Are you someone who consistently saves at least $250 a month and wishes your hard-earned cash could work harder for you? I was too. That's when I stumbled upon the LendingClub LevelUp Savings account, which boasts one of the best interest rates you'll find anywhere -- comparable to top-tier savings accounts and even some CDs. Intrigued, I took the plunge and haven't looked back since.

Curious about how it works and whether it's the right fit for you? Keep reading to find out everything you need to know before diving in.

LendingClub LevelUp Savings

On LendingClub's Secure Website.

On LendingClub's Secure Website.

- Competitive APY

- No fees

- Easy ATM access

- Unlimited number of external transfers (up to daily transaction limits)

- Requires you to make monthly deposits to earn the best APY

- ACH outbound transfers limited to $10,000 per day for some accounts

- No branch access; online only

The LendingClub LevelUp Savings account has a lot to offer. At the top of the list is its high APY, though you must deposit monthly to earn the best rate. Next is zero account fees, a strong and straightforward perk. Finally, you get a free ATM card, which you can use to withdraw from thousands of ATMs nationwide. Interested? You can open an account with $0.

At Motley Fool Money, we rate savings accounts on a five-star scale, shown in tenths of a point to highlight even small differences between products. Accounts are evaluated across four main criteria:

- APY

- Brand and reputation

- Fees and minimum requirements

- Accessibility and features

Scores may be adjusted to reward limited-time high rates or penalize accounts with excessive fees. Our goal is to highlight accounts that are competitive, easy to use, and backed by trusted institutions. Learn more about how Motley Fool Money rates bank accounts.

At Motley Fool Money, we rate savings accounts on a five-star scale, shown in tenths of a point to highlight even small differences between products. Accounts are evaluated across four main criteria:

- APY

- Brand and reputation

- Fees and minimum requirements

- Accessibility and features

Scores may be adjusted to reward limited-time high rates or penalize accounts with excessive fees. Our goal is to highlight accounts that are competitive, easy to use, and backed by trusted institutions. Learn more about how Motley Fool Money rates bank accounts.

What I like about the LendingClub LevelUp Savings account

Competitive APY

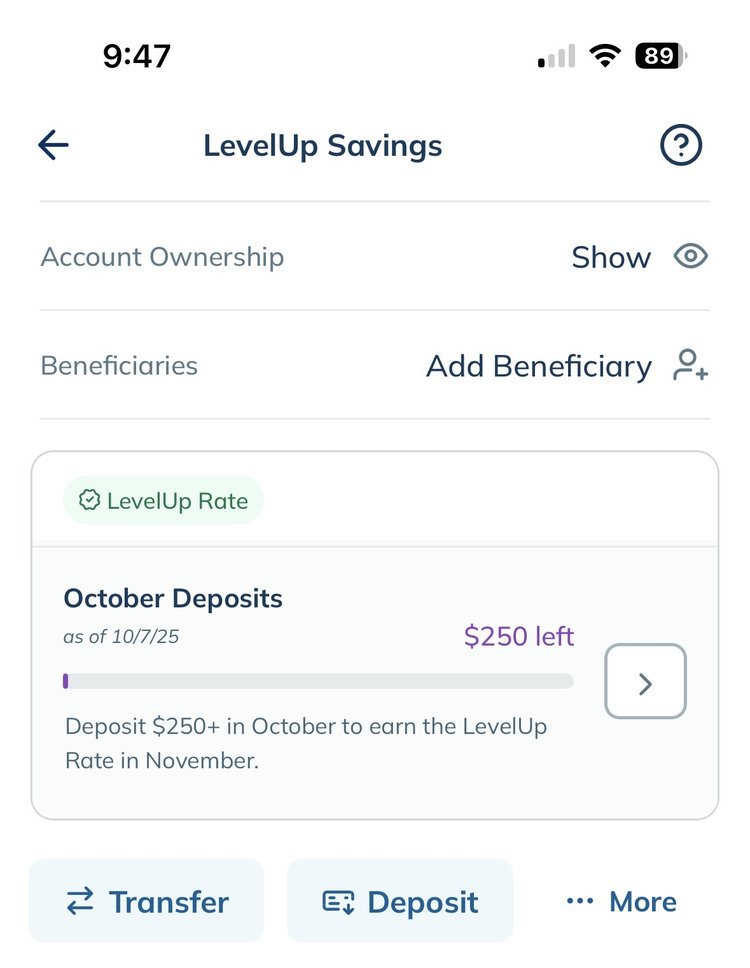

The APY is no doubt the best part of this account. At 4.00% APY with $250+ in monthly deposits, this account offers one of the best savings rates out there. Sure, you need to deposit at least $250 a month to get that top-tier rate, but even if you don't, you'll still earn a competitive APY.

I use this account to stash my future home down payment, and earning a strong APY on that savings has been a game changer.

