Looking at assets vs. revenue helps investors understand the relationship between a company's business operations and its balance sheet. Once understood, this can show how a business is performing over time -- crucial information for all long-term investors.

In this article, I'll explain what assets are, what revenue is, and contrast the two to paint a clearer picture.

What are assets?

What are assets?

Assets are things that companies possess and that have or create value. Assets are listed at the top of a company's balance sheet.

Asset

Multiple things qualify as assets, and they vary greatly with regard to liquidity. In fact, some assets aren't liquid at all.

Here's a non-exhaustive list of examples of assets:

- Cash, cash equivalents, and short-term investments. Cash is a liquid asset that can immediately be used for making purchases. Cash equivalents and short-term investments include things such as Treasury bonds, money in high-yield savings accounts, and certificates of deposit that expire in less than 12 months. They're often easily converted to cash and have a very low chance of decreasing in value.

- Long-term investments. Sometimes companies have investments that they intend to hold for longer than one year. This can include investments in public companies. For example, as of the first quarter of 2023, e-commerce giant eBay (EBAY 1.32%) had an investment in financial technology company Adyen (ADYE.Y -1.57%) valued at $300 million. The investment is an asset, but the company can't sell until 2025, so it's not a very liquid asset right now. It also can change in value with the volatility in Adyen's stock price.

- Property and equipment. Fast-food giant McDonald's (MCD -0.91%) is a great example of a company with this kind of asset. At the end of 2022, the company had buildings on land it owned and that it leased that were valued at more than $31 billion combined. Franchisees use these buildings and pay McDonald's rent, making these income-producing (revenue) assets and contributing to McDonald's healthy return on assets of almost 14%.

- Goodwill. Some assets are intangible, and this includes goodwill. If a company buys another business above the value of its net assets, the difference is regarded as goodwill. This happens with acquisitions because an acquired company can have value beyond the tangible numbers.

What is revenue?

What is revenue?

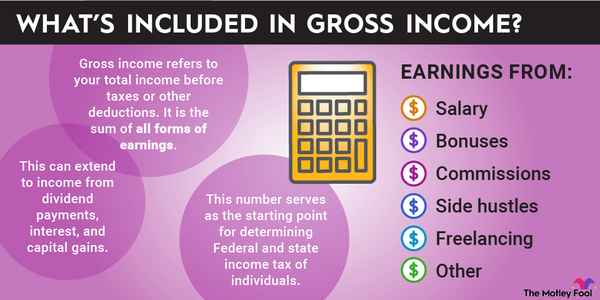

Revenue is money flowing into a company for providing goods and services to its customers. It's listed at the top of the consolidated statements of operations (also called the income statement).

Revenue

Often revenue is synonymous with sales, net of returns. But this isn't always the case.

For example, Domino's Pizza (DPZ 0.87%) had net sales of more than $17.5 billion in 2022. However, most of its pizza restaurant locations are owned by franchisees. These franchisees only pay Domino's a percentage of net sales. So revenue for Domino's Pizza was just under $1.4 billion in 2022 -- more than 90% lower.

There's another wrinkle with revenue: When money comes in and when it can be recognized as revenue from an accounting perspective isn't necessarily the same.

For example, many travelers book places to stay with Airbnb (ABNB 0.75%) months before their travel dates. These travelers pay Airbnb at the time of booking, and this money immediately hits Airbnb's coffers. The company then holds the money until guests check in. Once they check in, it sends money to the property owners and retains a percentage for its own revenue. So Airbnb's revenue often comes in months before it can be recognized, and the company doesn't retain everything that initially came in.

Herein lies one of the stronger relationships between assets and revenue. While Airbnb is waiting for travelers to check in, the money is recorded on the balance sheet as an asset -- the company possesses it, and it has value. However, it doesn't belong to Airbnb, so it's also listed as a liability on the balance sheet. When travelers eventually check in, the company's assets and liabilities decrease as money finally shows up on the income statement as revenue.

Assets vs. revenue: The major differences

Assets vs. revenue: The major differences

| Assets | Revenue | |

|---|---|---|

| Listed on the balance sheet. | Listed on the income statement. | |

| A single number recorded at a moment in time, typically the final day of the financial period. | A cumulative amount recorded during the financial period. |

Related investing topics

The bottom line

The bottom line

When public companies issue press releases, they show investors the numbers they want you to see, not necessarily all of the numbers that you need to see to make the best investment decision. But all of the pertinent numbers are there in the balance sheet, statement of operations, and statement of cash flows (not discussed here).

At first, it can be intimidating to evaluate assets vs. revenue. But everyday investors can learn to parse items like these in the three main financial statements. Doing this will help you see everything with businesses -- the good and the bad. And doing so will also give you an edge over other investors who don't want to put in as much work.

Assets vs. revenue FAQ

Assets vs. revenue FAQ

Are assets the same as revenue?

No, assets aren't the same as revenue. They are distinctly different figures.

What is revenue vs. assets in accounting?

For accounting purposes, assets are listed on a balance sheet. Revenue is disclosed on an income statement.

Why is income not an asset?

When a company has income (revenue), it still needs to pay operating expenses, taxes, and more. And some companies don't have an accounting profit at all after all the bills are paid. So income is not an asset.

With income, companies can do things like buy other assets or reward shareholders. So there is a relationship between assets and income.

Is cash considered revenue or asset?

Cash in a company's possession is an asset.