy through the first liftoff in interest rates in over a decade.

- My BlackRock colleague, Rick Rieder, for his passion for markets and ability to understand long-term impacts of demographics and technology.

- Thasunda Brown Duckett, president and chief executive officer of TIAA, for her focus on retirement.

What are some of your favorite educational resources (books, podcasts, websites, etc.) that you’d recommend for investors of all ages?

Where to start? I read the Financial Times and The Wall Street Journal every day and am an avid listener of multiple podcasts, including Bloomberg Surveillance and Odd Lots, Kara Swisher and Scott Galloway’s Pivot, and BlackRock’s The Bid.

What’s one quote or saying that inspires or challenges you?

I would pick two. The Chinese proverb, “The journey is the reward,” and the saying, “When you light another’s candle, you lose nothing of your own. You produce more light.”

You might also like:

Anything else to add?

Investment is the most powerful way women (and anyone who invests) can change the course of their lives, take control of their independence, support their own values, and generate a positive social, environmental, and financial return. When women do invest, they have tended to outperform men. So, ladies reading this, start your investing journey today.