Pro tip: I have a recurring $250 deposit scheduled at the end of each month. This ensures I always hit the deposit requirement without having to remember to do it manually.

No fees or opening deposit

No fees -- seriously. No maintenance fees, no hidden costs, nothing eating away at your savings. And the best part? No minimum opening deposit. Most banks that offer an APY this high require a couple thousand dollars to open an account, but not LendingClub.

Free ATM card

A perk that not all online banks offer is an ATM card. Some online-only banks don't even offer ATM access or in-person branches -- you're stuck doing online transfers to get money in or out. LendingClub not only has ATM access but goes a step further with a free ATM card you can use like a debit card.

Depending on your banking status (Classic, Preferred, Elite, or Reserve), you can withdraw between $500 and $2,000 each day. Considering that some of the best high-yield savings accounts don't have an ATM card, these limits are still above the industry standard.

Do you have first-hand knowledge of LendingClub LevelUp Savings? Share your thoughts with us and your fellow Motley Fool Money readers.

Downsides you should consider

As with any financial product, there are both pros and cons of a high-yield savings account to consider. Here are two of the biggest things to keep in mind with LendingClub LevelUp Savings.

Deposit requirement to earn the highest APY

As I mentioned above, while the APY is a great perk, it comes with a catch -- you'll need to deposit at least $250 each month to qualify. If you're already saving that amount or can easily commit to it, this isn't much of a drawback beyond remembering to transfer the funds on time.

However, some high-yield savings accounts, (ahem, American Express® High Yield Savings Account, Member FDIC), offer competitive rates without requiring monthly deposits. If you miss the $250 mark, you'll still earn an APY that's not far off from our list of the best savings account APYs, but it's lower than what some no-requirement accounts offer. Before opening an account, consider whether this monthly deposit requirement fits your savings habits.

Online-only bank

LendingClub operates entirely online, so there are no physical branches for in-person banking. If you prefer face-to-face customer service or like having the option to visit a branch, this could be a drawback. In that case, a high-yield savings account from a bank with physical locations, like the Capital One 360 Performance Savings account, may be a better fit.

The platform

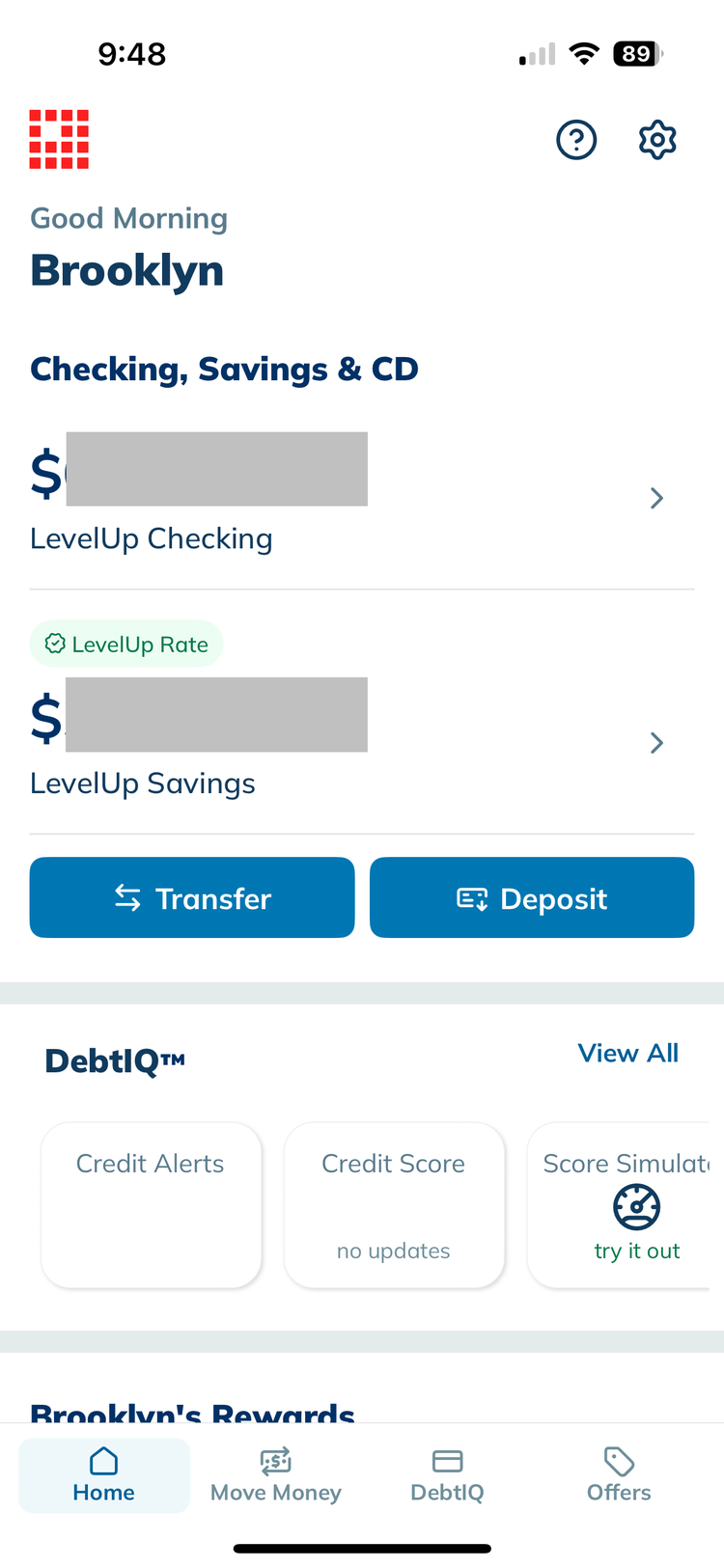

The app is incredibly simple. Don't expect a bunch of bells and whistles here. Here's what you'll see when you log in:

One thing I do really like is within my LendingClub LevelUp Savings account, it's very obvious if I've contributed the amount I need for the month to hit the LevelUp Rate. Here's what that looks like:

Customer service

LendingClub's customer service is reliable but not exceptional. I've had to contact them twice in my 3+ years with a high-yield savings account there, including changing my legal name and adding a joint owner. They were helpful enough over the phone both times, plus they followed up in email ensuring I had records of the changes.

Customer service is available by phone 8 a.m. - 8 p.m. ET, Monday-Saturday. Most large, well-known banks offer 24/7 customer service, so LendingClub falls behind a bit here. However, I've always found the bank's online interface to be very simple and straightforward, so you hopefully won't need to reach out very often.

Accessing your money

LendingClub imposes daily transaction limits on deposits and withdrawals, which vary based on how long your account has been open and your banking status. Your status -- Classic, Preferred, Elite, or Reserve -- is determined by how long you've had the account and your balance history.

| Status | Eligibility | Incoming ACH Transfers | Outgoing ACH Transfers | Mobile Check Deposits | Debit Card Transactions | ATM Withdrawals |

|---|---|---|---|---|---|---|

| New Clients | Accounts open 30 days or less | $5,000 | $5,000 | $20,000 | $500 | — |

| Classic | Accounts open for 30+ days | $5,000 | $5,000 | $20,000 | $2,000 credit / $2,000 PIN | $500 |

| Preferred | $2,000+ daily balance for 7+ days | $250,000 | $10,000 | $50,000 | $2,000 credit / $2,000 PIN | $500 |

| Elite | $10,000+ daily balance for 30+ days OR $30,000+ for 7+ days | $250,000 | $50,000 | $150,000 | $3,000 credit / $3,000 PIN | $1,000 |

| Reserve | $50,000+ daily balance for 60+ days OR $150,000+ for 7+ days | $250,000 | $250,000 | $250,000 | $4,000 credit / $4,000 PIN | $2,000 |

Deposit options

You can fund your LendingClub LevelUp Savings account through multiple methods:

- Online transfers: Link an external account for easy ACH transfers.

- ATM deposits: Use MoneyPass Deposit Taking ATMs or NYCE Shared Deposit ATMs to deposit cash.

- Debit card deposits: Fund your account instantly by using your debit card.

- Wire transfers: Transfer funds directly from another financial institution.

For your initial deposit, you can transfer money using your account and routing number or fund the account with a debit card. I've always done online transfers from an external account and never had an issues.

Withdrawal options

Withdrawing money is simple, with several ways to access your funds:

- Mobile banking: Send money to friends and family, transfer funds internally or externally, and pay bills.

- ATM withdrawals: Use your free ATM card to withdraw cash as needed.

- Free ACH transfers: Move money between your LendingClub account and an external bank account without fees.

While the transaction limits may take some getting used to, LendingClub offers a variety of ways to manage your money conveniently. I've personally never felt restricted by the limits here.

Security and reliability

LendingClub is an FDIC-insured bank, meaning your money is protected up to $250,000 per depositor, per account ownership category in the event of a bank failure. That's really the bottom line with an online bank -- as long as you stay within that limit, your money is fully secure.

In my experience, LendingClub has been reliable, with clear communication about any account changes. I've never had issues and trust them to keep my online savings safe.

Who will benefit from the LendingClub LevelUp Savings account?

This account is a great fit for:

- Consistent savers: If you can deposit at least $250 each month, you'll unlock the highest APY, maximizing your savings potential.

- Fee-averse customers: If you want every dollar you save to go towards growth.

- Online banking users: If you're comfortable managing your money digitally, LendingClub's user-friendly platform and mobile access make banking easy.

If you're looking for a high-yield savings account with no fees and one of the best APYs available, LendingClub LevelUp Savings is a strong choice -- especially if you can meet the deposit requirement.

Don't miss out on maximizing your savings. Open an account today and watch your money grow!

Compare savings rates

Make sure you're getting the best account for you by comparing savings rates and promotions. Here are some of our favorite high-yield savings accounts to consider.

| Account | APY | Bonus | Next Steps |

|---|---|---|---|

Open Account for SoFi Checking and Savings

On SoFi's Secure Website.

4.90/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

up to 4.00%

Rate info

Earn up to 4.00% Annual Percentage Yield (APY) on SoFi Savings with a 0.70% APY Boost (added to the 3.30% APY as of 12/23/25) for up to 6 months. Open a new SoFi Checking and Savings account and pay the $10 SoFi Plus subscription every 30 days OR receive eligible direct deposits OR qualifying deposits of $5,000 every 31 days by 1/31/26. Rates variable, subject to change. Terms apply at sofi.com/banking#2. SoFi Bank, N.A. Member FDIC.

Min. to earn: $0

|

Earn $50 or $300 and +0.70% Boost on Savings APY with direct deposit. Terms apply.

Earn up to 4.00% Annual Percentage Yield (APY) on SoFi Savings with a 0.70% APY Boost (added to the 3.30% APY as of 12/23/25) for up to 6 months. Open a new SoFi Checking and Savings account and pay the $10 SoFi Plus subscription every 30 days OR receive eligible direct deposits OR qualifying deposits of $5,000 every 31 days by 1/31/26. Rates variable, subject to change. Terms apply at sofi.com/banking#2. SoFi Bank, N.A. Member FDIC. |

Open Account for SoFi Checking and Savings

On SoFi's Secure Website. |

Open Account for CIT Platinum Savings

On CIT's Secure Website.

4.60/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

3.75%

Rate info

3.75% APY for balances of $5,000 or more; otherwise, 0.25% APY

Min. to earn: $5,000

|

Earn a bonus of up to $300 after a one-time deposit of $25,000+

This limited-time offer to qualify for a $225 cash bonus with a minimum deposit of $25,000 or a $300 bonus with a minimum deposit of $50,000 is available to New and Existing Customers who meet the Platinum Savings promotion criteria. The Promotion begins on September 23, 2025, and can end at any time without notice. Customers will receive a $225 or a $300 bonus provided that the program requirements are met. Click here to see promotion details and terms: https://www.cit.com/cit-bank/platinum-savings/PS2025 |

Open Account for CIT Platinum Savings

On CIT's Secure Website. |

Open Account for Western Alliance Bank High-Yield Savings Premier

On Western Alliance Bank's Secure Website.

4.40/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

3.80%

Rate info

The annual percentage yield (APY) is accurate as of January 8, 2025 and subject to change at the Bank’s discretion. Refer to product’s website for latest APY rate. Minimum deposit required to open an account is $500 and a minimum balance of $0.01 is required to earn the advertised APY.

Min. to earn: $500 to open, $0.01 for max APY

|

N/A

|

Open Account for Western Alliance Bank High-Yield Savings Premier

On Western Alliance Bank's Secure Website. |

Platinum Savings is a tiered interest rate account. Interest is paid on the entire account balance based on the interest rate and APY in effect that day for the balance tier associated with the end-of-day account balance. APYs — Annual Percentage Yields are accurate as of November 20, 2025: 0.25% APY on balances of $0.01 to $4,999.99; 3.75% APY on balances of $5,000.00 or more. Interest Rates for the Platinum Savings account are variable and may change at any time without notice. The minimum to open a Platinum Savings account is $100.

Based on comparison to the national average Annual Percentage Yield (APY) on savings accounts as published in the FDIC National Rates and Rate Caps, accurate as of December 15, 2025.

For complete list of account details and fees, see our Personal Account disclosures.

The annual percentage yield (APY) is accurate as of January 8, 2025 and subject to change at the Bank’s discretion. Refer to product’s website for latest APY rate. Minimum deposit required to open an account is $500 and a minimum balance of $0.01 is required to earn the advertised APY.

Accurate as of the time of publication. The national average rate referenced is from the FDIC’s published National Rates and Rate Caps for Savings deposit products, accurate as of December 15, 2025. See the FDIC website for more information.

-

Review sources

FAQs

-

The LendingClub LevelUp Savings account stands out with its high interest rate, which rivals many of the best savings and CD rates on the market, and it rewards users who make a minimum monthly deposit of $250, helping their savings grow faster.

-

No, you can get started with just $1, but you'll need to maintain a monthly deposit of at least $250 to earn the highest interest rate.

-

Yes, the account includes features like easy mobile access, automatic savings tools, and a clear, user-friendly interface that helps you track your progress towards your savings goals.